Students must start practicing the questions from CBSE Sample Papers for Class 11 Accountancy with Solutions Set 4 are designed as per the revised syllabus.

CBSE Sample Papers for Class 11 Accountancy Set 4 with Solutions

Time Allowed : 3 hours

Maximum Marks: 70

General Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Question Nos.1 to 15 and 25 to 29 carries 1 mark each.

- Questions Nos. 16 to 18, 30 to32 carries 3 marks each.

- Questions Nos. 19, 20 and 33 carries 4 marks each.

- Questions Nos. 21 to 24 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, I question of four marks and 2 questions of six marks.

Part – A ((Financial Accounting – I)

Question 1.

Which of the following is an advantage of accounting?

(A) Maintaining records

(B) Presenting financial position

(C) Estimating profit or loss

(D) All of the Above [1]

Answer:

(D) All of the Above

Question 2.

Assertion: The accountant measures only those events that are financial in nature.

Reasoning: Non-monetary items or events, however, significant they may be, are not measured or recorded in accounting.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Question 3.

Internal users are the of the business entity.

(A) Management

(B) Employees

(C) Both (A) and (B)

(D) None of the these

OR

Deepti wants to buy a building to start her business today. Which of the following is the relevant data for her decision:

(A) Similar business acquired the required building in 2000 for ₹ 10,00,000

(B) Building cost details of 2003

(C) Building cost details of 1998

(D) Similar building cost in August 2005 ₹ 25,00,000 [1]

Answer:

(C) Both (A) and (B)

OR

(A) Similar business acquired the required building in 2000 for ₹ 10,00,000

![]()

Question 4.

Which of the following Accounting Standard lays down fundamental accounting assumption:

(A) AS-1

(B) AS-3

(C) Both (A) and (B)

(D) None of the these [1]

OR

Pick the odd one out:

(A) Money Measurement Concept

(B) Business Entity Concept

(C) Accounting Period Concept

(D) Balance Sheet [1]

Answer:

(A) AS-1

Explanation: AS1 deals with disclosure of significant accounting policies followed in preparing andpresenting financial statements whereas AS3 deals

with preparation of Cash Flow Statement.

OR

(D) Balance Sheet

Explanation: Balance Sheet is the statement preparedto show the financial position of the company or firm. On the other hand the rest are the Accounting Concepts and Principles on the basis of which accounting is done.

Question 5.

According to assumption assets are shown in the accounting records at cost less depreciation.

(A) Conservatism

(B) Going Concern

(C) Matching Cost

(D) Dual Aspect [1]

Answer:

(B) Going Concern

![]()

Question 6.

Amongst the following, whose objective is to ensure uniformity in the preparation and presentation of financial statements:

(A) IFRS

(B) Ind-AS

(C) AS

(D) None of these [1]

OR

…………… issues accounting standards in India.

(A) ICAI

(B) ICWAI

(C) ICS

(D) UPSC [1]

Answer:

(C) AS

OR

(A) ICAI

Explanation: The Institute of Chartered Accountants of India issues the accounting standards and regulates how the accounts are to be maintained in India.

Question 7.

Assertion: Cash Book is both a subsidiary book as well as a principal book.

Reasoning: Cash balance is directly entered in the trial balance from Cash Book.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct.

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Explanation: Cash Book is both a subsidiary book as well as a principal book. As a subsidiary book, it records all the cash transactions, Ledger accounts are prepared on the basis of each book records. Thus, it is a book of original entry or a subsidiary book. Cash Book represents cash account. Cash balance is directly entered in the trial balance from Cash Book. Therefore, It is a part of ledger also. Hence, it is also treated as a principal book of accounts. The Cash Book is thus, both a subsidiary book and a principal book.

Question 8.

Which of the following is written evidence of a transaction that has taken place:

(A) Cash voucher

(B) Invoice

(C) Voucher

(D) Transfer voucher [1]

OR

Consider the following statements with respect to the rules of Debit and Credit:

(i) Debit what comes in, Credit what goes out.

(ii) Debit the receiver, Credit the giver.

(iii) Debit all incomes, Credit all expenses.

Identify the correct statement/statements:

(A) (i) and (ii)

(B) (i) only

(C) (ii) and (iii)

(D) (i), (ii) and (iii) [1]

![]()

Read the following hypothetical situation, answer question nos. 9 and 10.

Accounting principles are the basic guidelines that provide standards for accounting practices and procedures to be followed, so that uniformity in accounting transactions is maintained. Accounting concepts are the assumptions on the basis of which financial statements are prepared. Accounting conventions emerge out of the accounting practices that have been followed by various organizations, over a period of time. The generally accepted accounting principles are generally accepted accounting standards.

The concepts on the basis of which the financial statements are prepared and are agreed upon by the accountants, acting as a foundation for accounting are called accounting concepts. They are a uniform set of rules for uniformity and understandability of accounting information. They are derived from experience. They s\re not static. It needs to satisfy relevance, objectivity and feasibility. The going concern concept assumes that the enterprise has neither any intention nor any necessity to close the business and will last for a long time. It enables the firms to enter into long term contracts. It enables for the charge or depreciation on assets which have fixed life. Due to this concept prepaid expenses are treated as assets. It helps in the classification of assets and liabilities. [1]

Answer:

(C) Voucher

Explanation: Voucher Is a written evidence that supports a transaction that has taken place in reality. Invoice Is the written evidence of the buying and selling of goods.

OR

(A) (i) and (ii)

Explanation As per the traditional approach: Debit what comes in, credit what goes out.Debit all Debit the receiver and credit the giver.

Question 9.

Which of the following is not the purpose served by Accounting standards?

(A) To make the accounting information meaningful with other firms and across years

(B) To see the performance and compare with other firms and years.

(C) To bring uniformity and consistency in accounting process.

(D) To make the accounting very static and objective. [1]

Answer:

(D) To make the accounting very static and objective.

![]()

Question 10.

What are Accounting Principles also called?

(A) Generally Accepted Accounting Principles

(B) Generally Accepted Accounting Policies

(C) Globally Accepted Accounting Principles

(D) Globally Accepted Accounting Policies [1]

Answer:

(A) Generally Accepted Accounting Principles

Question 11.

The management of a firm is remarkably incompetent but the firm’s accountant cannot take this into account while

preparing book of accounts because of concept.

(A) Consistency

(B) Periodic Causes

(C) Revenue Recognition

(D) Money Measurement Concept

Answer:

(D) Money Measurement Concept

Explanation: According to this principle all business transactions should be recorded in terms of money. Thus, only those transactions are recorded in accounting books, which can be measured in terms of money. This is because a monetary unit is the most popular medium of measurement and exchange and it is relevant, sim,le and understandable. It should be noted that information, which cannot be expressed in terms of money i5 not recorded in accounting books.

Question 12.

Consider the following statements with regard to the advantages of Accounting Standards:

(i) Eliminates variations in accounting treatment, where alternatives exist.

(ii) Disclose certain important information which is not statutorily required.

(iii) There may be a tendency to rigidly follow the Accounting Standards, thereby moving away from its flexible nature.

(iv) They can override statute and have to abide by the laws prevalent in a country.

Identify the correct statement/statements:

(A) (i) and (iii)

(B) (ii) and (iii)

(C) (ii) and (iv)

(D) (i) and (ii) [1]

Answer:

(D) (i) and (ii)

![]()

Question 13.

Consider the following statements with regard to the advantages of Journal:

(i) Information about business transactions can be easily obtained on a timely basis, as transactions are recorded in a chronological order.

(ii) With the help of narration that is mandatory for every transaction, it is possible to understand the correct nature of the entry.

(iii) Chances of errors are minimized, as both debit and credit aspects are recorded.

(iv) They form the basis for posting entries into the ledger.

Identify the correct statement/statements:

(A) (i) and (ii)

(B) (ii) and (iii)

(C) (i), (ii) and (iv)

(D) (i), (ii), (iii) and (iv) [1]

Answer:

(D) (i), (ii), (iii) and (iv)

Question 14.

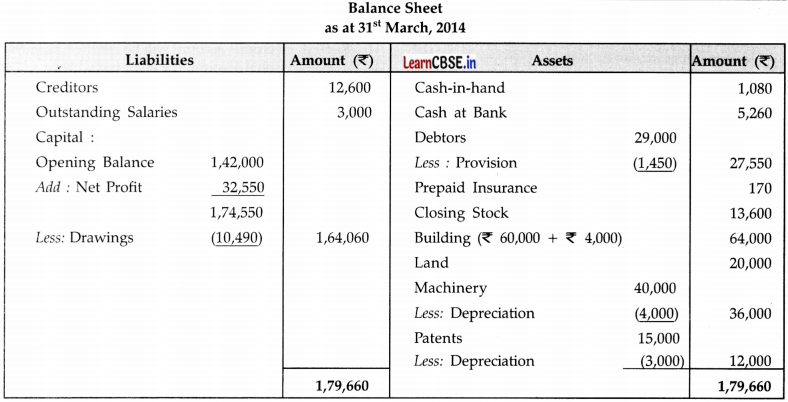

While preparing the trial balance it was found that the accountant of Ariyanth Jewellers had over casted the Purchases returns book by 1,08,000. What journal entry needs to be passed for rectifying the error? An old machinery was sold to Manish for ₹ 56,000.In which book will this entry be recorded?

(A) Cash Book

(B) Journal Proper

(C) Sales Book

Answer:

(A) Cash Book

Question 15.

An old machinery was sold to Manish for ₹ 56,000.In which book will this entry be recorded?

(A) Cash Book

(B) Journal Proper

(C) Sales Book

(D) None of the these

OR

Pick the odd one out:

(A) Commission received

(B) Goods sold for cash

(C) Amount received from Tripathi

(D) Salary paid

Answer:

(B) Journal Proper

OR

(D) Salary paid

Explanation: Salary paid is the only item to appear In the credit side of the Cash Book as It Is the only item of expense rest all are incomes and as they will increase the cash it will be in the debit side of the cash book.

![]()

Question 16.

Explain in brief, the limitations of financial accounting. [1]

Answer:

Following are the limitations of financial accounting:

(i) Incomplete information : The accountant measures only those events that are financial in nature, ii,, that are capable of being expressed in money, Non – monetary items or events, however significant they maybe, are not measured or recorded in accounting. For example, competency of management, competition in the market, industrial relations, etc.

(ii) Inexactness : Accounting data is sometimes based on estimations and it may be inaccurate, Therefore, profits and financial position disclosed by such accounts may not be true and exact. For example, stocks are also valued on some assumptions. Actual useful life of an asset cannot be accurately calculated for the purpose of depreciation.

(iii) Personal influence of accountant : Accounting may be influenced by the personal judgement of the accountant. He applies a choice between different methods of inventory valuation, depreciation methods, provision for doubtful debts, treatment of capital and revenue items and so on. Thus, due to lack of objectivity, income measured may not be true in certaîn cases.

(iv) Assets may not be shown at their real value : Fixed assets are shown at written down value, i.e., cost less depreciation. There may be a great difference between book value at which assets are shown and current replacement cost. Certain valueless assets are also sometimes shown in Balance sheet, such as, goodwill, patents and trademark, preliminary expenses, etc.

(v) Effect of price level changes not considered : Accounting statements are prepared at historical cost. Money as a measurement unit, changes in value, it is not thus, considered while preparing Profit & Loss Account. Thus, the accounting information will not show true financial results.

(vi) Non-monetary transactions are ignored : Financial statements record only monetary transactions. Certain important and valuable assets like Human Resources, do not find a place in the Balance sheet. This is because, there is no yardstick to measure the value of Human Resources in monetary terms.

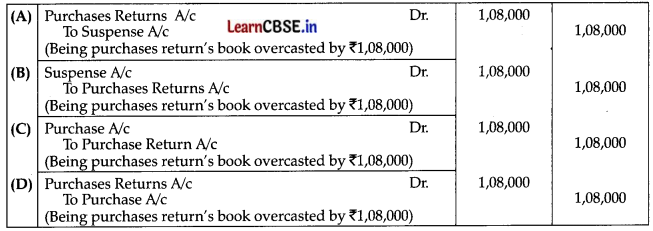

![]()

Question 17.

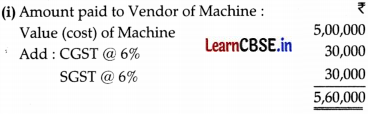

Rajan purchased a machine on 1 October, 2017 for ₹ 5,00,000 plus CGST and SGST @ 6% each. He paid ₹ 20,000 for loading/unloading and carriage expenses to bring the machine to factory. He further incurred ₹ 25,000 for installing the machine. Pass the Journal Entries giving effect to the transaction. [3]

OR

Rim Zim Ltd. maintains a current account with the State Bank of India. On 31st March, 2017, the bank column of its cash book showed a debit balance of ₹ 1,54,300. However, the bank statement showed a different balance as on that date. The following were the reasons for the difference :

(i) Cheques deposited, but not yet credited by the bank ₹ 75,450

(ii) Cheques issued, but not yet presented for payment ₹ 80,760

(iii) Bank charges not yet recorded in the cash book ₹ 1,135

(iv) Cheques received by the bank directly from trade debtors ₹ 1,35,200

(v) Insurance premium paid by the bank as per standing instructions, but not yet recorded in the cash book ₹ 15,400

(vi) Dividend collected by the bank, but not yet recorded in the cash book ₹ 1,000

Find out the balance as per the bank statement as on 31st March, 2017. [3]

Answer:

Question 18.

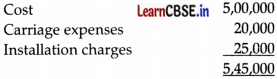

Prepare Accounting Equations on the basis of the given transactions:

(i) Started business with cash ₹ 80,000.

(ii) Credit purchase of goods ₹ 28,000.

(iii) Payment made to creditors in full settlement ₹ 27,000. [3]

Answer:

Question 19.

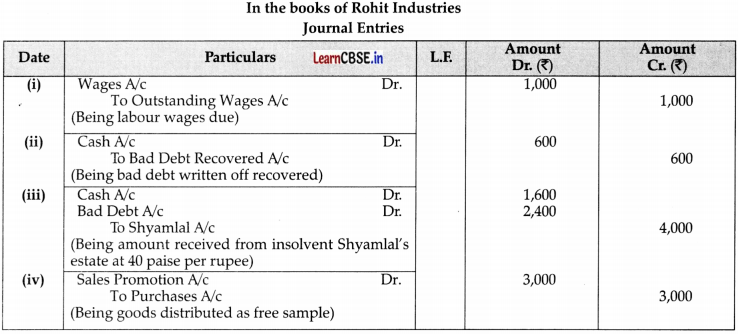

Pass necessary Journal Entries in the books of Rohit Industries :

(i) Wages due but not paid ₹ 1,000

(ii) Received ₹ 600 from Mohan, which were written off as bad debts 2 years ago.

(iii) Shyamlal who owed us ₹ 4,000 becomes insolvent and a final dividend of 40 paise in a rupee is received from his house.

(iv) Goods distributed as free sample ₹ 3,000.

Answer:

Question 20.

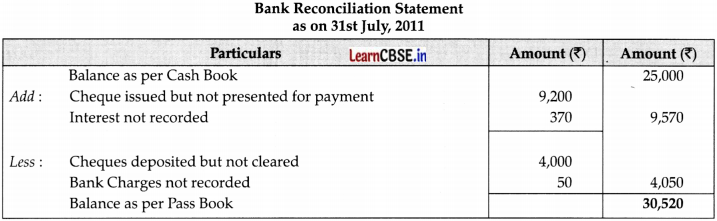

From the following information, prepare Bank Reconciliation Statement as on 31st July 2011:

(i) Balance as per Cash Book is ₹ 25,000 as on 31st July, 2011.

(ii) Cheque for ₹ 15,000 were deposited into the Bank in the month of July but only cheques for ₹ 11,000 were credited by the bank till 31st July 2011.

(iii) Cheques issued for ₹ 13,000 in July, out of which a cheque for ₹ 9,200 was presented for payment on 3rd August.

(iv) Bank charged ₹ 50 as bank charges and credited interest of ₹ 370. [4]

Answer:

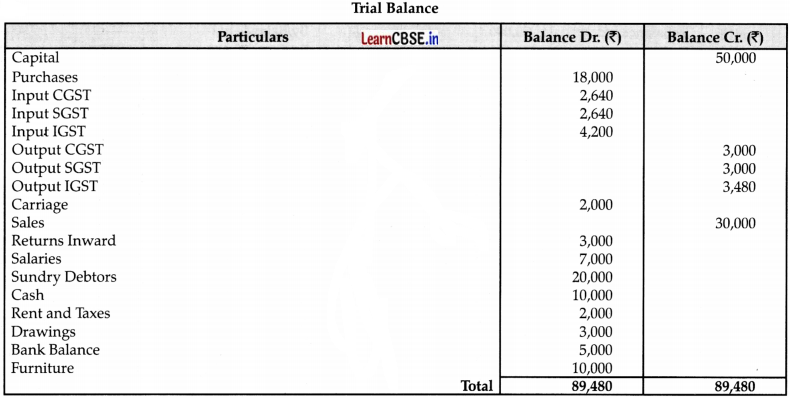

Question 21.

From the following Ledger Balances draw up the Trial Balance:

| Particulars | Balance (₹) |

| Capital | 50,000 |

| Purchases | 18,000 |

| Input CGST | 2,640 |

| Input SCST | 2,640 |

| Input IGST | 4,200 |

| Output CGST | 3,000 |

| Output SGST | 3,000 |

| Output IGST | 3,480 |

| Carriage | 2,000 |

| Sales | 30,000 |

| Returns Inward | 3,000 |

| Salades | 7,000 |

| Sundry Debtors | 2.0,000 |

| Cash | 10,000 |

| Rent and Thxes | 2,000 |

| Drawings | 3,000 |

| Bank Balance | 5,000 |

| Furniture | 10,000 |

| Particulars | Balance (₹) |

| Capital | 50,000 |

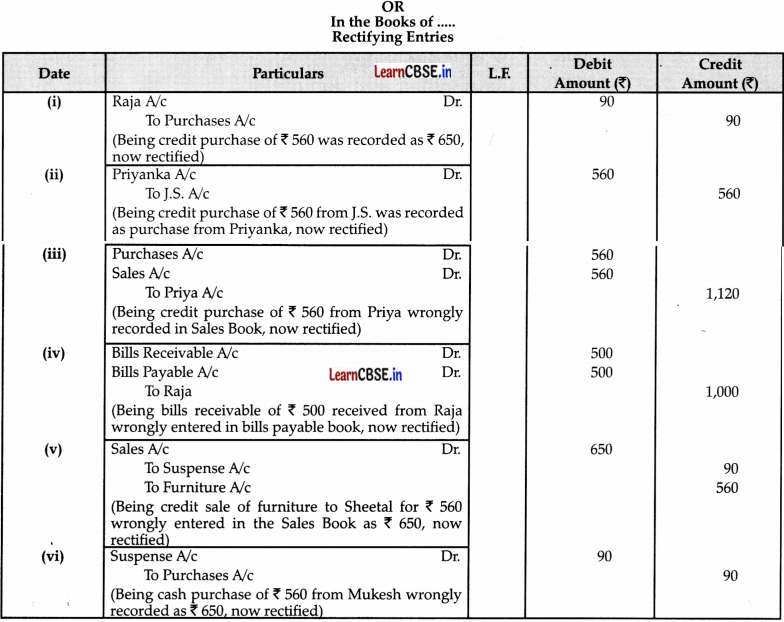

Pass the necessary journal entries to rectify the following errors:

(i) A credit purchase of ₹ 560 from Raja was recorded as ₹ 650.

(ii) A credit purchase of ₹ 560 from J.S. was recorded as purchase from Priyanka.

(iii) A credit purchase of ₹ 560 from Priya was recorded in the Sales Book.

(iv) A Bills Receivable of ₹ 500 received from Raja was entered in Bills Payable Book.

(v) A credit sale of old furniture to Sheetal for ₹ 560 was entered in the Sales Book for ? 650.

(vi) A cash purchase of ₹ 560 from Mukesh was posted to Purchase A/c as ₹ 650. [6]

Answer:

Question 22.

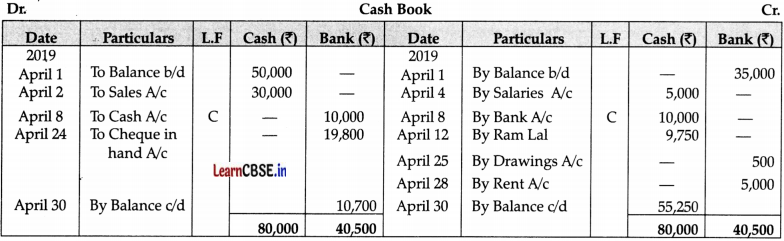

Prepare a two column Cash Book with cash and bank column with the following information:

| Date | Particulars | Amount(₹) |

| 2019 | ||

| April 1 | Cash in hand | 50,000 |

| Bank Overdraft | 35,000 | |

| April 2 | Cash Sales | 30,000 |

| April 4 | Paid Salaries | 5,000 |

| April 8 | Cash deposited into bank | 10,000 |

| April 10 | Goods purchased from Ram Lai | 10,000 |

| April12 | Payment made to Ram Lai in full settlement | 9,750 |

| April 14 | Goods sold to Ram | 20,000 |

| April20 | Received cheque from Ram and allowed him discount of ₹ 200 | 19,800 |

| April24 | Cheque received from Ram deposited into Bank | |

| April25 | Withdrew cash from Bank for personal use | 500 |

| April28 | Paid rent by cheque | 5,000 |

OR

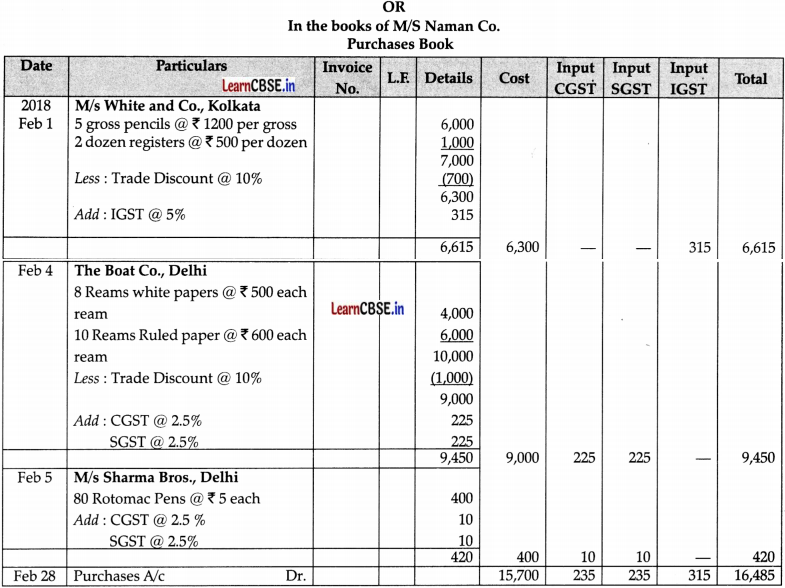

From the following information of M/s Naman Co., Delhi, prepare the Purchases Book for the month of February, 2018:

2018

Feb. 01 Purchased from M/s White Co., Kolkata on credit:

5 gross pencils @ ₹ 1200 per gross

2 dozen registers @ ₹ 500 per dozen

Less : Trade Discounts @10%

Feb. 02 Purchased for cash from the stationery mart:

10 dozen exercise books @ ₹ 300 per dozen

Feb. 03 Purchased computer printer for office use from M/s Neel Kamal Co. on credit for ₹ 20,000

Feb. 04 Purchased on credit from The Boat Co., Delhi 8 reams of white paper @ ₹ 500 per ream 10 reams of ruled paper @ ₹ 600 per ream Less : Trade Discount @ 10%

Feb. 05 Purchased 80 Rotomac Pens @ ₹ 5 each from M/s Sharma Bros., Delhi on credit

NOTE : CGST and SGST is levied @ 2.5 % each and IGST @ 5% [6]

Answer:

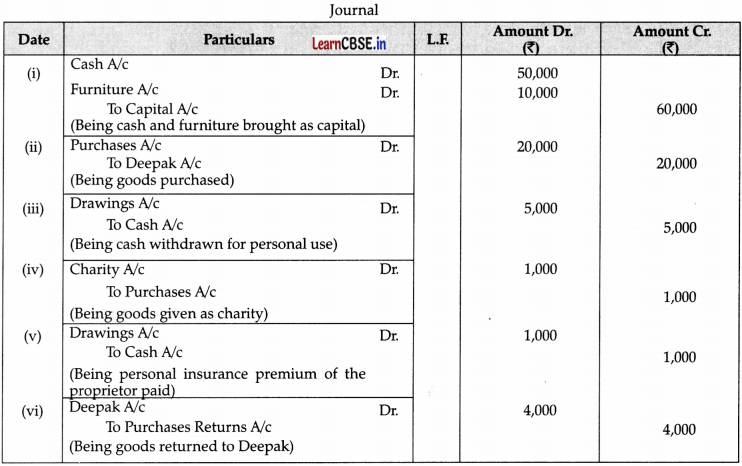

Question 23.

Journalise the following transactions :

(i) Lakhan started business with cash ₹ 50,000 and furniture ? 10,000.

(ii) Purchased goods from Deepak on credit ₹ 20,000.

(iii) Drew cash from office for his personal use ₹ 5,000.

(iv) Goods given as charity ₹ 1,000.

(v) Paid ₹ 1,000 for life insurance premium of Lakhan.

(vi) Goods return to Deepak ₹ 4,000. [6]

Answer:

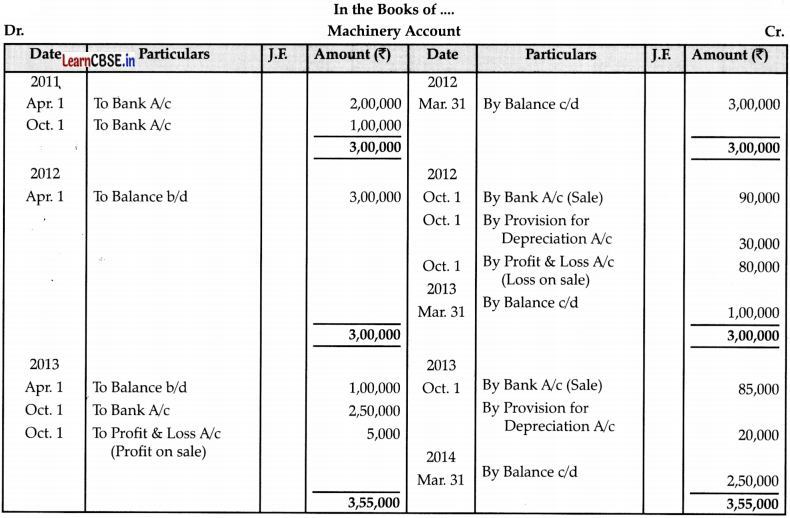

Question 24.

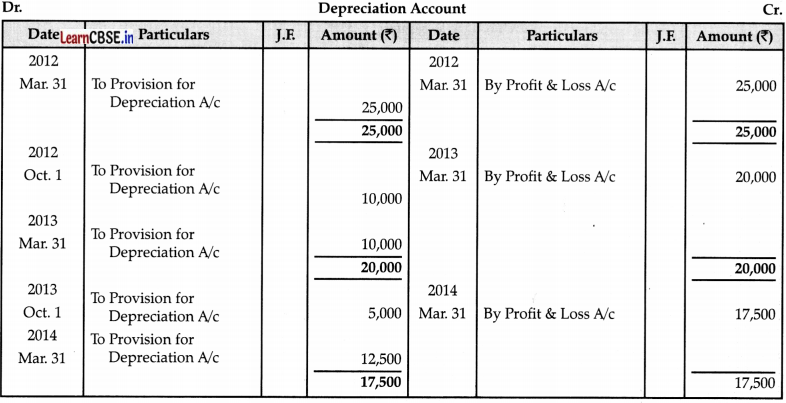

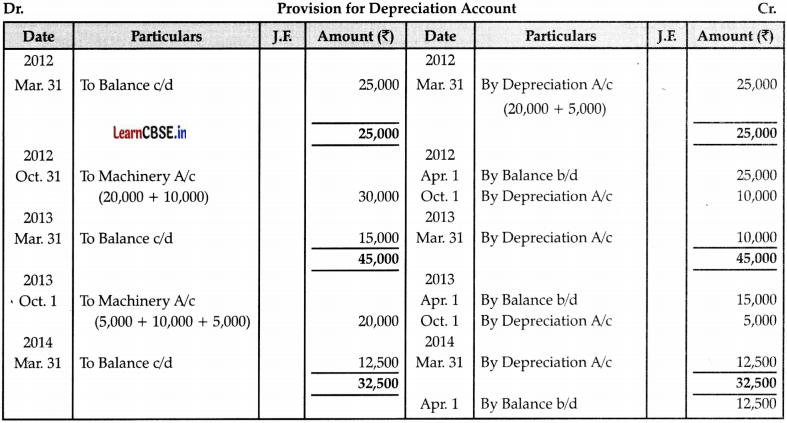

On 1st April, 2011 a firm purchased a machinery for ₹ 2,00,000. On 1st October in the same accounting year additional machinery costing ? 1,00,000 was purchased. On 1st October, 2012 the machinery purchased on 1st April, 2011 having become obsolete, was sold off for ₹ 90,000. On 1st October, 2013 new machinery was purchased for ₹ 2,50,000 while the machinery purchased on 1st October, 2011 was sold for ₹ 85,000 on the same day. The firm provides depreciation on its machinery @ 10% per annum on original cost on 31st March every year. Show Machinery account, Provision for depreciation account and Depreciation account for the period of three accounting years ending 31st March, 2014. [6]

Answer:

Part – B (Financial Accounting – II)

Question 25.

Which of the following is the use of financial statements for the creditors of the company:

(A) Ascertain the firms ability to repay its debt in a short period of time.

(B) Ascertain future prospects of the firm.

(C) Ascertain performance of the firm in terms of profit and financial position.

(D) All of the above

OR

Marshalling of various items in the BalanceSheet can be done in the order of …………….. or ……………

(A) Permanence, accruance

(B) Liquidity, permanence

(C) Occurrence, liquidity

(D) Occurrence, permanence [1]

Answer:

(D) All of the above

OR

(B) Liquidity, permanence

![]()

Question 26.

If the opening capital is ₹ 50,000 as on April 01, 2014 and additional capital introduced ₹ 10,000 on January 01, 2015, interest charged on capital 10% p.a, the amount of interest on capital shown in Profit and Loss Account as on March 31,2015 will be:

(A) ₹ 5,250

(B) ₹ 6,000

(C) ₹ 4,000

(D) ₹ 3,000 [1]

Answer:

(A) ₹ 5,250

Question 27.

Statement I: Depreciation is the decline in the value of an asset, on account of wear and tear or passage of time. Statement II: In the Balance Sheet, the asset is shown at cost plus the amount of depreciation.

(A) Both Statements are correct.

(B) Both Statements are incorrect.

(C) Statement I is correct and Statement II is incorrect.

(D) Statement I is incorrect and Statement II is correct.

OR

Ravi has added an accrued income of ₹ 10,000 into the income in Profit and Loss Account. The assets and liabilities side of this Balance Sheet does not tally. Help him in recording the adjustment of accrued income.

(A) Show accrued income in liabilities side of Balance Sheet.

(B) Instead of adding ₹ 10,000, deduct ₹ 10,000 from income in Profit and Loss A/c and then show it in liabilities side

of Balance Sheet.

(C) Show ₹ 10,000 in assets side of Balance Sheet also.

(D) Deduct ₹ 10,000 from income in Profit & Loss Account. [1]

Answer:

(C) Statement I is correct and Statement II is incorrect.

Explanation: Depreciation is the decline in the value of an asset, on account of wear and tear or passage of time. It actually amounts to writing-off a portion. of the cost of an asset which has been used in the business for the purpose of earning profits. In the Balance Sheet, the asset is shown at cost minus the amount of depreciation.

OR

(C) Show ₹ 10,000 in assets side of Balance Sheet also.

Explanation: Accrued income is a current asset, hence to be shown in the Balance Sheet.

![]()

Question 28.

Which of the following is not a feature of incomplete records:

(A) Double entry system is followed.

(B) Personal transactions of owners may also be recorded in cash book.

(C) Dependence on original vouchers is inevitable.

(D) All of the above [1]

Answer:

(A) Double entry system is followed.

Explanation: Incomplete records is done as per the single entry system.

Question 29.

Mr. X wants to start a limited company. He has approached you for advice as to which accounting system he should follow. Advice him.

(A) Single Entry system

(B) Either double entry or single entry system.

(C) Double entry system

(D) For some transactions single entry system and for others double entry system. [1]

Answer:

(C) Double entry system

Question 30.

Distinguish between statement of affairs and balance sheet. [3]

OR

What adjustment entries would you pass for the following?

(i) To write-off further bad debts

(ii) Provision for doubtful debts on debtors

(iii) Provision for discount on debtors. [3]

Answer:

| Basis of Distinction | Statement of Affairs | Balance Sheet |

| (i) Basis of Preparation | On the basis of some ledger accounts and estimates. | n the basis of all ledger accounts. |

| (ii) Balance of Capital Account | Balance of Capital account arrived at as a balancing figure. | Balance of Capital account is taken from the ledger. |

| (iii) Arithmetical Accuracy | It does not prove the arithmetical accuracy of accounting books because it is not prepared on the basis of trial balance. | The tallying of balance sheet proves arithmetical accuracy of accounting books because it is prepared on the basis of trial balance. |

| (iv) Objective | It is prepared for ascertaining the capital of the business. | It is prepared for ascertaining the financial position of the business. |

| (v) Value of Assets and Liabilities | The value of Assets and Liabilities shown in the statement of affairs are merely the estimates based on physical inspection. | The value of Assets and liabilities shown in a Balance Sheet are the actual values based on ledger accounts. |

| (vi) Omission of Assets/Liabilities | Omission of assets or liabilities cannot be easily traced. | Omission of assets or liabilities can be easily traced because of non agreement of both the sides of the Balance Sheet. |

| (vii) Estimated Vs. True Financial Position | It shows only the estimated financial position. | It shows the true financial position. |

| (viii) Reliability | It is treated as less reliable because it is based on incomplete records and estimates. | A Balance Sheet is more reliable because it is based on double entry principles. |

OR

Adjustments Entries:

(i) For writing-off further bad debts:

Bad debts A/c Dr.

To Debtors A/c

(Being bad debts written off)

(ii) For provision for bad debts:

P&LA/c Dr.

To Provision for Bad Debts Nc

(Being provision made for doubtful debts)

(iii) For provision for discount on debtors:

P&LA/c Dr.

To Provision for Discount on Debtors A/c

(Being provision made for discount on debtors)

![]()

Question 31.

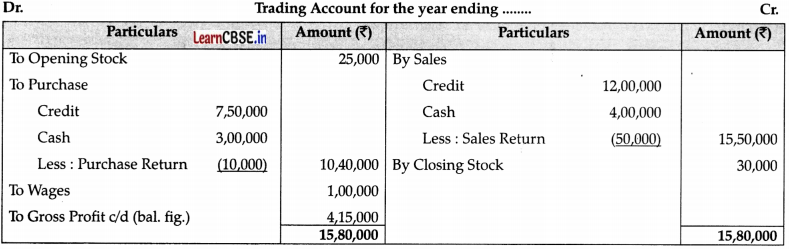

From the following balances extracted from the books of M/s Ahuja and Nanda, calculate the amount of:

(i) Cost of goods available for sale

(ii) Cost of goods sold during the year

(iii) Gross Profit

| Particulars | (₹) |

| Opening stock | 25,000 |

| Credit purchases | 7,50,000 |

| Cash purchases | 3,00,000 |

| Credit sales | 12,00,000 |

| Cash sales | 4,00,000 |

| Wages | 1,00,000 |

| Salaries | 1,40,000 |

| Closing stock | 30,000 |

| Sales return | 50,000 |

| Purchases return | 10,000 |

Answer:

(i) Cost of goods available for sale Opening Stock + Net purchase + Direct expenses

= ₹ 2.5,000 + ₹ 7,50,000 + ₹ 3,00,000 – ₹10,000 + ₹ 1,00,000

= ₹ 11,65,000

[Net purchase = Total purchase – Purchase Returni]

(ii) Cost of goods sold during the year = Cost of goods available for sale – Closing Stock

= ₹ 11,65,000 – ₹ 30,000

= ₹ 11,35,000

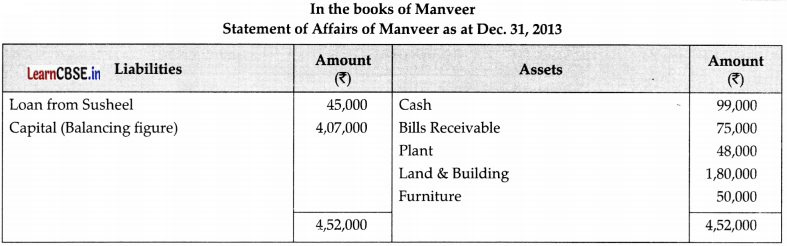

Question 32.

Manveer started his business on January 01,2013 with a capital of ₹ 4,50,000. On December 31,2013 his position was as under:

| Particulars | (₹) |

| Cash | 99,000 |

| Bills Receivable | 75,000 |

| Plant | 48000 |

| Land and Building | 1,80,000 |

| Furniture | 50,000 |

He borrowed ₹ 45,000 from his friend Susheel on the date. He withdrew ₹ 8,000 per month for his household purposes. Ascertain his profit or loss for the year ended December 31, 2013. [3]

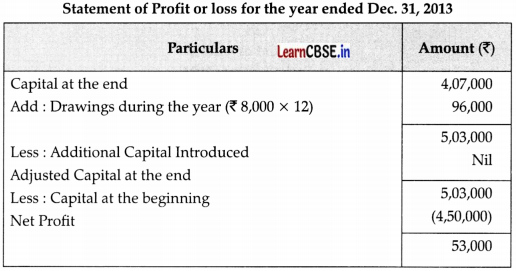

Answer:

Question 33.

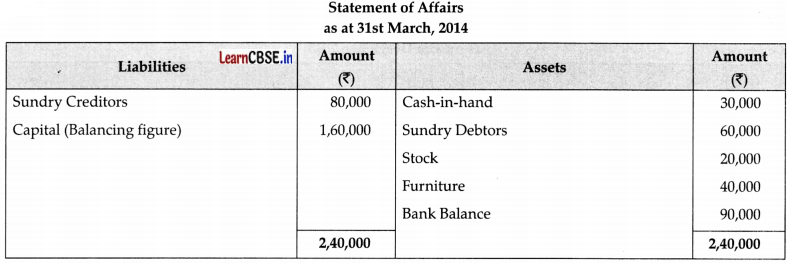

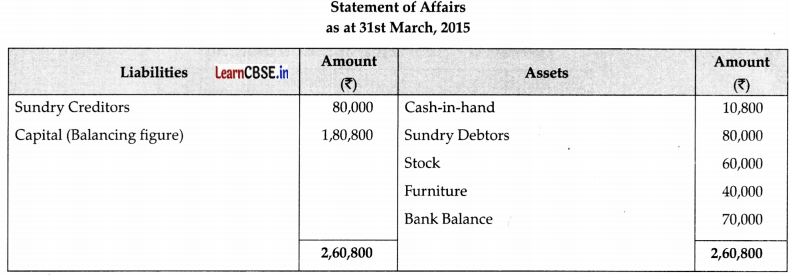

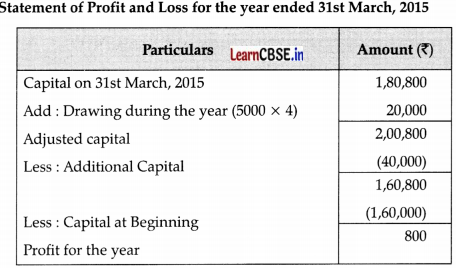

Shyamlal keeps his book under Single Entry System. His assets and liabilities were as under :

| Particulars | 31st March, 2014 (₹) | 31st March, 2015 (₹) |

| Cash-in-hand | 30,000 | 10,800 |

| Sundry Debtors | 60,000 | 80,000 |

| Stock | 20,000 | 60,000 |

| Furniture | 40,000 | 40,000 |

| Sundry Creditors | 80,000 | 80,000 |

| Bank Balance | 90,000 | 70,000 |

During 2014-15, he introduced ₹ 40,000 as new capital. He withdrew ₹ 5,000 every quarter for his household expenses. Ascertain his profit for the year ended 31st March, 2015. [4]

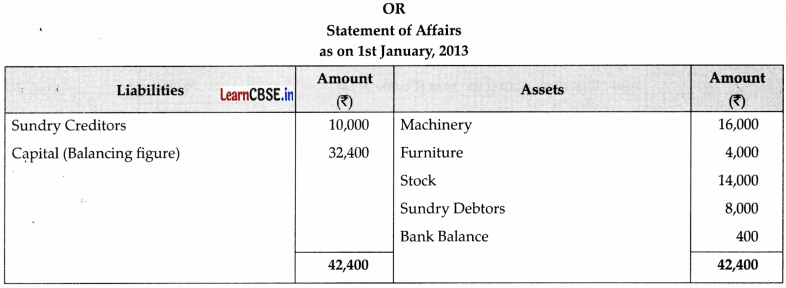

OR

From the following information relating to the business of Mr. X, who keeps books by single entry, ascertain the profit or loss of the year 2013:

| Particulars | 1stJanuar 2013 (₹) | 31st Decembex 2013 (₹) |

| Machinery | 16,000 | 16,000 |

| Furniture | 4,000 | 4,000 |

| Stock | 14,000 | 10,000 |

| Sundry Debtors | 8,000 | 9,000 |

| Bank Balance | 400 | 3,600 |

| Sundry Creditors | 10,000 | 7,000 |

Mr. X withdraw ₹ 4,100 during the year to meet his household expenses. He introduced ₹ 600 as fresh Capital. Machinery and furniture to be depreciated by 10% and 5% per annum respectively.

Answer:

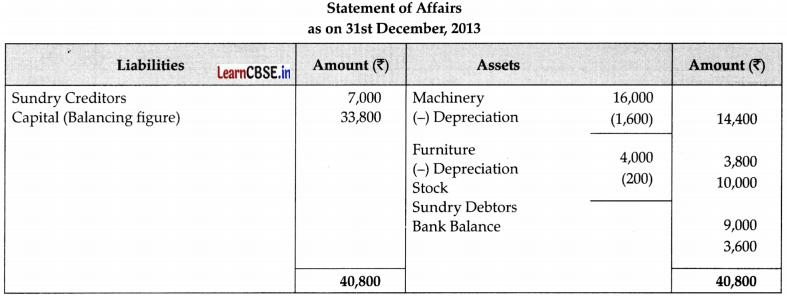

Question 34.

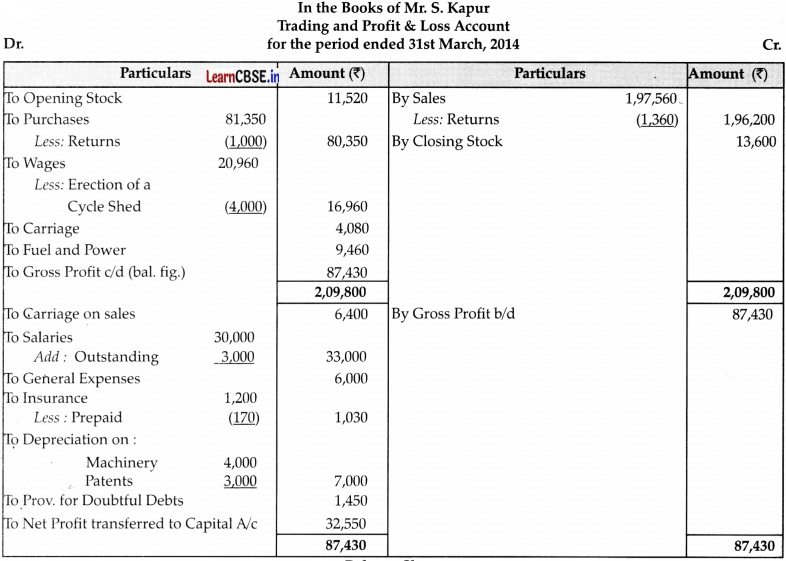

The following is the Trial Balance of Mr. S. Kapur on 31st March, 2014:

Taking into account the following adjustments, Prepare Trading and Profit & Loss Account and the Balance Sheet:

(i) Stock on hand on 31st March, 2014 is ₹ 13,600.

(ii) Machinery is to be depreciated @ 10% p.a. and patents @ 20% p. a.

(iii) Salaries for the month of March, 2014 amount to ? 3,000 were unpaid. ,

(iv) Insurance includes a premium of ₹ 170 for 2014-2015.

(v) Wages include a sum of ₹ 4,000 spent on the erection of a cycle shed for employees and customers.

(vi) A Provision for Doubtful Debts is to be created to the extent of 5% on Sundry Debtors.

Answer: