Students must start practicing the questions from CBSE Sample Papers for Class 11 Accountancy with Solutions Set 5 are designed as per the revised syllabus.

CBSE Sample Papers for Class 11 Accountancy Set 5 with Solutions

Time Allowed : 3 hours

Maximum Marks: 70

General Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Question Nos.1 to 15 and 25 to 29 carries 1 mark each.

- Questions Nos. 16 to 18, 30 to32 carries 3 marks each.

- Questions Nos. 19, 20 and 33 carries 4 marks each.

- Questions Nos. 21 to 24 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, I question of four marks and 2 questions of six marks.

Part – A ((Financial Accounting – I)

Question 1.

What is a voucher called that is prepared for a simple transaction₹

(A) Transaction voucher

(B) Supporting voucher

(C) Cash voucher

(D) None of the these [1]

Answer:

(A) Transaction voucher

Question 2.

Assertion: Compensating errors do not affect the Trial Balance.

Reasoning: Compensating errors are those two or more errors committed in such a way that they nullify the effect of each other on the debit and credit.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct.

Answer:

(A) Both A and R are correct, and R is the correct explanation of A.

Question 3.

The primary qualities that make accounting information useful for decision-making are:

(A) Relevance and freedom from bias

(B) Reliability and comparability

(C) Comparability and consistency

(D) None of the above [1]

OR

The …………… concept requires that accounting transaction should be free from the bias of accountants and others.

(A) Matching

(B) Conservatism

(C) Revenue Realisation

(D) Objectivity

Answer:

(B) Reliability and comparability

OR

(D) Objectivity

![]()

Question 4.

Consider the following statements with regard to the advantages of cash basis of Accounting:

(i) It is simple as adjustments for outstanding expenses, prepaid expenses are not required.

(ii) It is more objective as use of personal judgments and estimates are minimized.

(iii) It is suitable for non-profit organizations and other organizations that mainly deal in cash transactions. Identify the correct statement/statements:

(A) (i), (ii) and (iii)

(B) (i) and (ii)

(C) (i) only

(D) (ii) and (iii) [1]

OR

Pick the odd one out:

(A) Cash Basis of Accounting

(B) Accrual Basis of Accounting

(C) Credit Basis of Accounting

(D) None of the above

Answer:

(A) (i), (ii) and (iii)

OR

(C) Credit Basis of Accounting

Explanation: There are only two basis of accounting, i.e., cash and accrual.

Question 5.

Consider the following statements with respect to the purpose of Accounting Standards:

(i) Comparing financial statements easily, thereby improving their reliability.

(ii) Providing a set of standard accounting policies, valuation norms and disclosure requirements.

(iii) Reduces the scope of creative accounting i.e., interpreting the accounting policies for a favourable presentation of financial statements to a particular group.

Identify the correct statement/statements:

(A) (i) and (ii)

(B) (i) and (iii)

(C) (ii) and (iii)

(D) (i), (ii) and (iii) [1]

Answer:

(D) (i), (ii) and (iii)

Question 6.

accounting standards have been issued by

(A) 31

(B) 32

(C) 33

(D) 34 [1]

OR

Pick the odd one out:

(A) Indian Accounting Standards

(B) Securities and Exchange Board of India

(C) Generally Accepted Accounting Principles

(D) International Financial Reporting Standards

Answer:

(B) 32

OR

(B) Securities and Exchange Board of India

Explanation: The Securities and Exchange Board of India (SEBI) is the regulatory body for securities and commodities market in India.

![]()

Question 7.

Assertion: Double entry book keeping is more scientific.

Reasoning: The chance of error is minimised in case of single book keeping system.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(C) A is correct, but R is incorrect.

Question 8.

Depreciation is decline in the value of .

(A) Assets

(B) Liabilities

(C) Both (A) & (B)

(D) Neither (A) nor (B) [1]

OR

Double column cash book records:

(A) All transactions

(B) Cash and bank transactions

(C) Only credit transactions

(D) Only cash transactions [1]

Read the following hypothetical situation, answer question nos. 9 and 10.

Astha Ltd, which closes its books on 31st March every year, purchased on 1st July, 2018, machinery costing ₹30,000. It purchased further machinery on 1st January, 2019 costing ₹20,000 and on 1st October, 2019 costing ^10,000. On 1st April, 2021 one-third of the machinery installed on 1st July, 2018 became obsolete and was sold for ₹3,000. |Ap1 It being given that machinery was depreciated by Diminishing Balance Method at 10% per annum.

Answer:

(A) Assets

OR

(B) Cash and bank transactions

Question 9.

What will be the depreciation to be charged on the machinery purchased on 1st July, 2018, by the end of 31st March, 2020 for 2019-2020

(A) ₹3,000

(B) ₹2,565

(C) ₹2,430

(D) ₹2,775 [1]

Answer:

(D) ₹2,775

Explanation: Depreciation charged in 2018 – 19 = 10% of 30,000 x 9/12 = ₹ 2,250

Value of the Machine = ₹ 30,000 – ₹ = 2,250 = ₹ 27,750

Depreciation to be charged on 31st march 2020 = 10% of ₹ 27,750 = ₹ 2,775

Question 10.

What’is the total depreciation charged on the machinery purchased on 1st January 2019 by the end of 31st March 2021 ?

(A) ₹ 5,420

(B) ₹ 1,755

(C) ₹ 4,205

(D) ₹ 2,000 [1]

Answer:

(C) ₹4,205

Explanation: Depreciation on 31st March, 2019 = 10% of ₹ 20,000 x 3/12 = ₹ 5,00

Value on 31st March, 2019 = ₹ 20,000 – ₹ 500 = ₹ 19,500

Depreciation on 31st March, 2020 = 10% of ₹ 19,500 = ₹ 1,950

Value on 31st March, 2020 = if ₹ 9,500 – ₹ 1,950 = ₹ 17,550

Depreciation on 31st March, 2021 = 10% of ₹ 17,550 = ₹1,755

Total Depreciation = ₹ 500 + ₹ 1,950 + ₹ 1,755 = ₹ 4,205

![]()

Question 11.

Which accounting concept states that all assets should be recorded in the books of accounts at their historical cost ?

(A) Cost

(B) Accrual

(C) Money

(D) None of the these [1]

Answer:

(A) Cost

Question 12.

Branches or sub-discipline of accounting:

(A) Financial Accounting

(B) Management accounting

(C) Both (A) and (B)

(D) None of the these [1]

Answer:

(C) Both (A) and (B)

Explanation: The three main sub-branches of accounting are as follows:

(i) Financial Accounting

(ii) Management Accounting

(iii) Cost Accounting.

Question 13.

Pick the odd one out:

(A) Full Disclosure

(B) Accrual Basis

(C) Materiality

(D) Prudence [1]

Answer:

(B) Accrual Basis

Explanation: Rest are the concepts, principles of accounting while it is a basis of accounting.

Question 14.

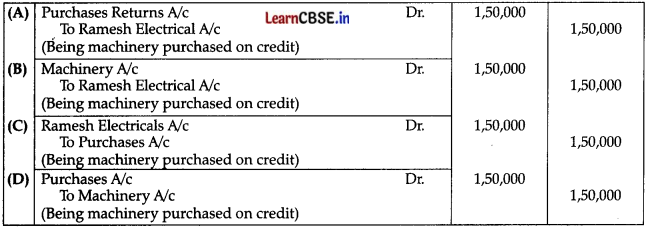

Tintin and Co. bought a machinery for ₹ 1,50,000 on credit from Ramesh Electricals. What would be the journal entry?

Answer:

Option (B) is correct

Explanation: As machinery is purchased on credit from Ramesh Electricals, Machinery Account will be debited as when real account comes we debit it and Ramesh electricals account will be credited as in the case of personal account, the giver is credited.

Question 15.

What are the costs called which are incurred by a business in the process of earning revenue?

(A) Expenses

(B) Income

(C) Revenue

(D) Capital

OR

…………….. are the assets that have physical existence and can be touched and seen.

(A) Current Assets

(B) Tangible Assets

(C) Intangible Assets

(D) Fictitious Assets

Answer:

(A) Expenses

OR

(B) Tangible Assets

![]()

Question 16.

What is meant by Accrual Basis of Accounting₹ Give any two advantages of Accrual basis of accounting

Answer:

Under accrual basis of accounting, revenues or expenses are recognised and recorded when they accrue (become due) and not when actual money is paid or received.

Advantages of accrual basis of accounting :

(i) Gives a true and fair view of the Profit & Loss and financial position, as adjustments relating to outstanding and prepaid expenses and accrued and advance income are taken into account.

(ii) More scientific as compared to cash basis.

(iii) Recognized under the Companies Act and used more widely by business enterprises.

(iv) Distinguishes between capital and revenue expenditure.

Question 17.

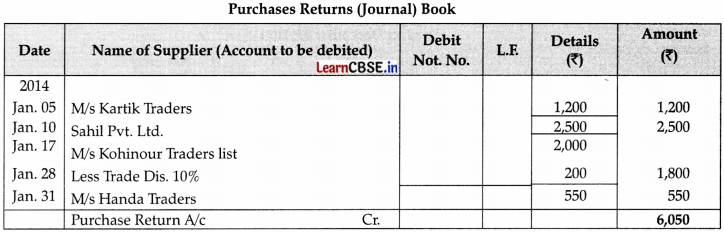

Prepare a Purchase Return Journal (Book) from the following transactions for January 2014.

| January 2014 | Particulars | ₹ |

| Jan.5 | Return Good to M/s Kartik Trader | 1,200 |

| Jan. 10 | Goods Returned to Sahil Pvt. Ltd. | 2,500 |

| Jan. 17 | Goods Returned to M/s Kohinoor Traders for list Price 2,000 | |

| Less 10% Trade Discount. | ||

| Jan. 28 | Return Outward to M/s Handa Traders | 550 |

OR

Mohit has following transactions. Prepare Accounting Equation:

(i) Business started with cash ₹ 1,75,000

(ii) Purchased goods from Rohit ₹ 50,000

(iii) Sold goods on credit to Manish (costing ₹ 17,500) ₹ 20,000

(iv) Purchased furniture for office use ₹ 10,000

(v) Cash paid to Rohit in full settlement ₹ 48,000

(vi) Cash received from Manish ₹ 20,000

Answer:

Question 18.

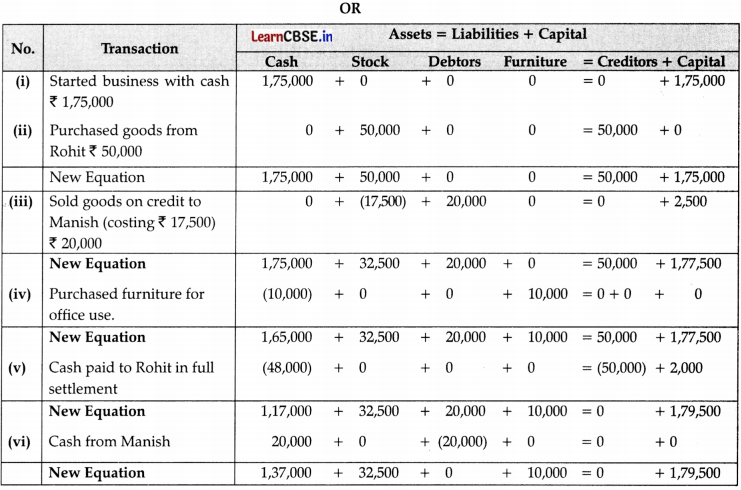

Prepare bank reconciliation statement.

(i) Overdraft shown as per cash book on December 31,2014 ₹ 10,000. ‘

(ii) Bank charges for the above period also debited in the pass book ₹ 100.

(iii) Interest on overdraft for six month ending December 31,2014 ₹ 380 debited in the pass book.

(iv) Cheques issued but not cashed prior to December 31,2014 amounted to ₹ 2,150.

(v) Interest on Investment collected by the bank and credited in the pass book ₹ 600.

(vi) Cheques paid into bank but not cleared before December 31,2014 were ₹ 1,100. [3]

Answer:

Question 19.

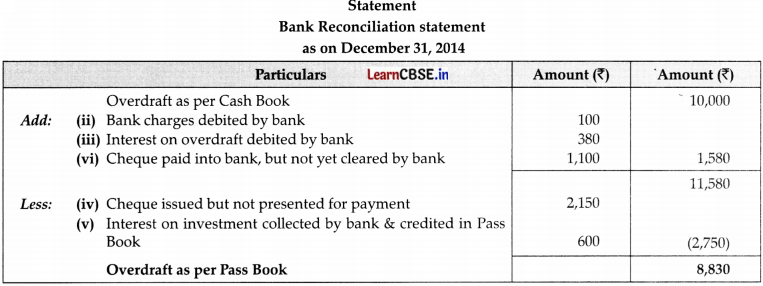

Rectify the following errors:

(i) Sales Book overcast by ₹ 700.

(ii) Purchases Book overcast by ₹ 500.

(iii) Sales Return Book overcast by ₹ 300.

(iv) Purchase Return Book overcast by ₹ 200.

Answer:

Question 20.

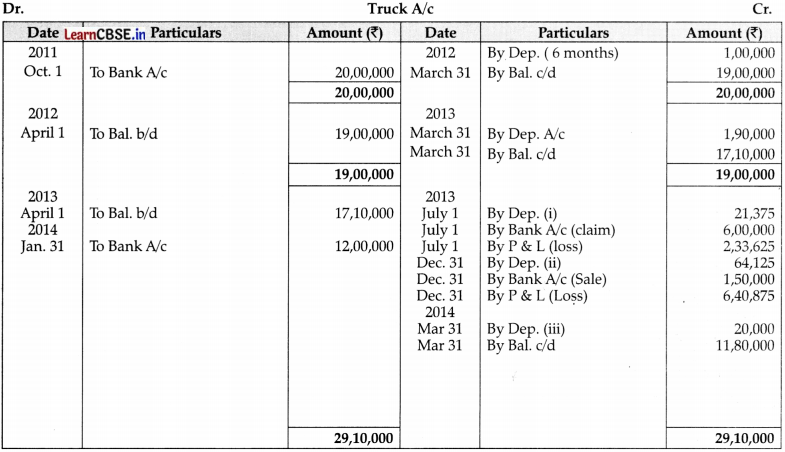

On October 01, 2011 Juneja Transport Company purchased 2 Trucks for ₹ 10,00,000 each. On July 01, 2013, One . Truck was involved in an accident and was completely destroyed and ₹ 6,00,000 were received from the Insurance Company in full settlement. On December 31, 2013 another Truck was involved in an accident and destroyed partially, which was not insured. It was sold off for ₹ 1,50,000. On January 31, 2014, company purchased a fresh truck for ₹ 12,00,000. Depreciation is to be provided at 10% p.a. on the written down value every year. The books are closed every year on March 31. Give the Truck Account from 2011 to 2014. [4]

Answer:

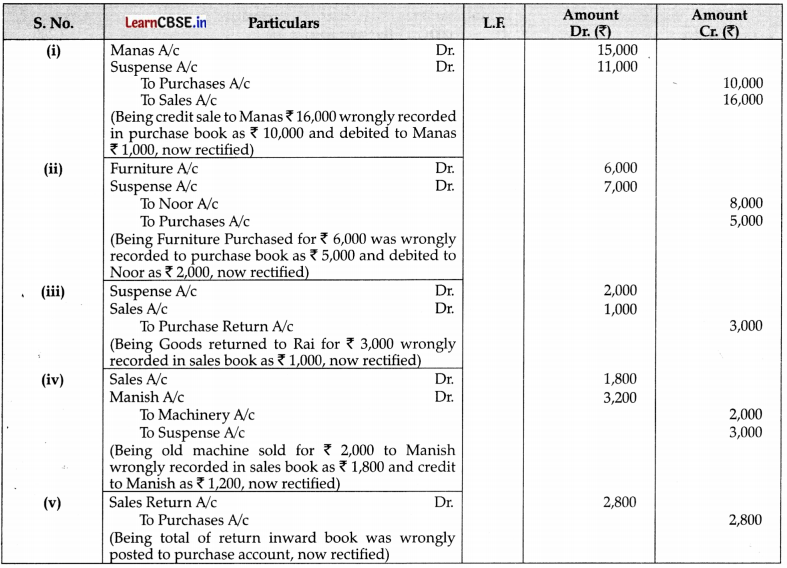

Question 21.

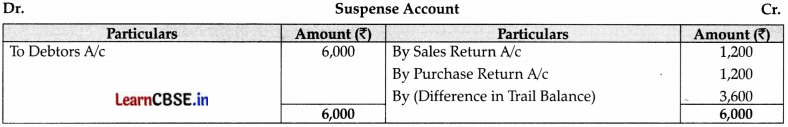

Trial balance of Khatau did not agree. He put the difference to Suspense A/c and discovered the following errors:

(i) Credit sales to Manas ₹ 16,000 were recorded in the purchases book as ₹ 10,000 and posted to the debit of Manas as ₹ 1,000.

(ii) Furniture purchased from Noor ₹ 6,000 was recorded through purchases books as ₹ 5,000 and posted to the debit of Noor ₹ 2,000.

(iii) Goods returned to Rai ₹ 3,000 recorded through the Sales book as ₹ 1,000.

(iv) Old machinery sold for ₹ 2,000 to Manish recorded through Sales book as ₹ 1,800 and posted to the credit of Manish as ₹ 1,200.

(v) Total of Returns Inwards book ₹ 2,800 posted to Purchase account.

Rectify the above errors and prepare suspense account to ascertain the difference in Trial balance. [6]

OR

Give Journal entries to rectify the following errors assuming that suspense account had been opened.

(i) Goods distributed as free sample ₹ 5,000 were not recorded in the books.

(ii) Goods withdrawn for personal use by the proprietor ₹ 2,000 were not recorded in the books.

(iii) Bill receivable received from a debtor ₹ 6,000 was not posted to his account.

(iv) Total of Returns Inwards book ₹ 1,200 was posted to Returns outwards account.

(v) Discount allowed to Reema ₹ 700 on receiving cash from her was recorded in the books as ₹ 70. [6]

Answer:

Question 22.

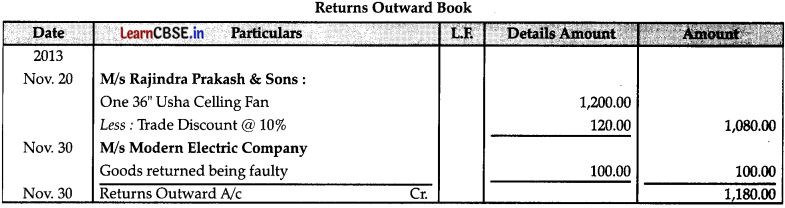

Post the following into the Ledger:

OR

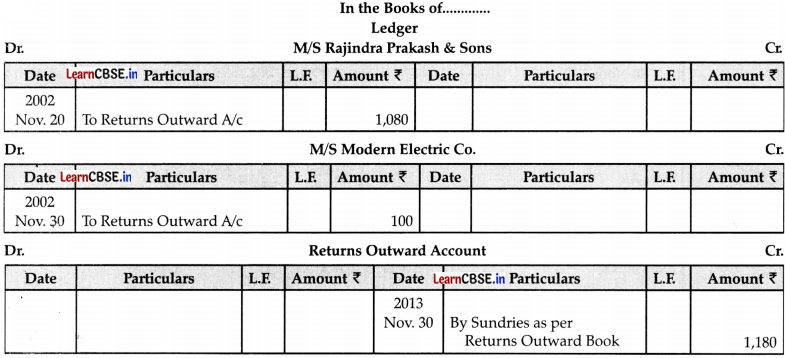

Journalise the transactions in the books of Himanshu :

| 2014 | ₹ |

| Dec. 01 Business started with cash | 75,000 |

| Dec. 07 Purchase goods for cash | 10,000 |

| Dec. 09 Sold goods to Swati | 5,000 |

| Dec. 12 Purchased furniture | 3,000 |

| Dec. 18 Cash received from Swati in full settlement | 4,000 |

| Dec. 25 Paid Rent | 1,000 |

| Dec. 30 Paid salary | 1,500 |

Answer:

Question 23.

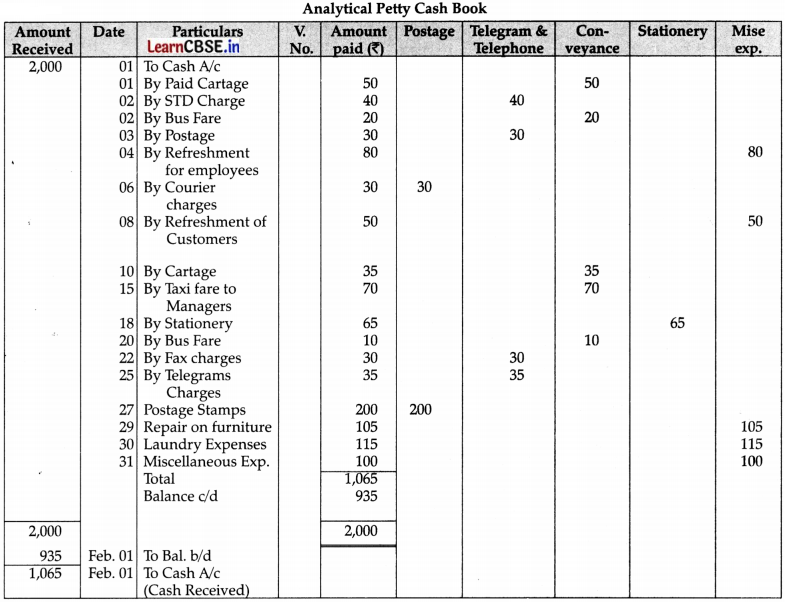

Prepare Petty Cash Book from the following transactions. The imprest system amount is ₹ 2,000.

| January 2014 | Particulars | ₹ |

| Jan. 01 | Paid Cartage | 50 |

| Jan. 02 | STO Charges | 40 |

| Jan. 02 | Bus Fare | 20 |

| Jan. 03 | Postage | 30 |

| Jan. 04 | Refreshment for Employees | 80 |

| Jan. 06 | Courier charges | 30 |

| Jan. 08 | Refreshment of Customers | 50 |

| Jan. 10 | Cartage | 35 |

| Jan. 15 | Taxi Fare to Managers | 70 |

| Jan. 18 | Stationary | 65 |

| Jan. 20 | Bus Fare | 10 |

| Jan. 22 | Fax charges | 30 |

| Jan. 25 | Telegrams charges | 35 |

| Jan.27 | Postage stamps | 200 |

| Jan. 29 | Repair on furniture | 105 |

| Jan 30 | Laundry Expenses | 115 |

| Jan, 31 | Miscellaneous expenses | 100 |

Answer:

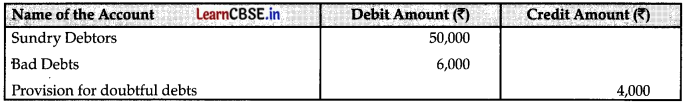

Question 24.

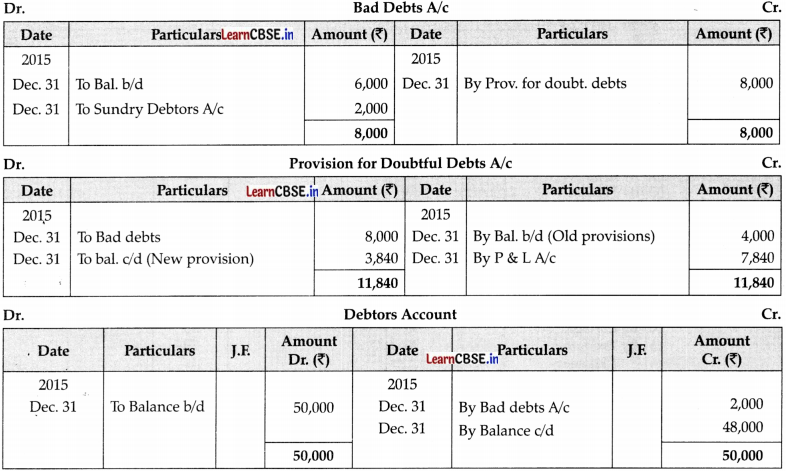

An extract of Trial balance from the books to Tahiliani and Sons Enterprises on December 31,2015 is given below:

Additional Information:

Bad Debts proved bad but not recorded amounted to ₹ 2,000

Provision is to be maintained at 8 % Debtors

Give necessary accounting entries for writing off the bad debts and creating the provision for doubtful debts account. Also show the necessary account.

Answer:

Part – B (Financial Accounting – II)

Question 25.

If the rent of one month is still to be paid then the adjustment entry will be:

(A) Debit outstanding rent account and Credit rent account.

(B) Debit profit and loss account and Credit rent account.

(C) Debit rent account and Credit profit and loss account.

(D) Debit rent account and Credit outstanding rent account. [1]

OR

Accrued Income means:

(A) Income due but not yet received.

(B) Income received but not belonging to current period.

(C) Both (A) and (B)

(D) None of the above [1]

Answer:

(D) Debit rent account and Credit outstanding rent account.

Explanation: To adjust the outstanding rent, the rent account being a nominal account needs to be debited and the outstanding rent account will be opened and credited with the outstanding amount.

OR

(A) Income due but not yet received.

Explanation: Accrued income is the income which has been earned during a particular accounting period, however, the related funds have not been received until the end of that accounting period. It is also considered as an outstanding income.

![]()

Question 26.

Credit purchase during the year is ascertained by preparing:

(A) Total creditors account

(B) Total debtors account

(C) Cash account

(D) Opening statement of affairs [1]

Answer:

(A) Total creditors account

Explanation: Purchases in cash will be known from the cash book, but for the credit purchases, total creditors account needs to be ascertained.

Question 27.

Statement I: Intangible assets are those assets which have no physical existence but can be sold and purchased.

Statement II: Amount taken as loan for the business is known as capital.

(A) Both Statements are correct.

(B) Both Statements are incorrect.

(C) Statement I is correct and Statement II is incorrect.

(D) Statement I is incorrect and Statement II is correct. [1]

OR

………………. is a statement showing true and fair view of the operating performance of the enterprise.

(A) Position Statement

(B) Income Statement

(C) Profit and Loss Appropriation Account

(D) None of the above [1]

Answer:

(C) Statement I is correct and Statement II is incorrect.

Explanation: Amount invested in the business is known as capital.

OR

(B) Income Statement

Explanation: The Income Statement is one of the company’s core financial statements that shows their profit and loss over a period of time.

![]()

Question 28.

Accounts are maintained under single entry system are ………………. and …………….

(A) Personal accounts, Cash accounts.

(B) Cash Account, Real Accounts

(C) Cash Account, Nominal Accounts

(D) Balance Sheet, Trial Balance [1]

Answer:

(A) Personal accounts, Cash accounts.

Explanation: In the case of the single entry system, only cash account and personal accounts are maintained

Question 29.

Consider the following statements with regard to the features of Trial Balance:

(i) To ascertain the arithmetical accuracy of the accounts recorded and posted in the books of accounts.

(ii) To help in locating errors.

(iii) To help in the preparation of the final accounts.

Identify the correct statement/statements:

(A) (i) and (ii)

(B) (i), (ii) and (iii)

(C) (i) and (iii)

(D) (ii) and (iii) [1]

Answer:

(B) (i), (ii) and (iii)

Question 30.

Net sales during the year 2016 are ₹ 2,85,000. Gross profit is 25% on sale. Find out Cost of Good Sold. [3]

OR

Calculate Net Sales and Gross Profit from the following information:

Cost of goods sold = ₹ 1,00,000

Gross profit 20% on sales.

Answer:

Gross Profit = Net Sales – Cost of goods sold

So, Cost of goods Sold = Net Sales – Gross Profit on sales

= ₹ 2,85,000 – 25/100 x ₹ 2,85,000

= ₹ 2,85,000 – ₹ 1,250

= ₹ 2,13,750 [3]

OR

Let Sales be ₹ 100, Gross Profit will be ₹ 20.

Therefore, Cost of goods sold will be = ₹ 100 – ₹ 20 = ₹80

When Cost of goods sold is ₹ 80, then sales = ₹ 100

& When the cost of goods sold is ₹ 1, then sales = ₹ 100/80

So when the cost of good sold is ₹ 1,00,000 then sales = 100/80 x ₹ 1,00,000 = ₹ 1,25,000

So, Gross profit on sales = ₹ 1,25,000 x 20% = ₹ 25,000 [3]

![]()

Question 31.

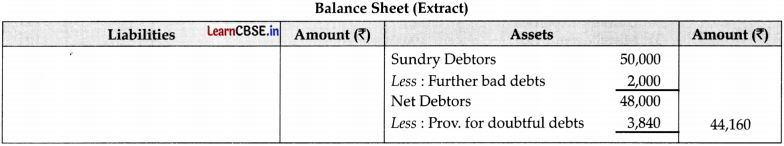

From the information given below ascertain the profit for the year:

| Particulars | ₹ |

| Capital at the beginning of the year | 70,000 |

| Additional Capital introduced during the year | I 7,500 |

| Stock | 59,500 |

| Sundry Debtors | 25,900 |

| Business Premises | 8,600 |

| Machinery | 2,100 |

| Sundry Creditors | 33,400 |

| Drawings made during the year | 26,400 |

Answer:

Question 32.

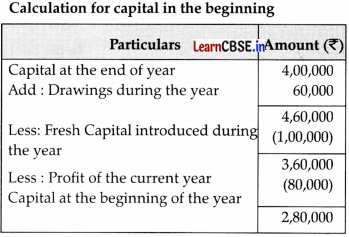

From the following information, calculate capital at the beginning:

| Particulars | ₹ |

| Capital at the end of the year | 4,00,000 |

| Drawings made during the year | 60,000 |

| Fresh Capital introduced during the year | 1,00,000 |

| Jrofit of the current year | 80,000 |

Answer:

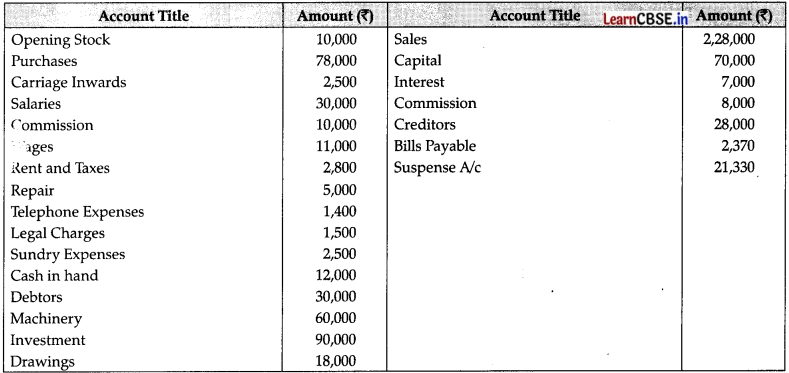

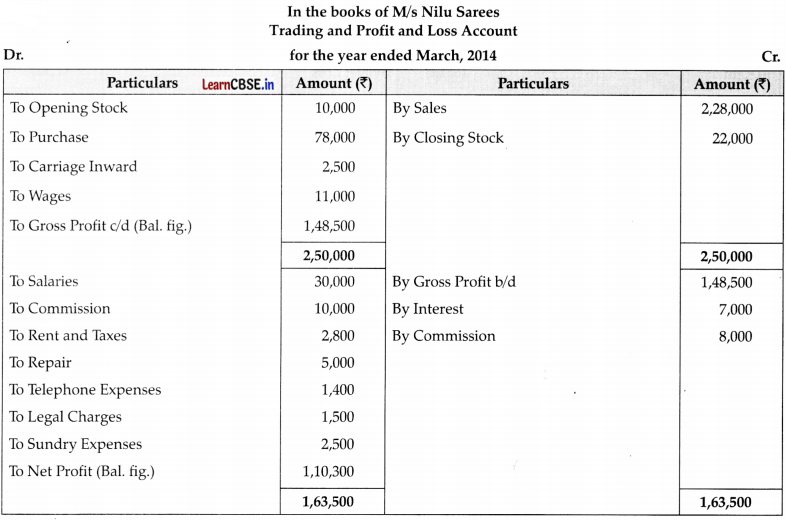

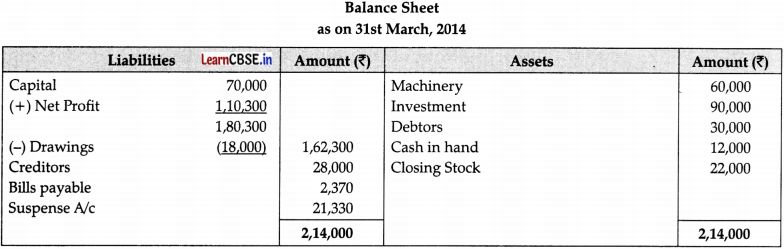

Question 33.

From the following balances of MIs Nilu Sarees as on March 31, 2014, prepare Trading and Profit and Loss Account

and balance sheet as on that date:

Closing Stock as on March 31, 2011 ₹ 22,000.

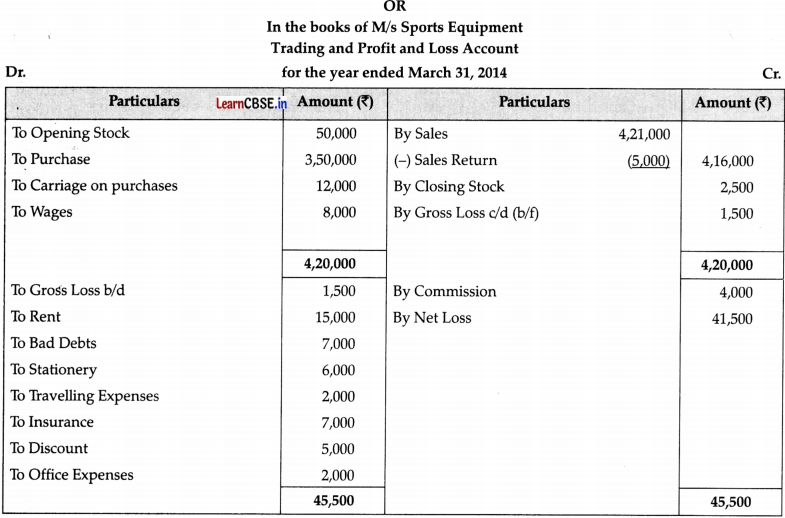

OR

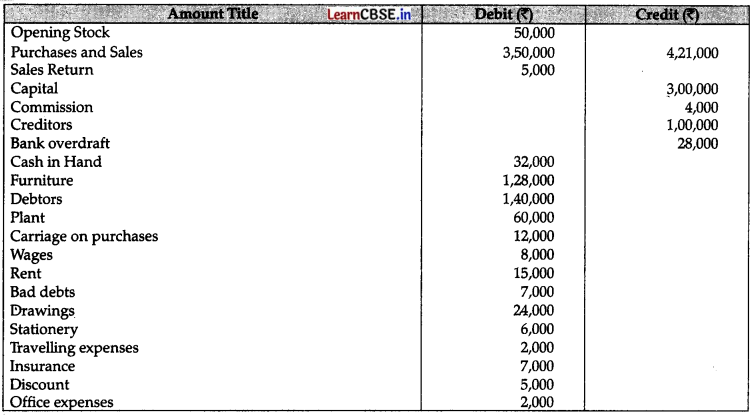

Prepare Trading and Profit and Loss Account of M/s Sports Equipment for the year ended March 31, 2014 and

Balance sheet as on that date:

Closing stock as on March 31, 2014 ₹ 2,500.

Answer:

Note : Being Credit Balance of Trial Balance the amount ₹ 21,330 is transferred to suspense account to be shown on ‘ Liabilities side of Balance Sheet.

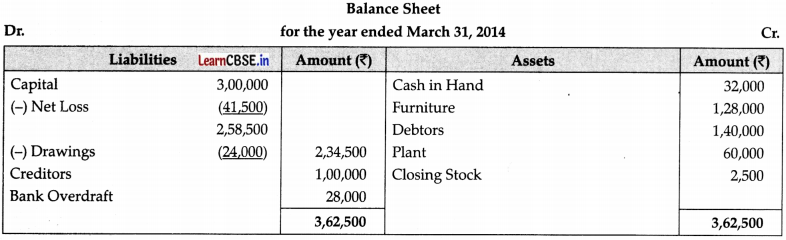

Question 34.

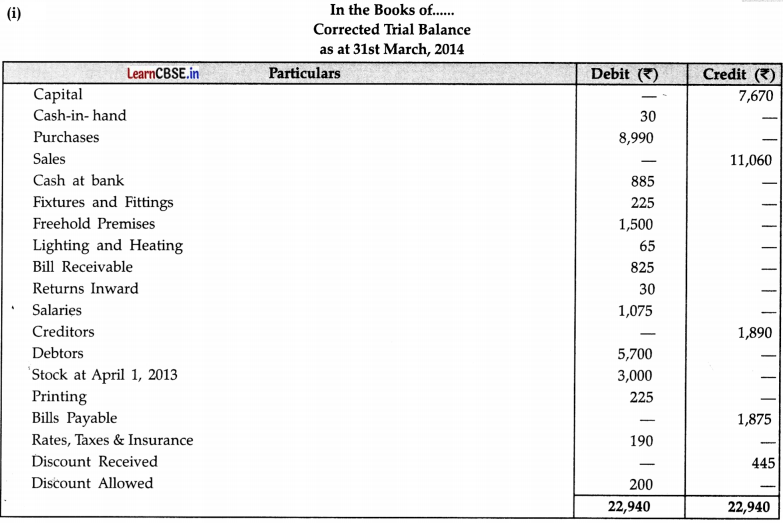

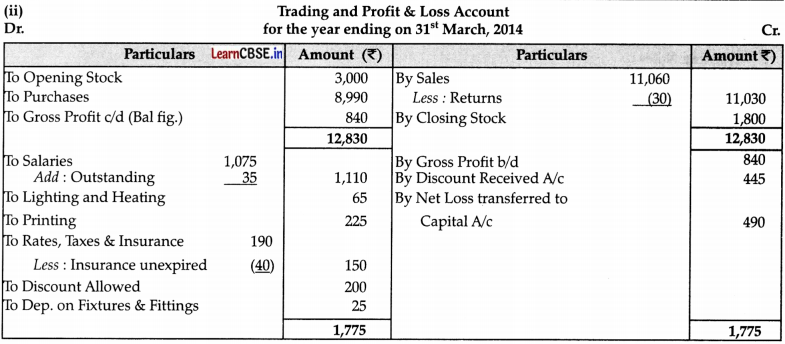

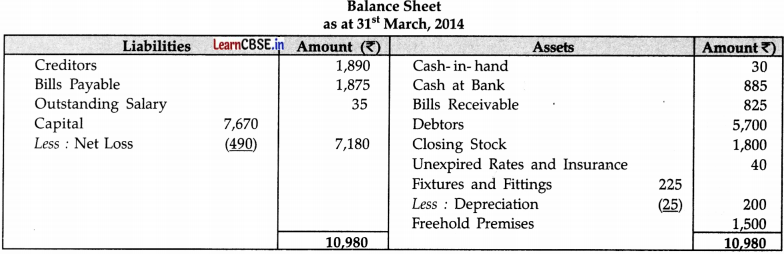

A book keeper has submitted to you the following Trial Balance wherein the totals of the Debit and Credit balances are not equal:

You are required to :

(i) Redraft the Trial Balance correctly as at 31st March, 2014.

(ii) Prepare a Trading and Profit & Loss Account and a Balance Sheet after taking into account the following adjustments:

(A) Stock on hand on 31st March, 2014 was valued at ₹ 1,800.

(B) Depreciate Fixtures and Fittings by ₹ 25.

(C) ₹ 35 was due and unpaid in respect of salaries.

(D) Rates and insurance had been paid in advance to the extent of ₹ 40.

Answer: