Students must start practicing the questions from CBSE Sample Papers for Class 11 Accountancy with Solutions Set 3 are designed as per the revised syllabus.

CBSE Sample Papers for Class 11 Accountancy Set 3 with Solutions

Time Allowed : 3 hours

Maximum Marks: 70

General Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Question Nos.1 to 15 and 25 to 29 carries 1 mark each.

- Questions Nos. 16 to 18, 30 to32 carries 3 marks each.

- Questions Nos. 19, 20 and 33 carries 4 marks each.

- Questions Nos. 21 to 24 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, I question of four marks and 2 questions of six marks.

Part – A ((Financial Accounting – I)

Question 1.

Which is the last step of accounting as a process of information?

(A) Posting to ledger

(B) Communicating the results

(C) Journalizing

(D) Analysis and Interpretation mw

Answer:

(B) Communicating the results

Explanation: Accounting process starts when transactions are recorded in the journal. These journal entries are then transferred to the respective ledger accounts and finally the results are analysed and interpreted through the trial balance and income statements. The result is then communicated to the various stakeholders through the Balance Sheet.

Question 2.

Assertion: The financial statements fail to show real worth of the business.

Reasoning: Assets are recorded at their market prices.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(C) A is correct, but R is incorrect.

Explanation: Assets are recorded at their costs and not at their market prices. Hence, financial statements fail to show real worth of the business.

![]()

Question 3.

The main task of which accounting is to find out the financial position of the business.

(A) Financial Accounting

(B) Cost Accounting

(C) Both (A) and (B)

(D) None of the above [1]

OR

……………… is an example of a fictitious asset.

(A) Land and Building

(B) Goodwill

(C) Patents

(D) Loss on the issue of shares. [1]

Answer:

(A) Financial Accounting

Explanation: The main task of cost accounting is to analyze cost and fix it.

OR

(D) Loss on the issue of shares.

Question 4.

Wages paid to workers for setting up new machinery is an example of which type of expenditure?

(A) Revenue Expenditure

(B) Capital Expenditure

(C) Recurring Expenditure

(D) Not an Expenditure [1]

OR

Which qualitative characteristic of accounting information is reflected when accounting information is clearly presented?

(A) Understandability

(B) Relevance

(C) Comparability

(D) Reliability [1]

Answer:

(B) Capital Expenditure

Explanation: Wages paid for the installation of machinery is a one-time expenditure and so is a capital expenditure.

OR

(A) Understandability

Explanation: Accounting information should be presented in such a way that every user is able to interpret the information without any difficulty in a meaningful and appropriate manner.

![]()

Question 5.

Consider the following statements with respect to the assumptions of accounting period principles:

(i) Measure the progress of business accurately and on a conservative basis.

(ii) It facilitates the accounting process.

(iii) Match periodic revenues with expenses for getting correct business results.

(iv) Calculate income tax and other government dues.

Identify the correct statement/statements:

(A) (i), (ii), and (iv)

(B) (i) and (iii)

(C) (iii) and (iv)

(D) (ii) and (iv) [1]

Answer:

(C) (iii) and (iv)

Question 6.

“A and B are starting a business. A is of the view that all facts, which influence the decision of users should be shown in financial statements.”A is following which accounting principle?

(A) Full disclosure concept

(B) Dual Aspect Concept

(C) Matching Cost Concept

(D) Accounting Period Concept [1]

OR

Arun receives an advance from a customer, which is not taken as income or sales by him. Which accounting assumption is being violated by him?

(A) Accrual

(B) Cash

(C) Cost

(D) Expense [1]

Answer:

(A) Full disclosure concept

Explanation: The principle of full disclosure means that financial statements should disclose all significant information relating to the economic affairs of the firm. The significance of the principle is that there is a sufficient disclosure of information which is of material interest to proprietor, creditors, investors, etc.

OR

(A) Accrual

Explanation: Accrual concept applies equally to revenue and expenses. As per the assumption, all revenues and costs are recognized when they are earned or incurred and not at the time when settlement is done.

![]()

Question 7.

Assertion: Cash Book ascertains the amount of cash with the firm.

Reasoning: It is necessary to know the amount of cash available with the firm at any point of time, whether at bank or at hand.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Explanation: It is necessary and useful for a business to know continuously the cash or bank balance in hand. For this purpose and for facilitating the record of cash transactions, Cash Book is maintained. The number of cash transactions in a firm is generally large and therefore, it becomes convenient to have a separate Cash Book, to record such transactions.

Question 8.

Consider the following statements with respect to the advantages of double entry system:

(i) It focuses where incomplete record of transactions are maintained.

(ii) It is a scientific method of recording transactions.

(iii) It establishes the arithmetical accuracy of recording transactions.

(iv) It helps in preparing financial statements without delay.

Identify the correct statement/statements:

(A) (i), (iii) and (iv)

(B) (i), (ii) and (iii)

(C) (ii), (iii) and (iv)

(D) (i), (ii), (iii) and (iv) [1]

OR

Which basis of accounting gives a correct picture of operating results and financial position of a firm?

(A) Accrual basis

(B) Cash basis

(C) Both (A) and (B)

(D) None of the these [1]

![]()

Read the following hypothetical situation, answer question nos. 9 and 10.

Business transactions only are recorded in the accounting books of a firm and no other transaction that happens in the day to day functioning of the business. Now the question arises what exactly are business transactions? To answer this basic question we need to see that the transaction fulfils the basic criteria. First one being the transaction should be an economic activity, that is it should create an income for the firm or an expense for it. Like we can say that the payment of salary to the staff is a business transaction but persuading a customer to buy a product or hiring a staff for that matter is not a business transaction.

Secondly, the transaction should change the financial position of the firm, that is it should either raise the income of the firm or create debt for the firm. For example, even if the goods are bought on credit, increasing creditors of the firm, it is a business transaction as it is creating a debt for the firm. But obviously,praising a staff for his work to sell the product at a better profit, is not termed as business transaction although it motivates the employee but does not result in changing the financial position of the firm. Lastly, the transaction should be able to be expressed in terms of money. [1]

Answer:

(C) (ii), (iii) and (iv)

OR

(A) Accrual basis

Question 9.

Business transactions is of nature.

(A) Economic

(B) Monetary

(C) Financial

(D) All of these [1]

Answer:

(D) All of these

Explanation: Business transaction is an economic activity as it creates an income for the firm or an expense for it. Business transaction changes the financial position of the firm, that is it should either raise the income of the firm or create debt for the firm. Business transactions is to be expressed in terms of money.

![]()

Question 10.

Which of the following is not a business transaction:

(A) Buying of Furniture

(B) Paying salaries of the accountant

(C) Giving a motivational speech to the employee

(D) Buying a good for personal use from the office money [1]

Answer:

(C) Giving a motivational speech to the employee

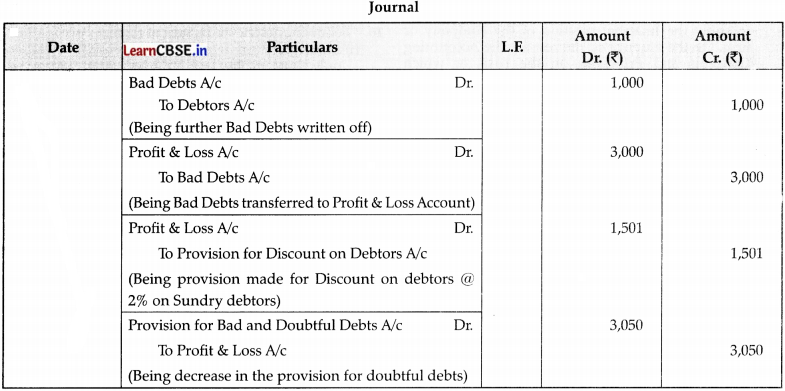

Question 11.

Rishikesh paid 15,000 as rent to his landlord John. What will be the correct journal entry for it?

Answer:

Option (D) is correct.

Explanation: As rent is a nominal account, it will be debited by cash account as the rent is paid in cash. John’s A/c will not be opened as in case of rent whether paid or not we do not debit or credit the account of landlord.

Question 12.

Pick the odd one out:

(A) Ledger

(B) Purchase Book

(C) Sales Book

(D) Purchase Return Book [1]

Answer:

(A) Ledger

Explanation: Sales Book, Purchase Books and Purchases Return Book are the Subsidiary books and record only the credit transactions while Ledger is the book that contains the entries from all the subsidiary books and represents all the transactions whether cash or credit.

![]()

Question 13.

What is the slip called which is filled when depositing a cheque or cash in a bank account?

(A) Cash voucher

(B) Pay-in-slip

(C) Cash memo

(D) Transfer voucher [1]

Answer:

(B) Pay-in-slip

Explanation: Cash Voucher is made for all the cash sales or purchases made by the entity. Cash Memo is the document made when the cash is received paid. Transfer vouchers are prepared for non-cash transactions.

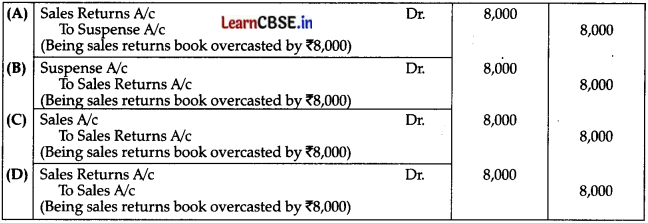

Question 14.

While preparing the trial balance it was found that the accountant of Sumangal Sarees had over casted the Sales Returns Book by ₹ 8,000. What journal entry needs to be passed for rectifying the error?

Answer:

Option (B) is correct.

Question 15.

Which of the following transactions will not become a part of Bank Reconciliation Statement:

(A) Direct deposit by Ram in bank ₹ 10,000

(B) Bank charges ₹ 35

(C) Goods sold to Shyam on credit ₹ 5,00,000

(D) Cheques deposited but dishonored.

OR

Amounts that are created against profit to meet a known liability:

(A) Reserves

(B) Provisions

(C) Both (A) & (B)

(D) None of the above [1]

Answer:

(C) Goods sold to Shyam on credit ₹ 5,00,000

Explanation: Credit sales and purchases are neither recorded in the cash book nor there will be any entry for the same in the passbook of the bank. Thus, credit sales to Shyam will not be recorded in the Bank Reconciliation Statement.

OR

(B) Provisions

Explanation: Reserve means an appropriation of profits or other surplus to strengthen the liquid resources of the business enterprise and not for meeting any liability, contingency, or any commitment of the business. Provisions means setting aside a part of the profits for meeting a known future liability, the amount of which is not accurately known at the time of finalization of financial statements.

![]()

Question 16.

Explain the following terms with an example:

(i) Sales

(ii) Cost [3]

Answer:

(i) Sales : Sales means transfer of ownership of goods or services to customers for a price. Sales may either be cash sales or credit sales. For example, if Varun sells a television set to Tarun, the ownership of television set will receives the payment immediately it would be cash sale and if Varun receives the payment after sometime it would be credit sale.

(ii) Cost : Cost means the amount of expenditure, actual or notional, attributable to or incurred on a given activity, product or service. For example, Mohit purchases a machine for his factory. The cost of machinery will include not only the purchase price but also freight, installation expenses, etc.

Question 17.

Determine the missing amount on the basis of Accounting Equation:

| Assets (₹) = | liabilities (₹) + | Capital (₹) |

| (i) 20,000 = | 15000 + | ? |

| (ii) ? = | 5000 + | 10,000 |

| (iii) 10,000 = | ? + | 8000 |

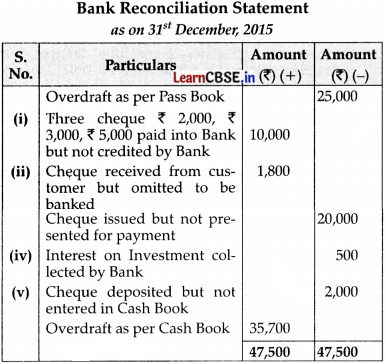

OR

From the following particulars, prepare a Bank Reconciliation Statement showing the balance as per cash book as on 31st December 2015. Overdraft as per pass book was ₹ 25,000.

(i) Three cheques of ₹ 2,000, ₹ 3,000 and ₹ 5,000 were paid into bank in November 2015 but were not credited by the bank in the month of December.

(ii) A cheque of ₹ 1,800 which was received from a customer was entered in the bank column of the cash book in ‘ December 2015 but was omitted to be banked in December 2015.

(iii) A cheque for ₹ 20,000 was issued in November 2015 but not debited in bank till 31st December, 2015.

(iv) Interest on investment ₹ 500 collected by bank appeared only in the pass book.

(v) A cheque of ₹ 2,000 deposited into bank on 26th December but not entered in the cash book, was dishonored

on 2nd January, 2016. [3]

Answer:

(1) ₹ 20,000 = ₹ 15,000 + ? [1]

? = ₹ 20,000 – ₹ 15,000 = 5000 [1]

(ii) ? = ₹ 5,000 + ₹ 10,000 = ₹ 15,000 [1]

(iii) ₹ 10,000 = ? + ₹ 8,000 [1]

? = ₹ 10,000 – ₹ 8,O00 = ₹ 2000. [1]

OR

Question 18.

On which side of the Trial Balance the following ledger balances will appear?

(i) Purchases

(ii) Capital

(iii) Trade Receivable

(iv) Drawings

(v) Discount Received

(vi) Buildings [3]

Answer:

| Account | Side of Trial Balance |

| Purchases | Debit |

| Capital | Credit |

| Trade Receivable | Debit |

| Drawings | Debit |

| Discount Received | Credit |

| Building | Debit |

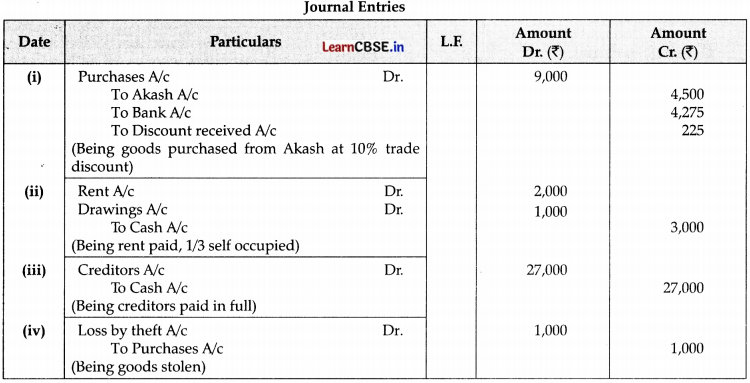

Question 19.

Journalize the following transactions:

(i) Bought goods from Akash of ₹ 10,000 @ 10% trade discount and 5% cash discount, 50% payment made by cheque.

(ii) Paid landlord ₹ 3,000 for rent. One-third of the premises is occupied by the proprietor for his own residence.

(iii) Payment made to creditors in full settlement ₹ 27,000.

(iv) Goods stolen by an employee of ₹ 1,000 (Sales price ₹ 1,200). [4]

Answer:

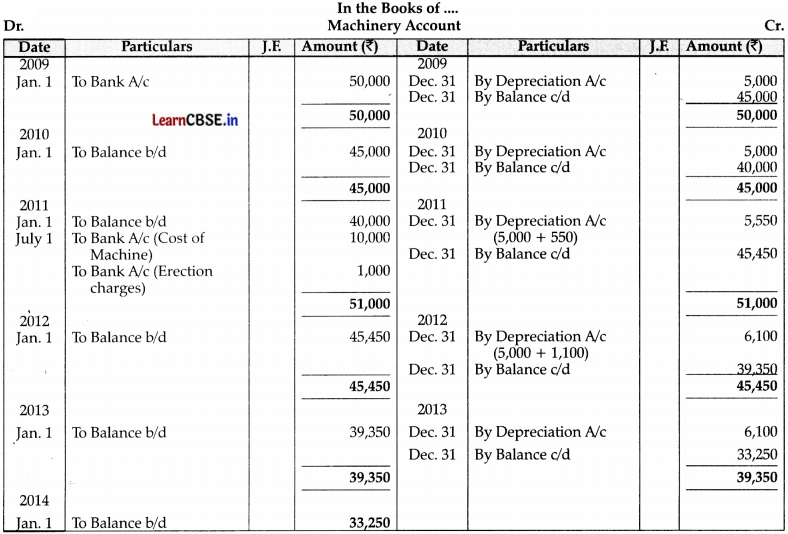

Question 20.

On 1st January 2009, a firm purchased machinery worth ₹ 50,000. On 1st July 2011, it buys additional machinery worth ₹ 10,000 and spends ₹ 1,000 on its erection. The accounts are closed each year on 31st December. Assuming that the annual depreciation is 10%, show the machinery account for 5 years under the straight-line method. [4]

Answer:

Question 21.

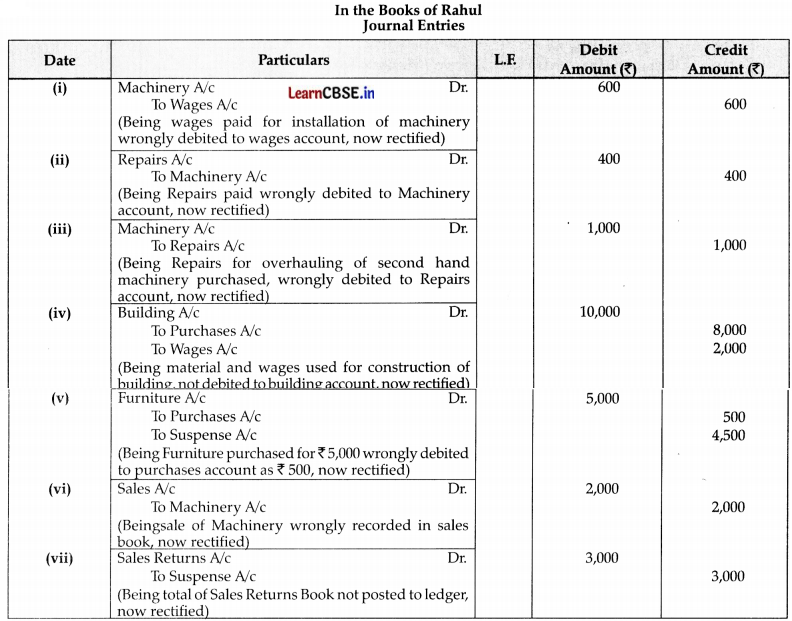

Trial Balance of Rahul did not agree. Rahul put the difference to the Suspense Account. Subsequently, he located the following errors:

(i) Wages paid for the installation of Machinery ₹ 600 was posted to Wages A/c.

(ii) Repairs to Machinery ₹ 400 debited to Machinery A/c.

(iii) Repairs paid for the overhauling of second-hand machinery purchased ₹ 1,000 was debited to Repairs A/c.

(iv) Own business material ₹ 8,000 and wages ₹ 2,000 were used for the construction of the building. No adjustment was made in the books.

(v) Furniture purchased for ₹ 5,000 was posted to PuTrchases A/c as ₹ 500.

(vi) Old machinery sold to Karim at its book value of ₹ 2,000 was recorded through sales book.

(vii) Total of Sales Returns Book ₹ 3,000 was not posted to the ledger.

Rectify the above errors and prepare a Suspense Account to ascertain the original difference in Trial Balance. [6]

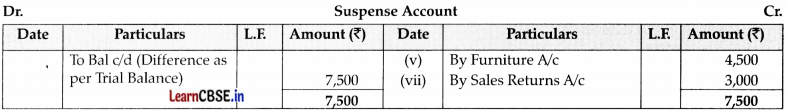

OR

Rectify the following errors assuming that a suspense account was opened. Ascertain the difference in trial balance.

(i) Credit sales to Mohan ₹ 7,000 were posted to the credit of his account.

(ii) Credit purchases from Rohan ₹ 9,000 were posted to the credit of his account as ₹ 6,000.

(iii) Good returned to Rakesh ₹ 4,000 were posted to the credit of his account.

(iv) Goods returned from Mahesh ₹ 1,000 were posted to the debit of his account as ₹ 2,000.

(v) Cash sales ₹ 2,000 were posted to the debit of Sales account as ₹ 5,000. [A|T| [6]

Answer:

Question 22.

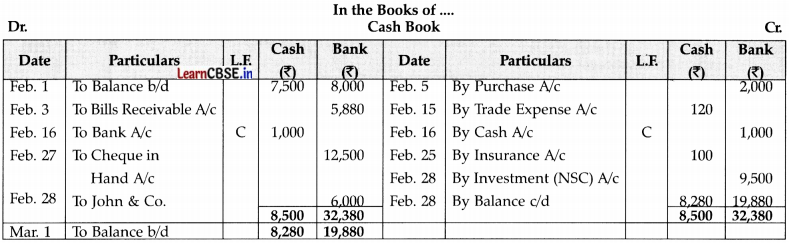

From the following transactions, prepare Cash Book with Cash and Bank columns:

Feb. 1 Cash-in-hand ₹ 7,500, Cash-at-bank ₹ 8,000

Feb. 3 Discounted a bill receivable for ₹ 6,000 at 2% through Bank .

Feb. 5 Bought goods for ₹ 2,000 and paid by cheque

Feb.15 Paid Trade expenses ₹ 120

Feb. 16 Drew from Bank for office use ₹ 1,000

Feb. 17 Sold goods for ₹ 12,500 and received a cheque

Feb. 25 Paid Insurance ₹ 100

Feb. 27 Cheque received on 17th deposited in Bank

Feb. 28 Received a cheque from John & Co. ₹ 6,000 and deposited into bank on the same day.

Feb. 28 Purchased 10 NSC for ₹ 100 at ₹ 95 each and paid by cheque. [6]

OR

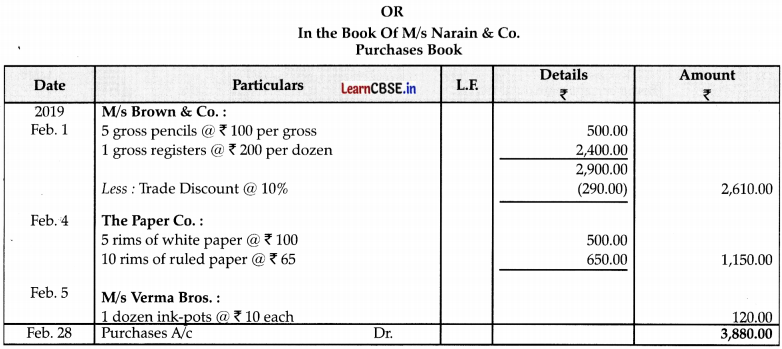

The rough books of M/s Narain & Co. contains the following:

![]()

2019

Feb. 1 – Purchased from M/s Brown & Co. on credit: 5 gross pencils @ ₹ 100 per gross. 1 gross registers @ ₹ 200 per dozen. Less : Trade Discount @ 10% Purchased for cash from the stationery mart: 10 gross exercise book @ ₹ 60 per dozen. Purchased typewriter for office use from M/s Office Goods Co. on credit for ₹ 800

Feb. 4. – Purchased on credit from the Paper Co :

5 Rims of white paper @ ₹ 100 per rim, 10 rims of ruled paper @ ₹ 65 per rim.

Feb. 5. – Purchased one dozen ink-posts @ ₹ 10 each from M/s Verma Bros, on credit.

Prepare the purchases book of M/s Narain & Co.

Answer:

Question 23.

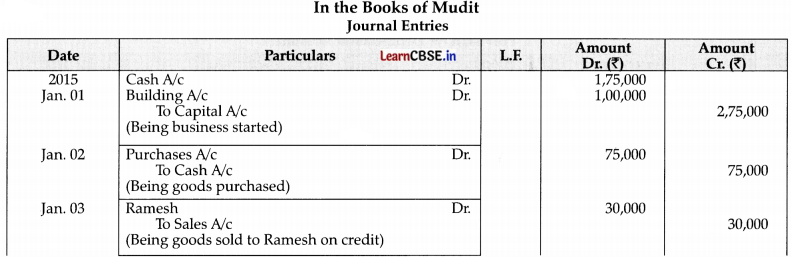

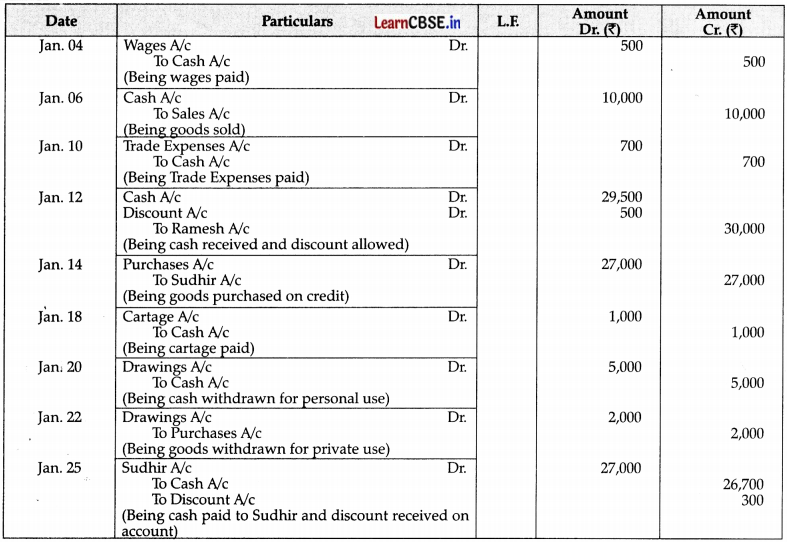

Enter the following transactions in the Journal of Mudit:

| 2015 | Particulars | |

| Jan. 01 | Commenced business with cash | 1,75,000 |

| Building | 1,00,000 | |

| Jan. 02 | Goods purchased for Cash | 75.000 |

| Jan. 03 | Sold goods to Ramesh | 30,000 |

| Jan. 04 | Paid wages | 500 |

| Jan.06 | Sold goods for cash | 10,000 |

| Jan. 10 | Paid for Trade Expenses | 700 |

| Jan. 12 | Cash Received from Ramesh | 29,500 |

| Discount Allowed | 500 | |

| Jan. 14 | Goods purchased from Sudhir | 27,000 |

| Jan. 18 | Cartage paid | 1,000 |

| Jan. 20 | Drew cash for personal use | 5,000 |

| Jan.22 | Goods used for house hold | 2,000 |

| Jan.25 | Cash paid to Sudhir | 26,700 |

| Discount received | 300 |

Answer:

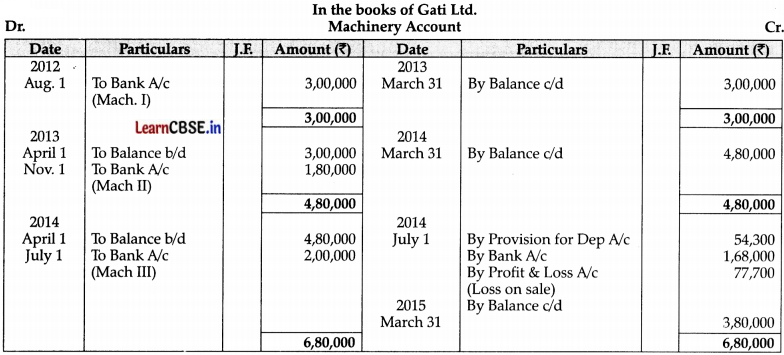

Question 24.

On 1st August 2012, Gati Ltd. purchased a machinery for ₹ 3,00,000. On 1st November, 3 another machinery was purchased for ₹ 1,80,000. On 1st July, 2014 the machine which was purchased on 1st August, 2012 was sold for ₹ 1,68,000 and on the same date a fresh machinery was purchased for ₹ 2,00,000. Depreciation was provided @ 10% p.a. on the reducing balance method. Books are closed on 31st March every year. You are required to

prepare Machinery Account and Provision for Depreciation Account for three years ending 31st March, 2015. [6]

Answer:

Working Note:

Part – B (Financial Accounting – II)

Question 25.

Which of the following is a use of financial statements:

(A) Ascertain future prospects of the firm

(B) To increase claim in wages, bonus, etc.

(C) Ascertain Return on Investment

(D) All of the these [1]

OR

A newly appointed accountant is confused as to which expenses should be treated as deferred revenue expenditure. Help him by giving him an example of deferred revenue expenditure.

(A) Research and development expenditure

(B) Expenses related to issue of shares and debentures

(C) Preliminary expenses

(D) All of the these

Answer:

(D) All of the these

OR

(D) All of the these

Question 26.

Which of the following expenses is shown on the Assets side of Balance sheet?

(A) Prepaid expenses

(B) Outstanding expenses

(C) Both (A) & (B)

(D) None of the these [1]

Answer:

(A) Prepaid expenses

![]()

Question 27.

Statement I: A Trial Balance is prepared to verify the arithmetical accuracy of the books of accounts.

Statement II: Balance Sheet is prepared to present the financial position of a company on a particular date.

(A) Both Statements are correct.

(B) Both Statements are incorrect.

(C) Statement I is correct and Statement II is incorrect.

(D) Statement I is incorrect and Statement II is correct. gain

OR

Net Profit of a firm before charging manager’s commission is ? 21,000. If a manager is entitled to 5% commission on net profit after charging such commission, what is the commission payable to the manager?

(A) ₹ 1,050

(B) ₹ 1,000

(C) ₹ 7 950

(D) None of the these [1]

Answer:

(A) Both Statements are correct.

OR

(B) ₹ 1,000

Explanation: Commission payable to the manager = (₹ 21,000 x 5)/105 = ₹ 1,000

Question 28.

Mr. Y is planning to start a new business. He wants to know the limitations of incomplete records. Which of the following is the limitation of the same?

(A) Trail Balance cannot be prepared.

(B) Correct ascertainment and evaluation of financial result of business operations cannot be made.

(C) It becomes difficult to convince income tax authorities about the reliability of the computed income.

(D) All of the above.

Answer:

(D) All of the above.

Question 29.

If opening capital is ₹ 60,000, drawings ₹ 5,000,capital introduced during the period ₹ 10,000, closing capital ₹ 90,000. The value of profit earned during the period will be :

(A) ₹ 20,000

(B) ₹ 25,000

(C) ₹ 30,000

(D) ₹ 40,000 [1]

Answer:

(B) ₹ 25,000

Explanation: 90,000 – (60,000 – 5,000 + 10,000) = 25,000

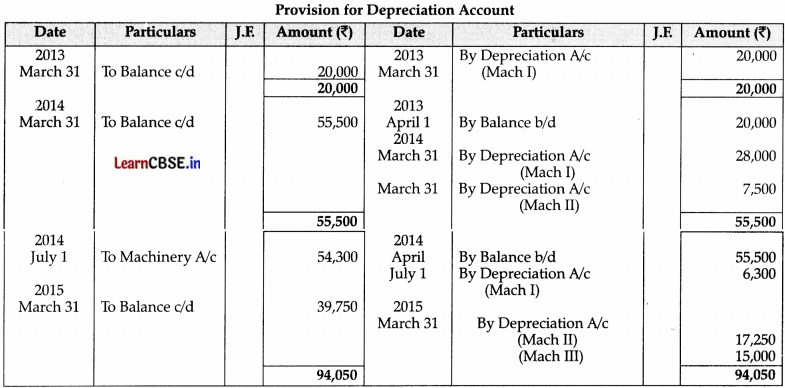

![]()

Question 30.

The following information is given of an accounting year opening creditors ₹ 15,000; cash paid to creditors ₹ 15,000; Returns outward ₹ 11,000 and closing creditors ₹ 12,000. Calculate credit purchases during the year. [3]

OR

The operating profit earned by M/s Arora and Sachdeva in 2013-14 was ₹ 17,00,000. Its non-operating incomes were ₹ 1,50,000 and non-operating expenses were ₹ 3,75,000. Calculate the amount of net profit earned by the firm. [3]

Answer:

OR

Net Profit = Operating Profit + Non-operating Income – Non-operating Expenses

= ₹ 17,00,000 + ₹ 1,50,000 – ₹ 3,75,000 = ₹ 14,75,000

Net profit earned by M/S Arora and Sachdeva in 2013 – 14 was ₹ 14,75,000.

Question 31.

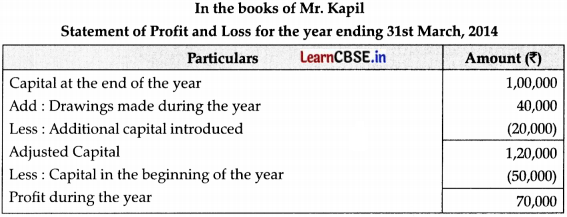

Mr. Kapil does not keep proper records of his business. He provided the following information. You are required to prepare a statement showing the profit or loss for the year 2013-14. [3]

| Opening Capital (01-04-2013) | 50,000 |

| Closing Capital (31-03-2014) | 1,00,000 |

| Additional capital introduced (2013-14) | 20,000 |

| Drawings made during the year (2013-14) | 40,000 |

Answer:

Question 32.

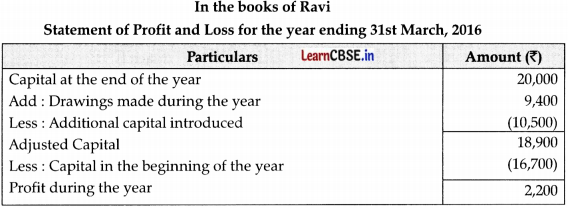

Ravi, who keeps his books on Single Entry System, has his capital on 31st March, 2016 ₹ 20,000 and on 1st April, 2015 was ₹ 16,700. He further informs that during the year, he withdrew for his personal expenses ₹ 9,400. He also sold his personal investment of ₹ 10,000 at 5% premium and brought that money into the business. Prepare a Statement of Profit or Loss. [3]

Answer:

Question 33.

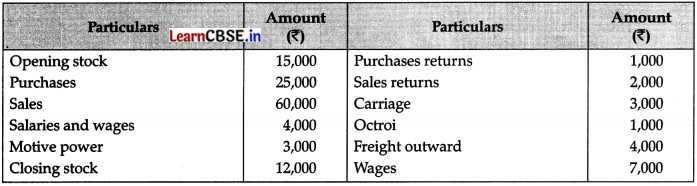

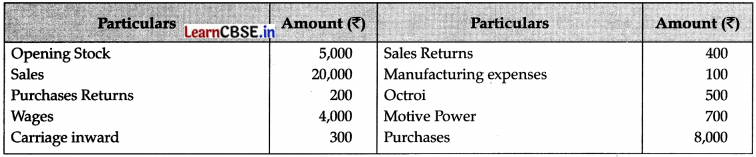

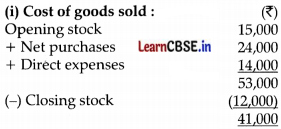

Calculate Gross Profit from the following information: [4]

OR

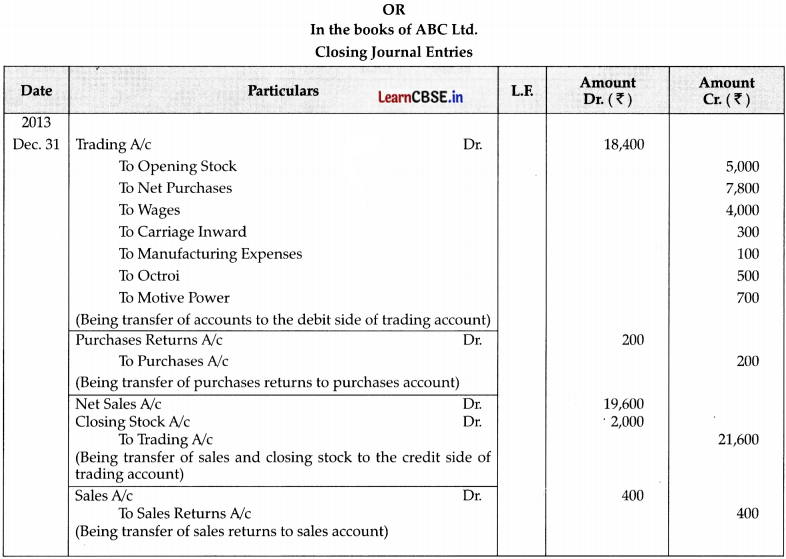

Following is the information from the books of ABC Ltd. as on 31st Dec., 2013. Pass closing journal entries:

Closing stock as on 31st Dec., 2013 was ₹ 2,000.

Answer:

Calculation of Gross Profit:

Gross profit = Net sales – Cost of goods sold

= ₹ 58,000 – ₹ 41,000 = ₹ 17,000

Working Notes:

(ii) Net Purchases = Purchases – Purchases returns = ₹ 5,000 – ₹ 1,000 = ₹ 24,000

(iii) Net sales = Sales – Sales returns = ₹ 60,000 – ₹ 2,000 = ₹ 58,000

(iv) Direct expenses Motive power + Carriage + Octroi + Wages = ₹ 3,000 + ₹ 3,000 + ₹ 1,000 + ₹ 7,000 = ₹ 14,000

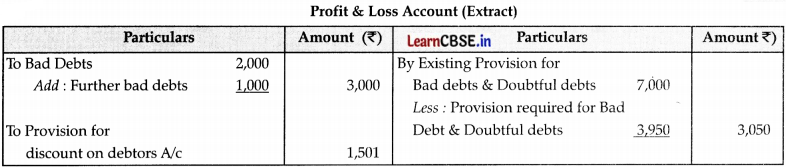

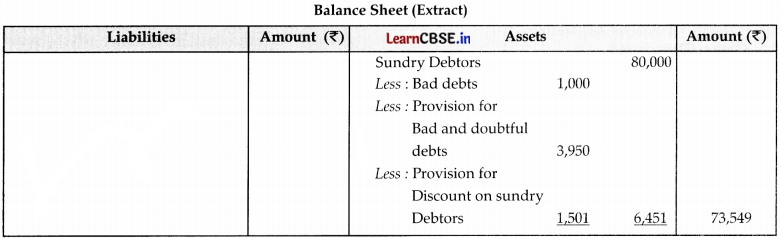

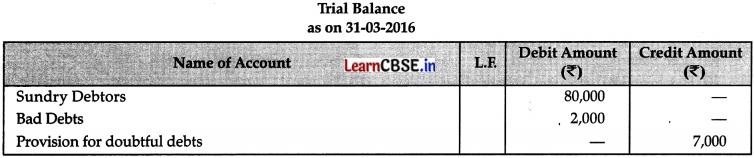

Question 34.

Show the following items in Profit & Loss Account and Balance Sheet.

Adjustments:

(i) Further Bad Debts amounted of ₹ 1,000.

(ii) Create a provision for doubtful debts on Sundry Debtors @5%.

(iii) Make a provision of discount on Sundry Debtors @ 2% .

You are also required to pass Journal Entries for the above transactions.

Answer: