NCERT Solutions for Class 12 Accountancy Part II Chapter 6 Cash Flow Statement

NCERT Solutions CBSE Sample Papers AccountancyClass 12 Accountancy

TEST YOUR UNDERSTANDING I

DO IT YOUR SELF I

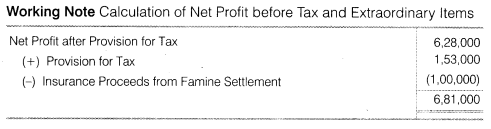

Question 1. The profit and loss account of Roy Limited is given here under

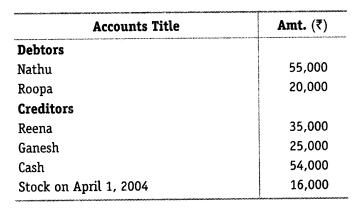

Question 2. From the following information calculate net cash from operations

TEST YOUR UNDERSTANDING II

Question 1. Choose one of the two alternatives given below and fill in the blanks in the following statements

(a) If the net profits earned during the year is Rs. 50,000 and the amount of debtors in the beginning and the end of the year is Rs. 10,000 and Rs.20,000 respectively, then the cash from operating activities will be equal to Rs……………..(Rs. 40,000/ Rs.60,000).

Answer Rs. 40,000

(b) If the net profits made during the year are Rs. 50,000 and the bills receivables have decreased by Rs. 10,000 during the year then the cash flow from operating activities will be equal to Rs…………………..(Rs. 40,000/Rs. 60,000).

Answer Rs. 60,000

(c) Expenses paid in advance at the end of the year are……………………the profit made during the year (added to/deducted from).

Answer Deducted from

(d) An increase in accrued income during the particular year is……………………..for calculating the cash flow from operating activities (added to/deducted from).

Answer Added to

(f) For calculating cash flow from operating activities, provision for doubtful debts is………………………………..the profit made during the year (added to/deducted from).

Answer Added to

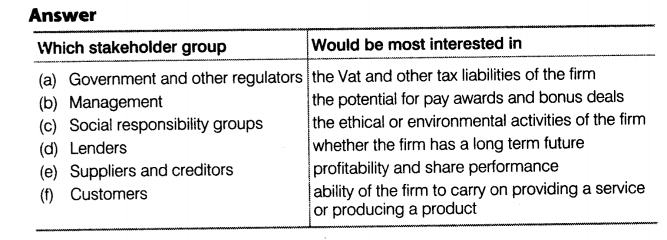

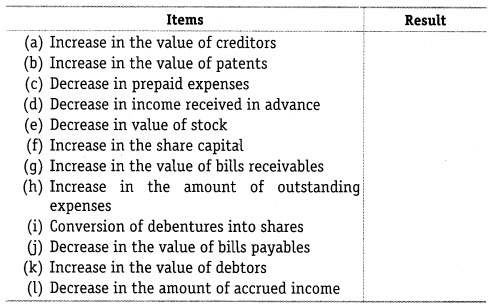

Question 2. While computing cash from operating activities, indicate whether the foltowing items witl be added or subtracted from the net profit, if not to be considered write NC.

DO IT YOURSELF II

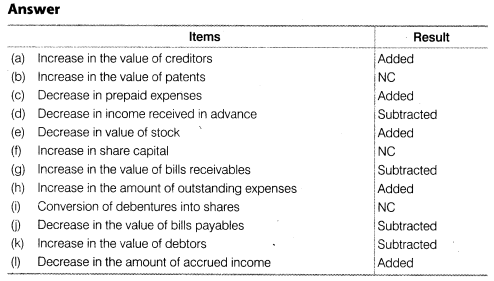

Question 1. From the following particulars, calculate cash flows form investing activities

Interest received on debentures held as investment Rs.60,000 Dividend received on shares held as investment Rs.10,000

A plot of land had been purchased for investment purposes and was let out for commercial use and rent received Rs. 30,000.

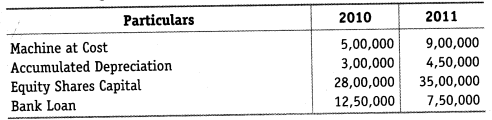

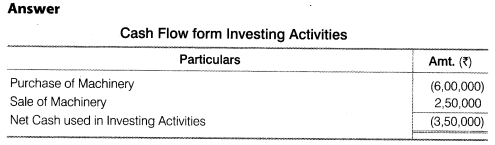

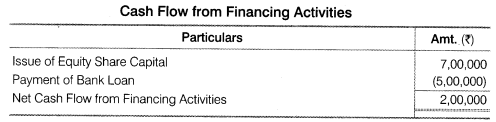

Question 2. From the following Information, calculate cash flow from investing and financing activities

In year 2011, machine costing Rs. 2,00,000 was sold at a profit of Rs. 1,50,000, depreciation charged on machine during the year 2011 amounted to Rs. 2,50,000.

SHORT ANSWER TYPE QUESTIONS

Question 1. What is a cash flow statement?

Answer A cash flow statement shows inflow and outflow of cash and cash equivalents from various activities of a company during a specific period. The primary objective of cash flow statement is to provide useful information about cash flows (inflows and outflows) of an enterprise during a particular period under various heads, i.e., operating activities, investing activities and financing activities. It explains the reasons of receipts and payments in cash and change in cash balances during an accounting year in a company.

Question 2. How the various activities are classified (as per AS-3 revised) while preparing cash flow statement?

Answer As per Accounting Standard-3 various activities of cash flow statement are classified into three categories as follows

(i) Cash Flow from Operating Activities :These are the principal revenue producing activities of the enterprise and other activities. The cash flow statement begins with the operating activities section. Operating activities generally reflect cash generated and/or paid as a result of the firm’s core business functions. Under US GAAP, this category incorporates the cash received from customers, paid to suppliers, paid for operating costs, paid for income taxes, received from interest or dividends, and paid for periodic interest costs.

(ii) Investing Activities: These are the acquisition and disposal of long-term assets, other investments not included in cash equivalents. Cash flows from investing activities are those involving non-current capital assets used in the firm’s operations, such as Property, Plant, Equipment (PP&E) and intangible assets. When a company invests in new long-term capacity by acquiring either PP&E or another company, the investment is a cash outflow from investing activities. Disposals of these types of assets for cash generate inflows.

(iii) Financing Activities :These are the activities that result in changes in the size and composition of the owner’s capital and borrowings of the enterprise. Cash flows from financing activities are those that take place between a firm and its investors. These include both the equity investments of stockholders (owners) and the loans from bondholders and other creditors. When the company issues new shares, it records a cash inflow from financing, and when it repurchases shares, pays dividends or pays off debt, it records a cash outflow.

Question 3. State the uses of cash flow statement

Answer The various uses of cash flow statement are as follows

(i) First of all a cash flow statement along with other financial statements provides information that enables users to evaluate changes in net assets of an enterprise, its financial structure (including its liquidity and solvency) and its ability to affect the amounts and timings of cash flows in order to adapt to changing circumstances and opportunities.

(ii) Cash flow information is useful in assessing the ability of the enterprise to generate cash and cash equivalents and enables users to develop models to assess and compare the present value of the future cash flows of different enterprises.

(iii) It also enhances the comparability of the reporting of operating performance by different enterprises because it eliminates the effects of using different accounting treatments for the same transactions and events.

(iv) Historical cash flow information is often used as an indicator of the amount, timing and certainty of future cash flows. It is also helpful in checking the accuracy of past assessments of future cash flows and in examining the relationship between profitability and net cash flow and impact of changing prices.

Question 4. What are the objectives of preparing cash flow statement?

Answer The various objectives of preparing cash flow statement are as follows

(i) The first and most important objective of cash flow statement is that helps to ascertain the gross inflows and out flows of cash and cash equivalents from operating, investing and financial activities.

(ii) A cash flow statement helps in determining the various causes for change in the cash balances during an accounting period.

(iii) A cash flow statement is also prepared to determine the liquidity position of the organisation.

(iv) Moreover a cash flow statement is prepared to know about the requirenTent of cash in future.

Question 5. Explain the terms : Cash equivalents, Cash flows.

Answer A cash flow statement shows inflows and outflows of cash and cash equivalents from various activities of an enterprise during a particular period. As per AS-3, ‘Cash equivalents’ means short term highly liquid investments that are readily convertible into known amounts of cash and which are subject to an insignificant risk of changes in value.

Thus, cash equivalents refer to such investments that are held for the purpose of meeting short term cash commitments rather than for investments or other purposes. An investment normally qualifies as cash equivalent only when it has a short maturity, of say, three months or less from the date of acquisition.

Investments in shares are excluded from cash equivalents unless they are in substantial cash equivalents, e.g., preference shares of a company acquired shortly before their specific redemption date provided there is only insignificant risk of. failure of the company to repay the amount at maturity. Similarly, short term marketable securities which can be readily converted into cash are treated as cash equivalents.

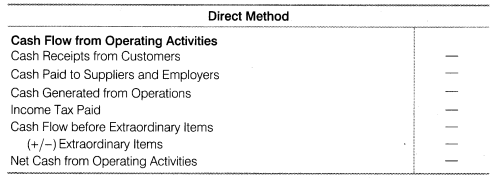

Question 6. Prepare a format of cash flow from operating activities under direct method and indirect method.

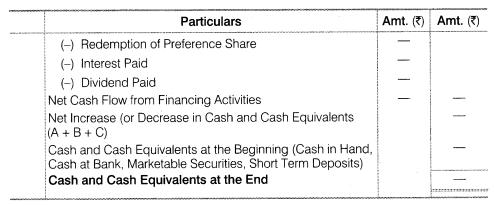

Answer Format of cash flow from operating activities under direct method is as follows

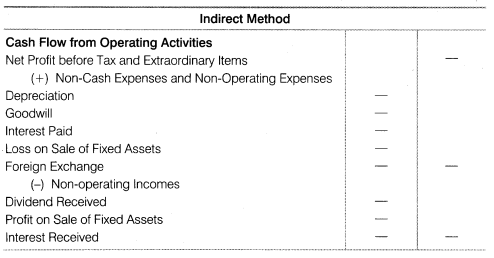

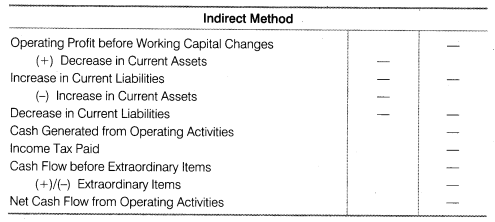

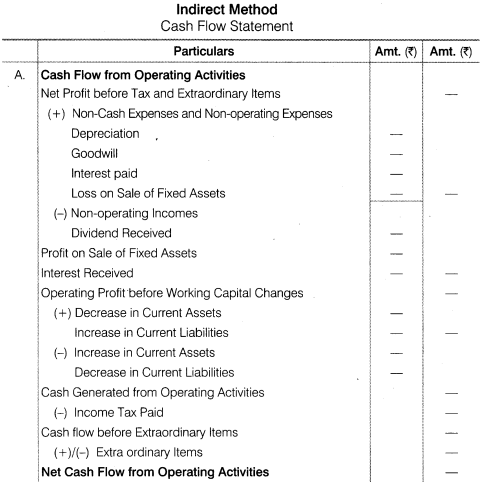

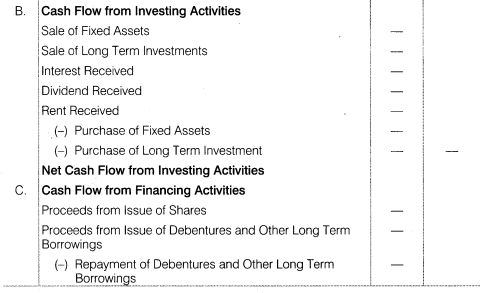

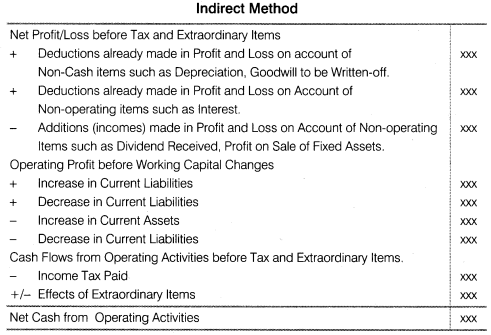

Format of cash flow from operating activities under indirect method is as follows

Question 7. Now that you know the meaning of operating activities, state clearly what would constitute the operating activities for the following types of enterprises

(i) Hotel (ii) Film production house

(iii) Financial enterprise (iv) Media enterprise

(v) Steel manufacturing unit (vi) Software business unit

Answer Operating Activities: As we know that these are the principal revenue producing activities of the enterprise and other activities. Operating activities generally reflect cash generated and/or paid as a result of the firm’s core business functions. Hence, the following will be the operating activities in the above mentioned enterprises respectively

(i) In Case of a Hotel :Receipts from sale of goods and services to the customer will be operating activity related to revenue generation. And payment of wages and salaries, electricity, food items and other items used in accommodation and stay of customer will be an operating activity related to expenditure.

(ii) Film Production House: In case of film production house revenue generating operating activity would be its receipts from selling film rights of a film to the distributors and its operating activity related to expenditure would be payment made to the staff member, unit, actors, dctresses, directors, location rent and air fare etc.

(iii) Financial Enterprise: In case of a financial enterprise like bank the receipts from repayment of loans, interest incomes from investments, etc will be considered as revenue generating operating activity and repayment of loans, recovery expenditure for recover of loans, etc. Salaries of employees will be considered as operating activity related to the expenditure.

(iv) Media Enterprise: A media enterprise is involved in service industry and its revenue generating operating activity would be receipts from advertisements. And expenditure related operating activity would be payments to staff, reporters, photographers, etc.

(v) Steel Manufacturing Unit :The main source for revenue for a steel manufacturing unit would be its receipts from sale of steel sheets, steel castings, steel rods, etc. And the expenditure related operating activity would be payment for raw material (iron, coal), salaries to staff, etc.

(vi) Software Business Unit: A software business unit is basically a service providing unit which get its revenue through receipts from sale of software and renewal of licenses as an operating activity and various payment made by it in the form of salaries to its employees, etc. It is the part of operating activity as expenditure.

Question 8. “The nature/type of enterprise can change altogether the category into which a particular activity may be classified.” Do you agree? Illustrate your answer.

Answer Yes, the nature or type of an enterprise can change altogether the category into which a particular activity may be classified. This can be better understood with the help of an example of two firms. One engaged in real estate and the other engaged in general business.

For the firm that is engaged in real estate business purchase and sales of building will be part of the operating activity on the other hand firm that is engaged in general business purchase and sales of building will be part of the investing activity. Hence, it can be said that the classification of activities depends on the nature and type of enterprise.

LONG ANSWER TYPE QUESTIONS

Question 1. Describe the procedure to prepare cash flow statement.

Answer The procedure for preparing cash flow statement is as follows

Step 1 First of all cash flows from operating activities is ascertain.

Step 2 After that cash flows from investing activities is ascertain.

Step 3 The third step is to ascertain the cash flows from financing activities.

Step 4 Sum up the total of all the three steps and ascertain net increase or decrease.

Step 5 Write the opening balance of cash and cash equivalents and deduct it from the amount ascertained in Step 4. The resulting figure arrived is the closing balance of cash and cash equivalents.

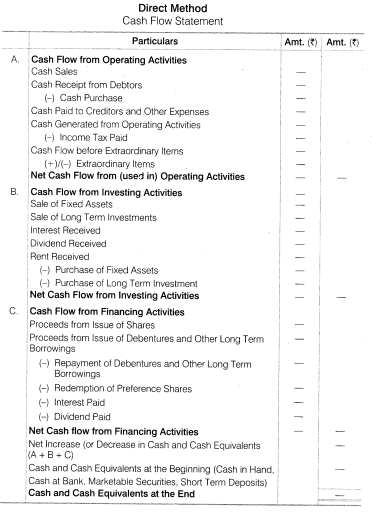

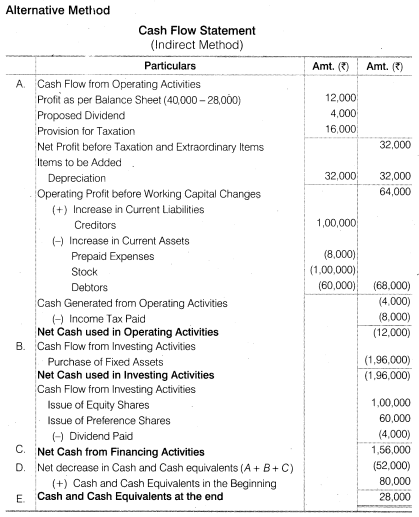

There are two methods viz Direct Method and Indirect Method for the preparation of cash flow statement. The main difference in direct and indirect method is to calculate the cash flow from operating activities. Computation of rest of the two activities will remain same. Here are the Proforma of cash flow statement from both the methods.

Question 2. Describe “Direct” and “Indirect” method of ascertaining cash flow from operating activities.

Answer

Computation of Cash Flow From Operating Activities

The first section of cash flow statement, known as cash flow from operating activities, can be prepared by two methods known as direct method and indirect method.

(i) Direct Method :In the direct method format, each line of the operating activities section represents a sum of all cheques or deposits in a particular category, e.g., the operating activities section would include such items as cash received from customers; cash paid to suppliers; cash paid for interest; cash paid for wages; cash paid for research and development; cash paid for selling, general, and administrative costs; and any other relevant summary lines.

Direct Method Format: Cash flow from operating activities is calculated by direct method as follows

(ii) Indirect Method: In indirect method, the net income figure from the income statement is used to calculate the amount of net cash flow from operating activities. Since income statement is prepared on accrual basis in which revenue is recognised when earned and not when received therefore net income does not represent the net cash flow from operating activities and is necessary to adjust EBIT for those items which effect net income although no actual cash has been paid or received against them.

Indirect Method :Following is the indirect method formula which is used to calculate cash flow from operating activities

Question 3. Explain the major cash inflows and outflows from investing activities.

Answer

Cash Flows from Investing Activities: The next step in building cash flow statement is to look at money a company spent on new capital investments. If a company capitalizes an investment, then that outflow of money does not show up on the income statement. That’s because accounting rules allow the company to depreciate (expense) the cost of the investment over time.

From a practical standpoint, if a company purchase an asset such as new plant equipment or machinery, then they most likely paid for that asset in cash. When monpy leaves a company, we have an outflow of cash that we need to show in our statement.

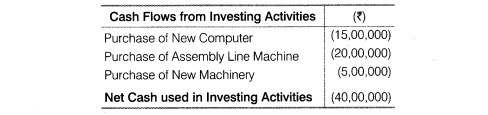

Example In this example, let’s say ‘X’ Company purchased a new computer system for Rs. 15,00,000 along with an assembly line machine for Rs. 20,00,000. These were the only two capital investments made by ‘X’ Company for the year. In this example, the company was also required to buy a new Machinery worth Rs. 5,00,000 into a special decommissioning fund.

Normally, a company might show one line item for the capital investments and label that line item as additions to plant. In this example, we are going to show these items separately

In the above example, we saw that the company made investment in fixed assets and used Rs.40,00,000.

Question 4. Explain the major Cash inflows and outflows from financing activities.

Answer

Cash Flows from Financing Activities :The final category of adjustments we need to address on a statement of cash flows is money raised by financing activities. As was the case with cash from operations, we can have both positive and negative adjustments to cash flow depending on the financing activities the company is engaged during the year.

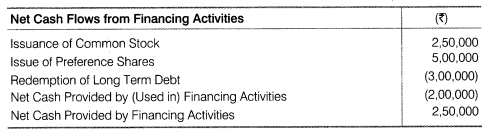

Typical adjustments appearing here include changes in long and short term debt (issuing and redemption), issuing of preferred stock, issuing of common stock, retirement of stock, and stock dividends paid in cash.

Example In our example, ‘X’ Company decided to raise Rs. 2,50,000 by issuing common stock. They also issued around Rs.5,00,000 in preference share, and redeemed around Rs. 3,00,000 in long term debt. Finally, they paid a cash

In this example, ‘X’ Company used less money in their financing activities than they generated during the year.

NUMERICAL QUESTIONS

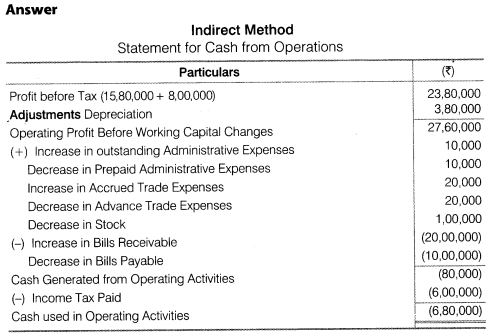

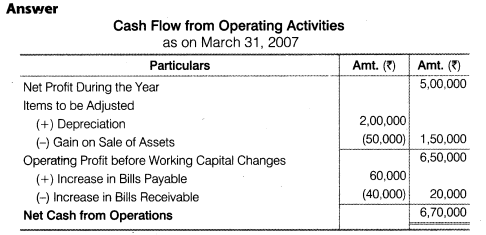

Question 1. Anand Ltd arrived at a net income of Rs. 5,00,000 for the year ended March 31, 2007. Depreciation for the year was Rs. 2,00,000. There was a gain of Rs. 50,000 on assets sold which was credited to profit and loss account. Bills receivable increased during the year by Rs. 40,000 and bills payable also increased by Rs. 60,000. Compute the cash flow from operating activities by the indirect approach.

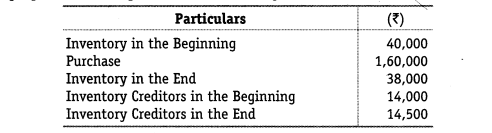

Question 2. From the information given below, you are required to prepare the cash paid for the inventory

Cash paid for inventory amounts toRs. 1,59,500

Note :Purchase is considered to be credit purchase. Inventory in beginning and end has no effect.

Question 3. For each of the following transactions, calculate the resulting cash flow and state the nature of cash flow viz, operating, investing and financing.

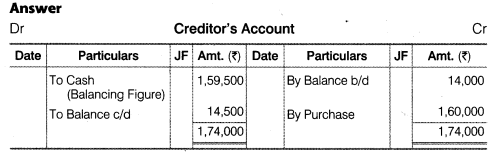

(a) Acquired machinery for Rs. 2,50,000 paying 20% drawn and executing a bond for the balance payable.

(b) Paid Rs. 2,50,000 to acquire shares in Informa Tech and received a dividend of Rs.50,000 after acquisition.

(c) Sold machinery of original cost Rs. 2,00,000 with an accumulated depreciation of Rs. 1,60,000 for Rs. 60,000.

(b) Related to investing activity. Acquiring shares in Informa Tech is an investment and dividend received on it is also part of same (Rs. 2,50,000-50,000= Rs. 2,00,000 outflow).

(c) Related to investing activity. It is treated as sale of investment. Rs. 60,000 inflow and Rs. 20,000 as profit on sale of investment as operating activity.

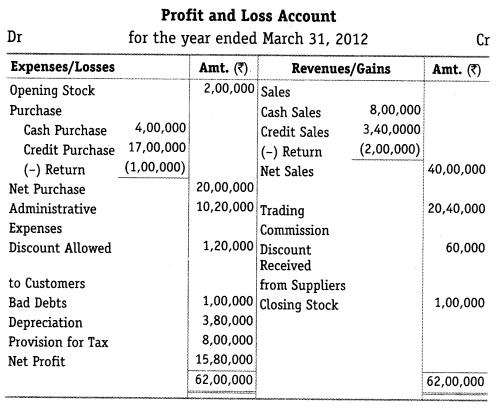

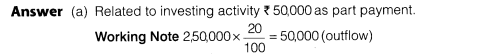

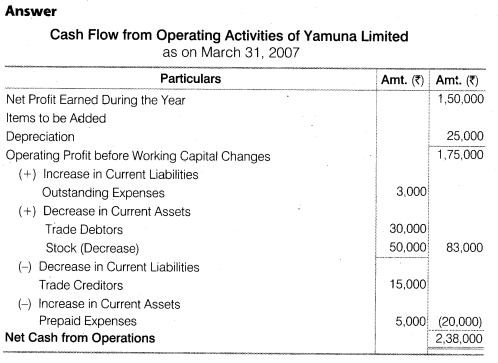

Question 4. The following is the profit and loss account of Yamuna Limited

Additional Informations

(i) Trade debtors decrease by Rs. 30,000 during the year.

(ii) Prepaid expenses increase by Rs. 5,000 during the year.

(iii) Trade creditors decrease by Rs. 15,000 during the year.

(iv) Outstanding expenses increased by Rs. 3,000 during the year.

(v) Operating expenses inctuded depreciation of Rs. 25,000.

Compute net cash provided by operations for the year ended March 31, 2007 by the indirect method

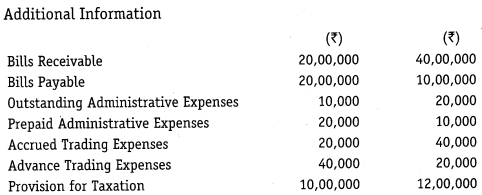

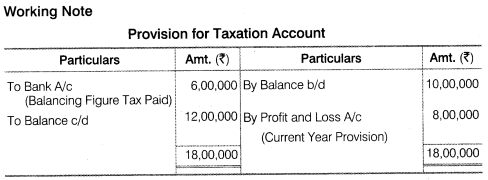

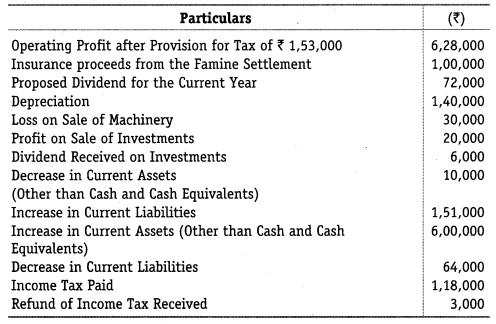

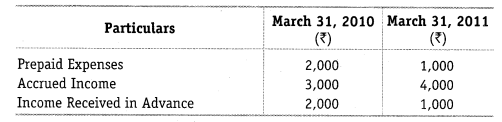

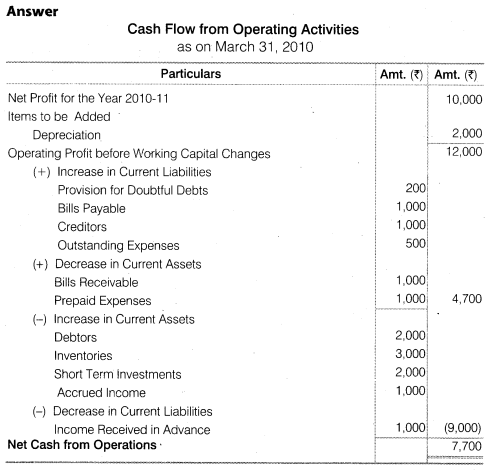

Question 5. Compute cash from operations from

(i) Profit for the year 2010-11 is a sum of Rs. 10,000 after providing for depreciation of Rs. 2,000.

(ii) The current assets of the business for the year ended March 31, 2010 and 2011 are as follows

Prepare of cash flow statement from summary cash account.

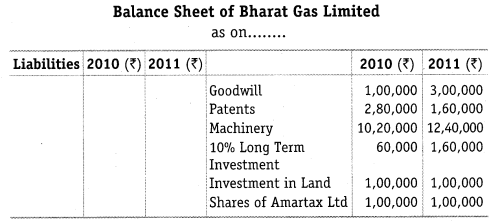

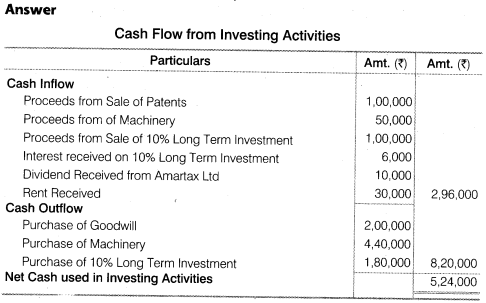

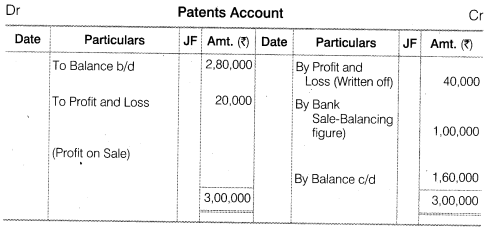

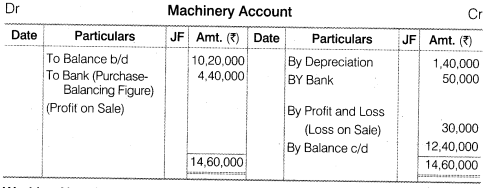

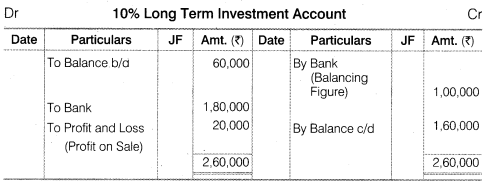

Question 6. From the foltowing Particulars of Bharat Gas Limited, calculate cash flows from investing activities. Also show the workings clearly preparing the ledger accounts.

Additional Informations

(a) Patents were written-off to the extent of Rs. 40,000 and some patents were sold at a profit of Rs.20,000.

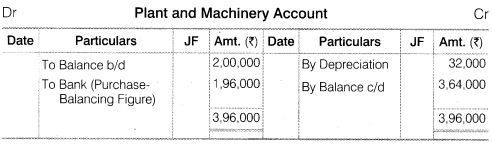

(b) A machine costing Rs. 1,40,000 (depreciation provided thereon Rs. 60,000) was sold for Rs. 50,000. Depreciation charged during the year was Rs. 1,40,000.

(c) On March 31, 2007, 10% investments were purchased for Rs. 1,80,000 and some investments were sold at a profit of Rs.20,000. Interest on investment was received on March 31, 2011.

(d) Amartax Ltd paid dividend @ 10% on its shares.

(e) A plot of land had been purchased for investment purposes and let out for commercial use and rent received Rs.30,000.

Working Note Machine costing Rs. 1,40,000 less depreciation Rs. 60,000, present value Rs. 80,000 sold for Rs. 50,000 i.e., loss on sale Rs. 30,000.

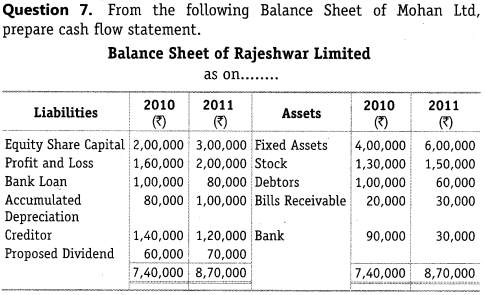

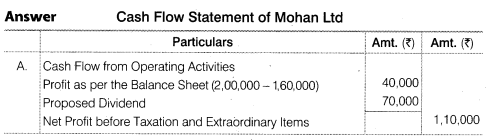

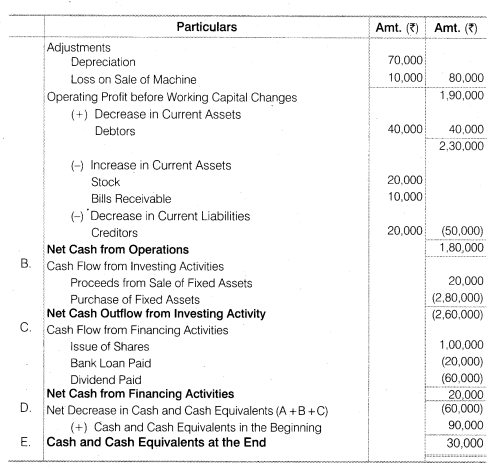

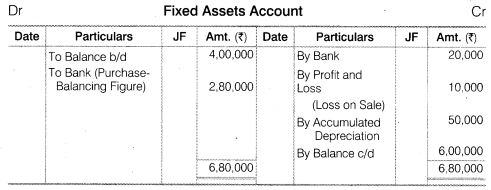

Question 7.

Note: Any income received on investment is a part of investments like dividend,interest or rent received.

Additional Information

Machine costing Rs.80,000 on which accumulated depreciation was Rs.50,000 was sold for Rs. 20,000.

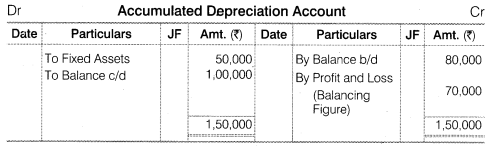

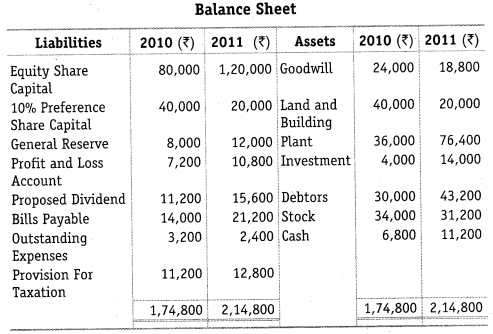

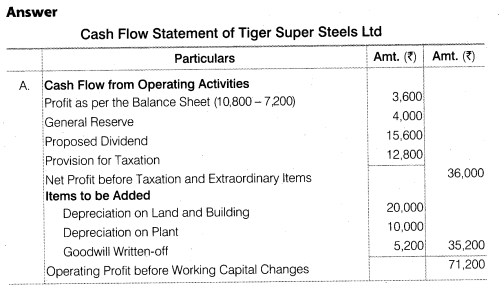

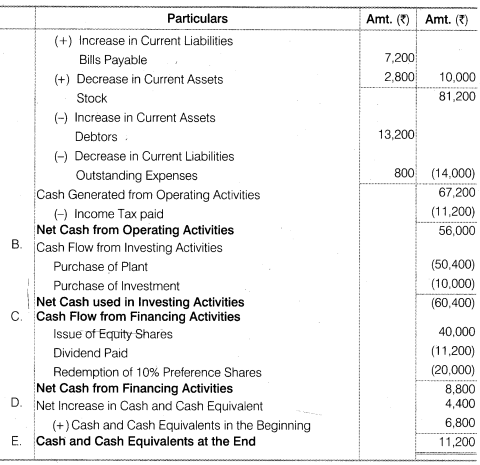

Question 8. From the foltowing Batance Sheet of Tiger Super Steel Ltd, prepare Cash flow statement.

Additional Information

Depreciation Charged on Land and building Rs. 20,000 and plant Rs. 10,000 during the year.

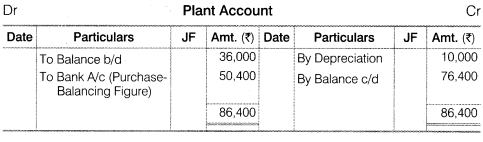

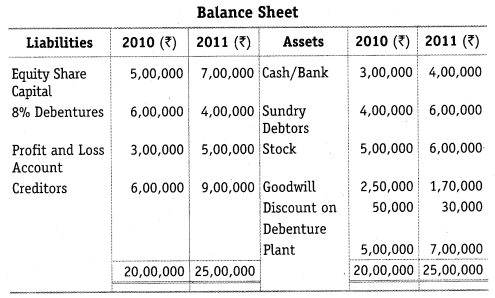

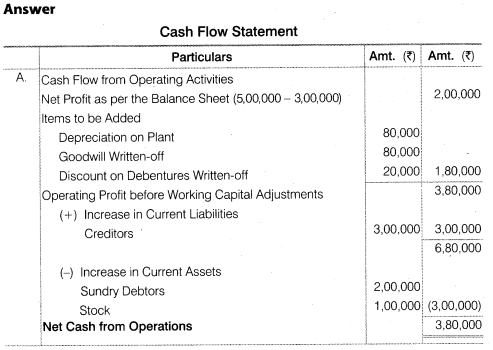

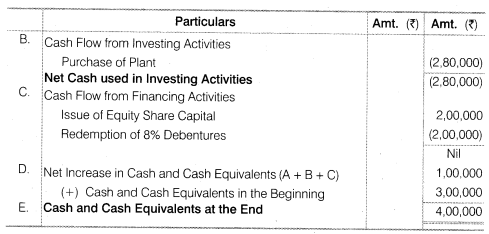

Question 9. Prepare cash flow statement from the following information

Additional Information

Depreciation charged on plant amount to Rs. 80,000.

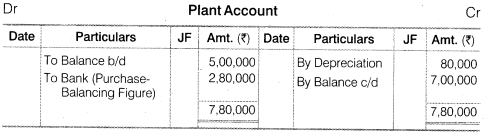

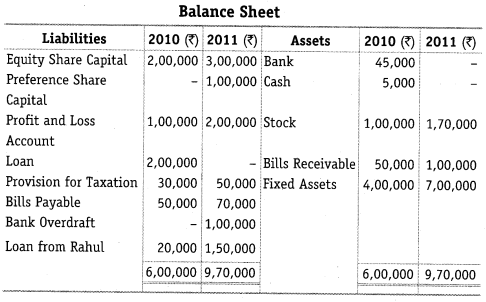

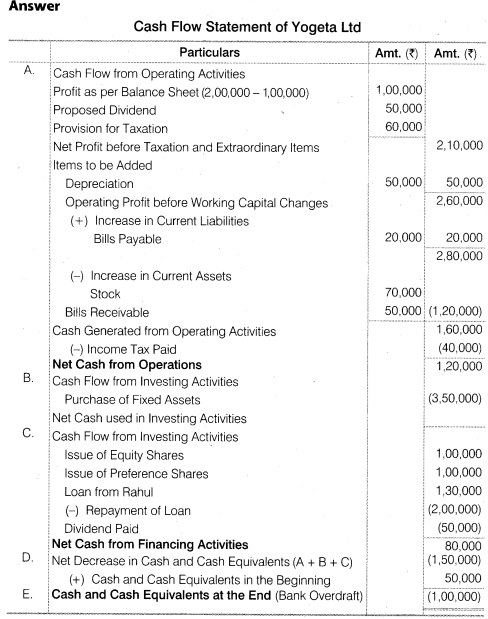

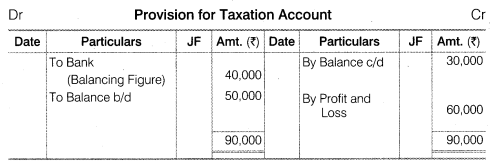

Question 10. From the following information, prepare cash flow statement for Yogeta Ltd.

Additional Information

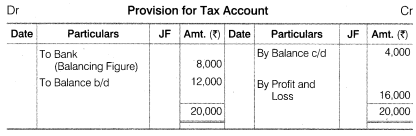

Net profit for the year after charging Rs. 50,000 as depreciation was Rs. 1,50,000, dividend paid on share was Rs. 50,000, tax provision created during the year amounted to Rs. 60,000.

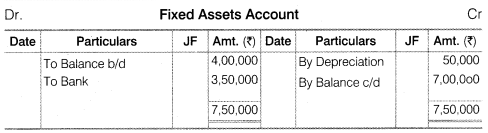

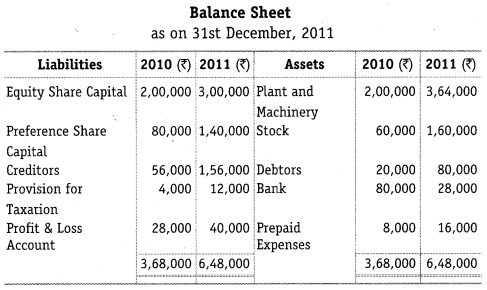

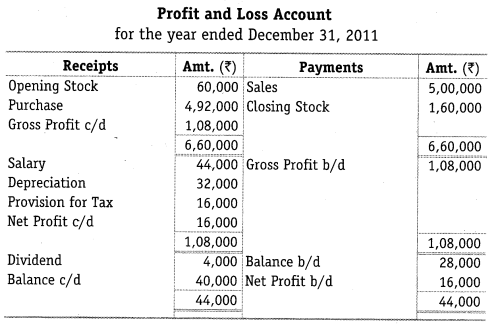

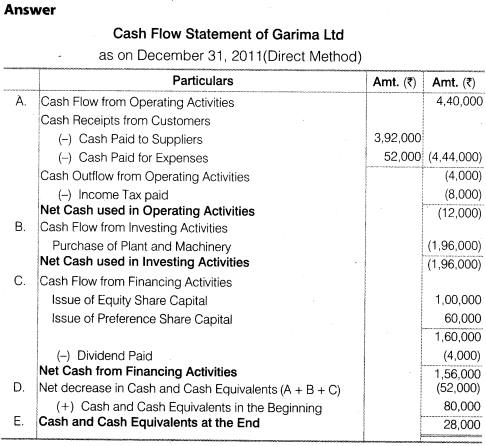

Question 11. Following is the Financial Statement of Garima Ltd. Prepare cash flow statement.

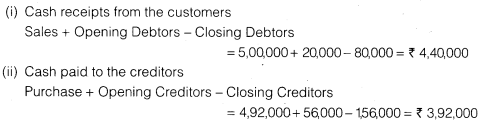

Note Debtors and creditors account can also be prepared to calculate cash receipt or cash paid.

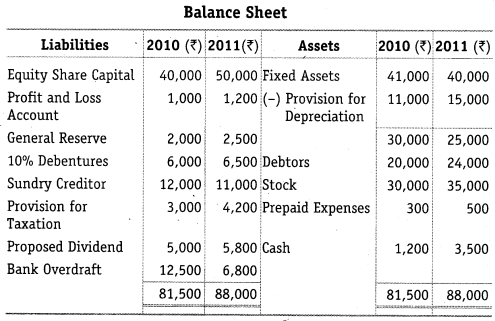

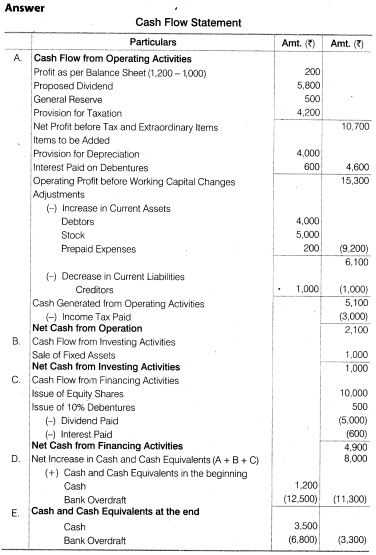

Question 12. Foltowing is the Balance Sheet of Computer India Ltd

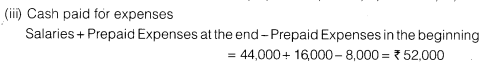

Additional Information Interest paid on debenture ? 600.

More Resources for CBSE Class 12

RD Sharma class 12 Solutions

NCERT Solutions for Class 12th English Flamingo

NCERT Solutions for Class 12th English Vistas

CBSE Class 12 Accountancy

NCERT Solutions for Class 12th Maths

CBSE Class 12 Biology

CBSE Class 12 Physics

CBSE Class 12 Chemistry

CBSE Sample Papers For Class 12

NCERT SolutionsAccountancyBusiness StudiesMacro EconomicsCommerce