Students must start practicing the questions from CBSE Sample Papers for Class 11 Accountancy with Solutions Set 2 are designed as per the revised syllabus.

CBSE Sample Papers for Class 11 Accountancy Set 2 with Solutions

Time Allowed : 3 hours

Maximum Marks: 70

General Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Question Nos.1 to 15 and 25 to 29 carries 1 mark each.

- Questions Nos. 16 to 18, 30 to32 carries 3 marks each.

- Questions Nos. 19, 20 and 33 carries 4 marks each.

- Questions Nos. 21 to 24 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, I question of four marks and 2 questions of six marks.

Part – A ((Financial Accounting – I)

Question 1.

Which of the following is not an objective of accounting?

(A) Maintaining records

(B) Estimating profit and loss

(C) Providing useful information to various users

(D) Recording all the qualitative factors [1]

Answer:

(D) Recording all the qualitative factors

Explanation: The qualitative factors of business are not recorded in the books of account.

Question 2.

Assertion: The financial statements do not reflect the true position of a business.

Reasoning: Accounting information is sometimes based on estimates.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(A) Both A and R are correct, and R is the correct explanation of A.

Explanation: Among other factors, accounting information is sometimes based on estimates. Hence, the financial statements do not reflect the true position of the business.

![]()

Question 3.

…………….. are the assets which are actually not assets but represent deferred expenses and losses.

(A) Current Assets

(B) Fixed Assets

(C) Fictitious Assets

(D) Nominal Assets [1]

OR

Which expenditures are incurred for day-to-day running of the business and maintenance of capital assets ?

(A) Capital Expenditure

(B) Revenue Expenditure

(C) Investment Expenditure

(D) Fixed Expenditure [i]

Answer:

(C) Fictitious Assets

Explanation: Items shown as asset in the Balance Sheet, having no market value, are called fictitious assets. For example: Preliminary expenses,

share issue expenses, underwriting commission, miscellaneous expenditure. etc.

OR

(B) Revenue Expenditure

Explanation: Expenditure incurred to earn revenue for the current period whose benefit gets exhausted within a year are called revenue expenditure. They are necessary for the day to day functioning of the business.

Question 4.

Which of the following is not a business transaction?

(A) Bought furniture of ₹ 10,000 for business.

(B) Paid for salaries of employees ₹ 5,000.

(C) Paid son’s fees from her personal bank account ₹ 20,000.

(D) Paid son’s fees from the business ₹ 2,000. [1]

OR

Information in financial reports is based on ……………. transactions.

(A) Economic

(B) Political

(C) Social

(D) Cultural [1]

Answer:

(C) Paid son’s fees from her personal bank account ₹ 20,000.

Explanation: As personal account has been used to pay the fees of the son’s school, it is a personal transaction and so will not be a part of the financial transactions of the business.

OR

(A) Economic

![]()

Question 5.

Which accounting concept tells that depreciation is to be charged as per one particular method year to year?

(A) Revenue Recognition

(B) Consistency

(C) Matching

(D) Materiality [1]

Answer:

(B) Consistency

Explanation:

Consistency concept states that the methods of recording of accounting transactions should not frequently as it will lead to confusion. So,

as per this concept the method of depredating fixed assets need not change over a period of time.

Question 6.

Meeta and Vaishali are two partners of a firm. The firm receives an order for goods. Vaishali wants to include it in the sales figure but Meeta opposes it. How should the issue be settled ?

(A) Amount of goods should be included in purchase figure.

(B) Amount of goods should be included in sales figure.

(C) Amount of goods should be excluded from sales figure.

(D) Amount of goods should be excluded from purchases figure. [1]

OR

The process of ascertaining the amount of profit earned or loss incurred during a particular period involves deduction of related expenses from the revenue earned during that period. This concept emphasizes exactly on this aspect. It states that expenses incurred in an accounting period should be matched with revenues during that period. It follows from this that the revenue and expenses incurred to earn these revenues must belong to the same accounting period.

Which accounting concept is being referred above?

(A) Principle of Prudence.

(B) Dual Aspect Concept.

(C) Matching Cost Concept.

(D) Going Concern Concept. [1]

Answer:

(C) Amount of goods should be excluded from sales figure.

Explanation: Vaishali is incorrect as according to Revenue Recognition concept, an order, received should not be included in sales figure as no obligation is established in this transaction.

OR

(C) Matching Cost Concept.

![]()

Question 7.

Assertion: Accounting standards provide a structured framework within which credible financial statements cannot be produced.

Reasoning: Accounting standards standardize diverse accounting policies and practices and eliminate the non-comparability of financial statements.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(D) A is incorrect, but R is correct.

Question 8.

Consider the following statements with regard to the accounting treatment of various accounts:

(i) Increase in asset is debited and decrease in asset is credited.

(ii) Increase in expenses/losses is debited and decrease in expenses/ losses is credited.

(iii) Increase in liabilities is credited and decrease in liabilities is debited.

(iv) Increase in capital is credited and decrease in capital is debited.

Identify the correct statement/statements:

(A) (I) and (ii)

(B) (ii) and (iii)

(C) (i), (iii) and (iv)

(D) (i), (ii), (iii) and (iv) [1]

OR

Pick the odd one out:

(A) Computer

(B) Goodwill

(C) Patents

(D) Trade Mark [1]

Read the following hypothetical situation, answer question no. 9 and 10.

A business purchased goods for ₹2,00,000 and sold 75% of such goods during accounting year ended 31st March, 2020. The market value of remaining goods was ₹43,000. Accountant valued closing stock at cost. According to him:

(i) Owner of the business is treated as creditor to the extent of his capital;

(ii) All expenses incurred to earn revenue of a particular period should be charged against that revenue to determine the net income.

Financial statements are prepared on 31st March ever year.

Answer:

(D) (i), (ii), (iii) and (iv)

OR

(A) Computer

Explanation: Only computer is a tangible asset, rest goodwill, patent and trademark are intangible assets.

![]()

Question 9.

‘A business purchased goods for ₹ 2,00,000 and sold 75% of such goods during accounting year ended 31st March, 2020. The market value of remaining goods was ₹ 43,000. Accountant valued closing stock at cost.’ Identify the concept violated in the above situation.

(A) Conservatism

(B) Business entity

(C) Accounting period

(D) Matching [1]

Answer:

(A) Conservatism

Explanation: The principle of conservatism requires a business to be extremely cautious about possible losses. It should guard against all possible losses. If there is an anticipated loss, there should be adequate provision in the account. There need not to be any provision for anticipated revenue or gain. Here, cost of closing stock is 50,000 whereas its Net realizable value or market value is 43,000. As per Conservatism concept, closing stock should be valued at cost price or net realizable value, whichever is lower.

Question 10.

Under which concept, owner of the business is treated as creditor to the extent of his capital?

(A) Conservatism

(B) Business entity

(C) Accounting period

(D) Matching [1]

Answer:

(B) Business entity

Explanation: According to this assumption, a business unit should be understood as a separate entity apart from the businessman. Transactions of business should not be merged with the personal transactions of businessman. When the owner invests money into the business it should be assumed that the business owes money to the owner. This is known as capital. Capital is the amount which a business owes to its owner.

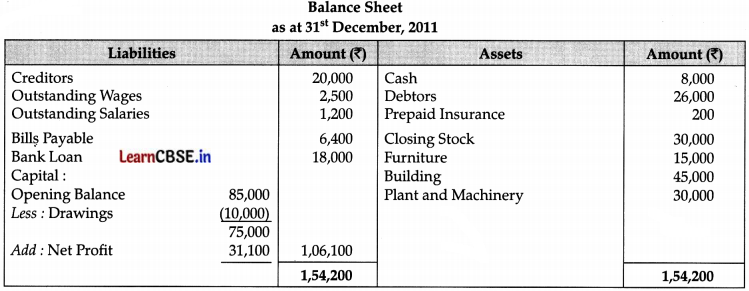

Question 11.

Ram sold the goods to Rahim on credit for ₹ 10,000. What will be the journal entry?

Answer:

Option (D) is correct.

Question 12.

Consider the following statements with respect to the advantages of Petty Cash Book:

(i) It saves the time of the main cashier.

(ii) It helps in controlling the petty expenses.

(iii) Posting from Petty Cash Book is made at the end of a specified period. This saves time and simplifies the posting

(A) (i) and (ii)

(B) (ii) and (iii)

(C) (i) and (iii)

(D) (i), (ii) and (iii) [1]

Answer:

(D) (i), (ii) and (iii)

![]()

Question 13.

Pick the odd one out:

(A) Return Inward Book

(B) Return Outward Book

(C) Journal Proper

(D) Purchases Account [1]

Answer:

(D) Purchases Account

Explanation: Purchases Account is a ledger and rest all are subsidiary books.

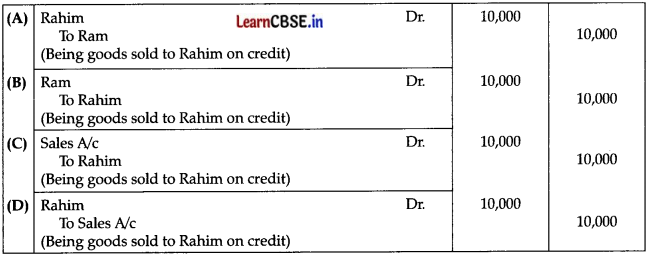

Question 14.

X Ltd purchased a machinery for ₹ 1,00,000 and paid ₹ 15,000 for its installation. Every year it depreciates its assets at the rate of 10%. What will be the correct journal entry for it?

Identify the correct statement/statements:

Answer:

Option (B) is correct.

Explanation: Cost of installation is added to the purchase price of the asset to find its total cost.

Question 15.

Which of the following errors do not affect the trial balance:

(A) Errors of principle

(B) Compensating errors

(C) Errors in carrying forward

(D) Both (A) and (B)

OR

Which of the following transaction is not shown in Cash Book?

(A) Cheque issued but not yet presented in bank.

(B) Credit sale to Mohan and he promised to make payment through cheque after two months.

(C) Cheques deposited but not credited.

(D) Cheque deposited but dishonoured. [1]

Answer:

(D) Both (A) and (B)

Explanation:

Errors of Principle: These errors occur because accounting is not in accordance with accounting principles and standards. Compensating Error: Compensating errors refer to a situation when an accountant makes mistakes on both sides of an account with same amount, hence compensating one error with another.

OR

(B) Credit sale to Mohan and he promised to make payment through cheque after two months.

Explanation: As cheque is to be paid after two months, it will not be recorded in the cash book.

![]()

Question 16.

Explain the following terms citing an example for each:

(i) Double Entry System of Accounting

(ii) Cash Basis of Revenue and Cost Recognition. [3]

Answer:

(i) Double Entry System : A business transaction involves the exchange of money and goods or services for money or for a right to claim money in future. Each business transaction involves two parties, i.e., two aspects. There cannot be a business transaction with one aspect. A transaction is just like a scale which must have equal weight on each of the two sides in order to be balanced.

Following are some examples which emphasise the two aspects of a transaction:

(a) If a business firm acquires an asset for cash, it has to give up some other asset say cash or the obligation to pay for it in future. Thus, a giver necessarily implies a receiver and a receiver necessarily implies a giver.

(b) If goods of ‘ 30,000 are sold to Rajendra on credit, the business firm gives goods and acquires a right to receive payment in future. Thus, goods and Rajendra are two aspects of this transaction

(ii) Cash Basis of Revenue and Cost Recognition: Cash basis of revenue and cost recognition means that revenues and expenses are recorded when they are received or paid in cash. For example, if total sales of the firm is 5,00,000 including credit sales of 2,00,000, the revenue from sales will be recorded as 3,00,000 (? 5,00,000 – 2,00,000). If total expenses of the firm are 60,000, including 20,000 as outstandin expenses, the expenses would be recorded as 4a,000(6O,000 – 20,000).

Question 17.

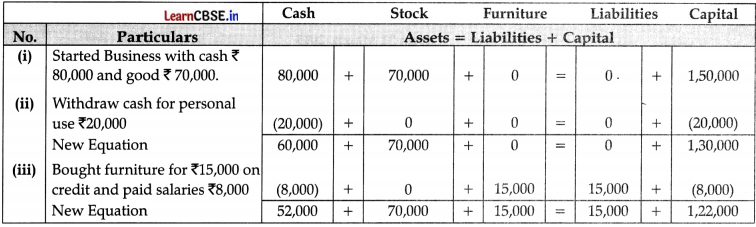

Show an accounting equation on the basis of the following transactions :

(i) Started business with cash ₹ 80,000 and goods ₹ 70,000.

(ii) Withdraw cash for personal use ₹ 20,000.

(iii) Bought furniture for ₹ 15,000 on credit and paid salaries ? 8,000.

OR

Journalise the following transactions:

(i) Goods destroyed by fire for ₹ 4,500.

(ii) Paid ₹ 1,500 in cash as wages on installation of machinery.

(iii) Issue a cheque in favour of M/s. Parmatma Saran & Sons on account of purchase of goods ₹ 7,500. [3]

Answer:

Question 18.

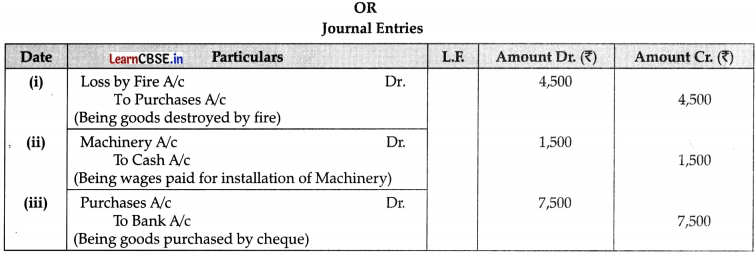

Prepare a Sales Return Journal (Book) from the following transactions of M/s Bansal Electronics for the year November 2014:

Nov. 04 M/s Gupta Trader Returned the goods amounted 1500

Nov.10 Goods Return from M/s Harish Traders for 800

Nov.18 M/s Rahul Traders return the goods not as per Specification for 1,200

Nov.28 Goods Return from Sushil Traders for 1,000 [3]

Answer:

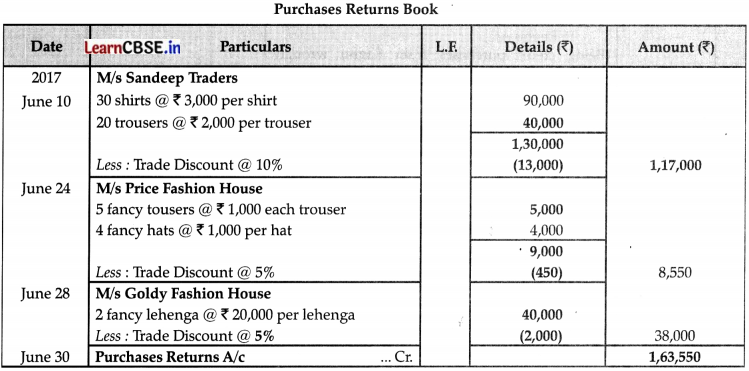

Question 19.

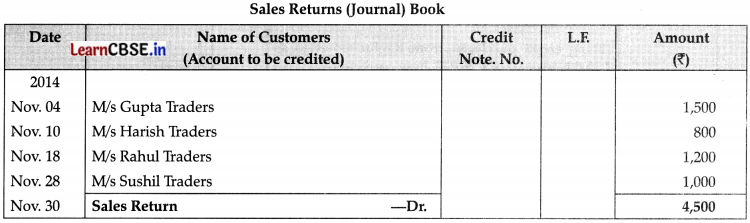

In the following Purchases Return Book, determine the missing information:

Answer:

Question 20.

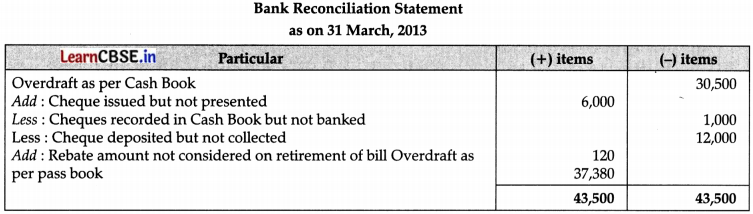

Chhabra & Sons find that overdraft shown by their Cash Book on 31st March, 2013 is ₹ 30,500 but the Pass Book shows a difference due to the following reasons:

(i) A cheque for ₹ 6,000 drawn in favour of Shyam has not been presented for payment.

(ii) A post-dated cheque for ₹ 1,000 has been debited in the Bank column of the Cash Book but it could not have been presented in Bank.

(iii) Cheque totalling ₹ 12,000 deposited with the bank have not yet been collected.

(iv) A bill for ₹ 5,000 was retired by the bank under a rebate of ?120 but the full amount of the bill was credited in the bank column of the Cash Book.

Prepare a Bank reconciliation statement and find out the balance as per pass book. [4]

Answer:

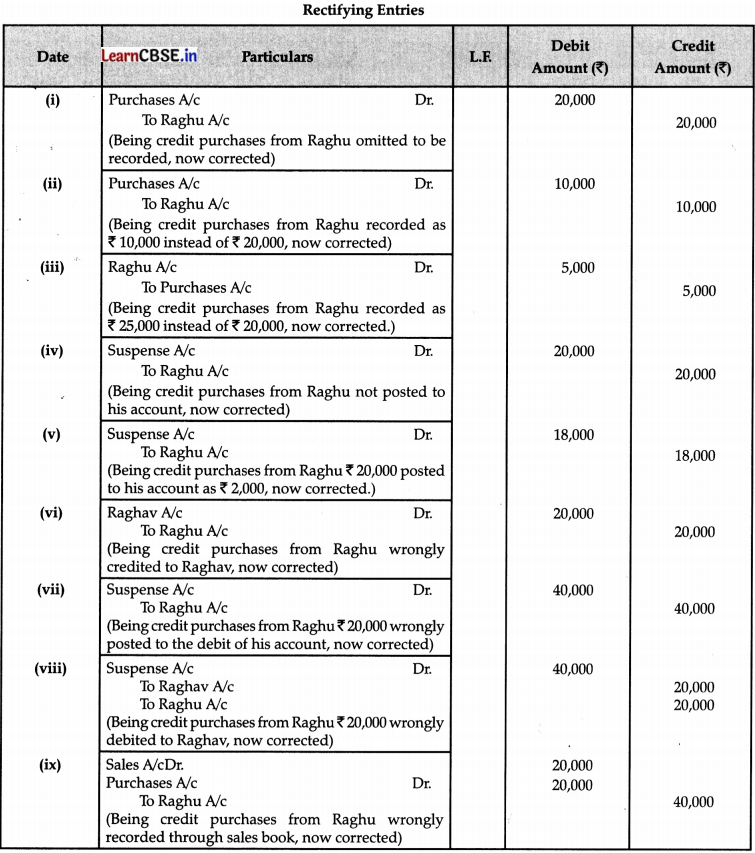

Question 21.

Rectify the following errors:

Credit purchases from Raghu ₹ 20,000,

(i) were not recorded.

(ii) were recorded as ₹ 10,000.

(iii) were recorded as ₹ 25,000.

(iv) were not posted to his A/c.

(v) were posted to his account as ₹ 2,000.

(vi) were posted to Raghav’s A/c.

(vii) were posted to the debit of Raghu’s A/c.

(viii) were posted to the debit of Raghav.

(ix) were recorded through sales book. [6]

![]()

OR

Give the rectification Journal Entries for the following transactions: [6]

(i) A builder’s bill for ₹ 50,000 for creation of small shed for cycles was debited to Repairs A/c.

(ii) A Bill of Exchange (received from Prateek) for ₹ 25,000 had been returned by bank as dishonoured and had been credited to Bank A/c and debited to Bills Receivable A/c.

(iii) Purchase of goods from Vinod amounting to ₹ 6,000 has been wrongly passed through Sales Book.

(iv) An amount of ₹ 3,600 due from Vrinda, which had been previously written off as bad debt, was unexpectedly recovered, and has been posted to personal account of Vrinda.

(v) A cheque of ₹ 5,500 received from Riddhi was dishonoured and had been posted to the debit of Sales Returns A/c.

(vi) Purchased machinery for ₹ 1,25,000 was passed through Invoice Book.

(vii) Return of Goods worth ₹ 2,350 by Abhinav were taken into stock but no entry was passed.

(viii) Goods worth ₹ 3,900 returned to Mayank were passed through Sales Returns Book.

(ix) An amount of ₹ 2,000 spent on repair and installation of second hand machinery purchased was debited to Repair and Maintenance A/c.

Answer:

Question 22.

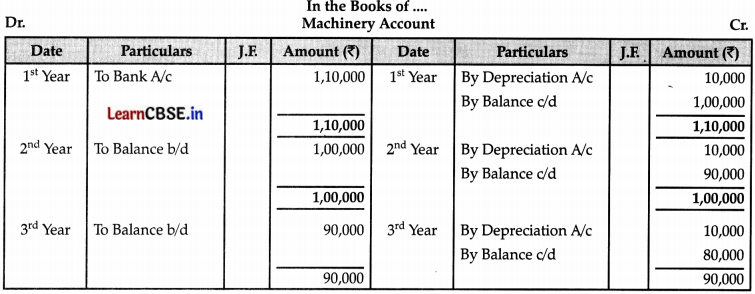

An asset is purchased for ₹ 1,10,000. Depreciation is to be provided annually according to the straight line method. The useful life of the asset is 10 years and the residual value is ₹ 10,000. You are required to find out the amount of annual depreciation and prepare asset account for the first three years. [6]

OR

A Maruti van was purchased on 01/01/2000 for ₹ 60,000 and ₹ 5,000 was spent on its repair and registration. On 01/07/2001 another van was purchased for ₹ 70,000.0n 01/01/2002,the van purchased on 01/01/2000 was sold for ₹ 45,000 and a new van costing ₹ 1,70,000 was purchased on the same date.Show the Maruti Van Account from 2000-2002 on the basis of Straight Line Method, if the rate of depreciation charged @ 10% p.a. Assume that books are closed on 31st December every year. [6]

Answer:

Depredation = \(\frac{₹ 1,10,000-₹ 10,000}{10}\)

\(\frac{₹ 1,00,000}{10}\)

Depreciation = ₹ 10,000 p.a.

Question 23.

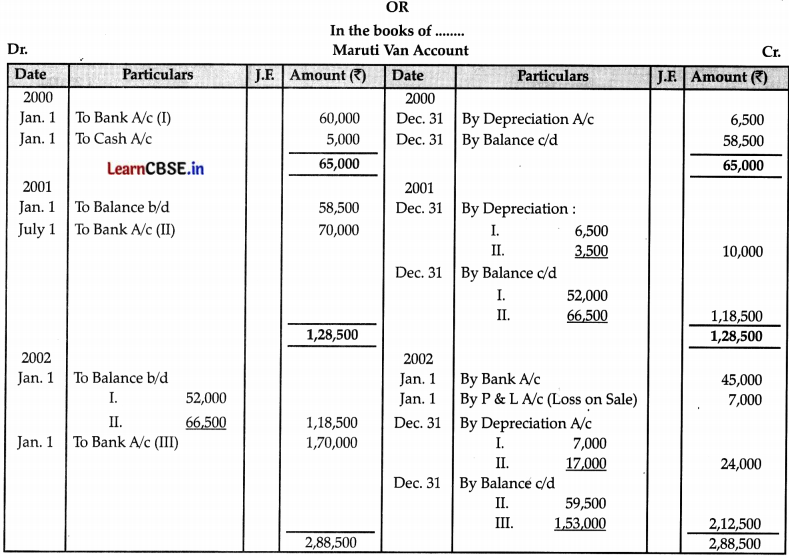

Journalise the following transactions :

(i) Bought goods for ₹ 5,000 plus CGST and SGST @ 6% each.

(ii) Sold goods to Mehtab for ₹ 50,000, charged CGST and SGST @ 6% each.

(iii) Sold goods to Arpana for ₹ 60,000 against cheque, charged IGST @ 12%

(iv) Computer purchased by Atul & Co., Delhi for office use from HP Ltd., Greater Noida (UP) for ₹ 50,000 plus IGST @ 12%, payment made by cheque.

(v) Paid Telephone bill of ₹ 5,000 plus CGST and SGST @ 6% each.

(vi) Goods that were purchased paying CGST and SGST @ 6% each costing ₹ 1,000 given as charity.

Answer:

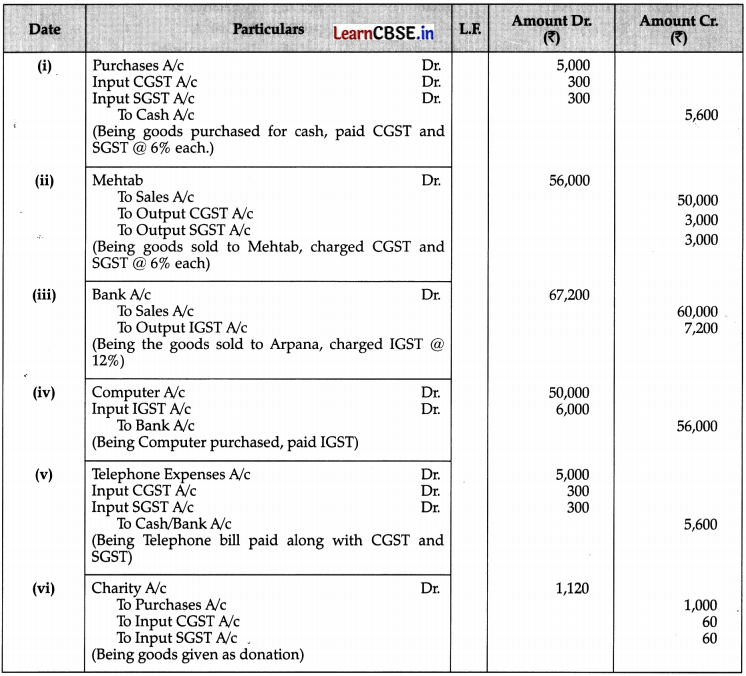

Question 24.

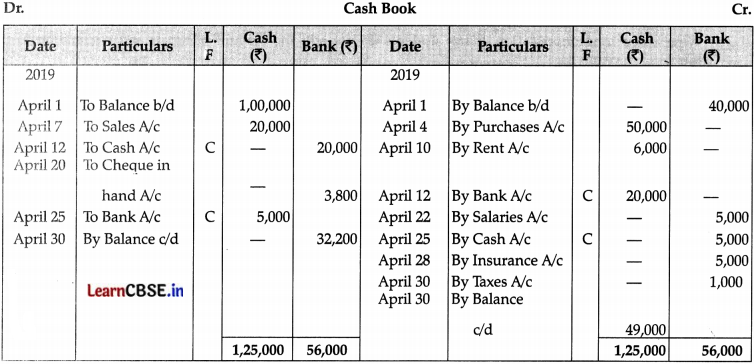

Prepare a double column Cash Book with cash and bank column with following information:

Answer:

Part-B (Financial Accounting – II)

Question 25.

Reports prepared to present a periodical review of financial performance and the financial position of a business enterprise are called:

(A) Bank Reconciliation Statement

(B) Auditor’s Report

(C) Financial statements

(D) All the above [1]

OR

Gross Profit is:

(A) Excess of income over expenditure

(B) Excess of sales over purchases

(C) Excess of sales and stock over purchases

(D) Excess of sales over cost of goods sold

Answer:

(C) Financial statements

EpIanation: Financial statements are written records that convey the business activities and the financial performance of a company through Profit and Loss A/c financial position through Balance Sheet.

OR

(D) Excess of sales over cost of goods sold

Explanation: Gross profit, also called gross income, is calculated by subtracting the cost of goods sold from sales revenue.

![]()

Question 26.

Land has been purchased by M/s XYZ Ltd.Registration fees has been paid for the same. Its accountant is not sure about the treatment of the registration fees. Choose the correct option that he needs to follow:

(A) To be treated as capital expenditure and added to the cost of Land.

(B) To be treated as revenue expenditure and shown in the Trading account.

(C) To be treated as capital expenditure and subtracted from the cost of Land.

(D) To be treated as revenue expenditure and shown in the Trading account. [1]

Answer:

(A) To be treated as capital expenditure and added to the cost of Land.

Question 27.

Statement I: Accrued Income refers to the income that has fallen due till the end of the accounting year but has not yet been received.

Statement II: Accrued Income is added to the relevant income in the Trading A/c, and Profit & Loss account and shown on the assets side of the Balance Sheet.

(A) Both Statements are correct.

(B) Both Statements are incorrect.

(C) Statement I is correct and Statement II is incorrect.

(D) Statement I is incorrect and Statement II is correct. [1]

OR

The Balance sheet of M/s X Traders is showing a difference between the total amounts of assets side and liabilities side. Its accountant has recorded closing stock on the assets side of the Balance sheet only while closing stock was given under adjustments. Identify where a mistake is made by him.

(A) Closing stock should be recorded on the credit side of the Profit & Loss Account also.

(B) Closing stock should be deducted from the amount of Purchases in Trading Account also.

(C) Closing stock should be recorded on the debit side of the Profit & Loss Account also.

(D) Closing stock should be recorded on the credit side of the Trading Account also.

Answer:

(A) Both Statements are correct.

OR

(D) Closing stock should be recorded on the credit side of the Trading Account also.

![]()

Question 28.

Mayank does not keep proper records of his business. He has given you the following information:

| Opening Capital | ₹ 1,00,000 |

| Closing Capital | ₹ 1,25,000 |

| Drawings | ₹ 30,000 |

| Additional Capital | ₹ 37,500 |

The profit is ……………..

(A) ₹ 17,500

(B) ₹ 18,500

(C) ₹ 19,500

(D) ₹ 17,000 [1]

Answer:

(A) ₹ 17,500

Explanation: 1,25,000 + 30,000 – 37,500 – 1,00,000 = 17,500

Question 29.

Incomplete record mechanism of book keeping is :

(A) Scientific

(B) Unscientific

(C) Unsystematic

(D) Both (B) and (C) [1]

Answer:

(D) Both (B) and (C)

Question 30.

Opening Stock ₹ 10,000, Purchases ₹ 18,200, Expenses on purchases ₹ 2,000, Sales ₹ 30,000, Expenses on sales ₹ 1,000, Closing Stock ₹ 12,200. Calculate Cost of Goods Sold and Gross Profit. [3]

OR

Drawings ₹ 15,000, Profit for the year ₹ 25,000, Closing Capital ₹ 70,000. Calculate the Opening Capital. [3]

Answer:

Cost of Goods Sold = Opening stock + Purchases + Expenses on purchases – Closing Stock

= ₹ 10,000 + ₹ 18,200 + ₹ 2,000 – ₹ 12,200 = 18,O00

Gross Profit Net Sales – Cost of goods sold

= ₹ 30,000 – ₹ 18,000 = ₹ 12,000 [3]

OR

Profit = Closing Capital + Drawings – Additional

Capital – Opening Capital.

₹ 25,000 = ₹ 70,000 + ₹ 15,000 – 0 – Opening Capital.

∴ Opening Capital = ₹ 85,000 – ₹ 25,000

= ₹ 60,000 [3]

![]()

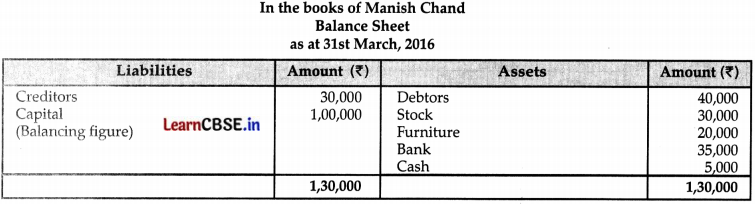

Question 31.

Manish Chand started a business with a capital of ? 80,000 and maintains his account on Single Entry System. Calculate his profit on 31st March, 2016 from the following information:

| Liabilities and Assets on 31st March, 2016 | (₹) |

| Debtors | 40,000 |

| Creditors | 30,000 |

| Stock | 30,000 |

| Furniture | 20,000 |

| Bank Balance | 35,000 |

| Cash-in-hand | 5,000 |

During the year his drawings were 110,000 and additional capital invested ₹ 20,000. [3]

Answer:

Calculation of Profit:

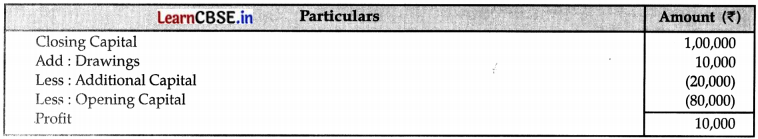

Question 32.

Following information is given to prepare the statement to calculate the profit or loss:

| ₹ | |

| Capital at the beginning of the year | 5,00,000 |

| Drawings made during the period | 7,50,000 |

| Additional Capital introduced | 3,75,000 |

| Capital at the end of the year | 50,000 |

Answer:

Question 33.

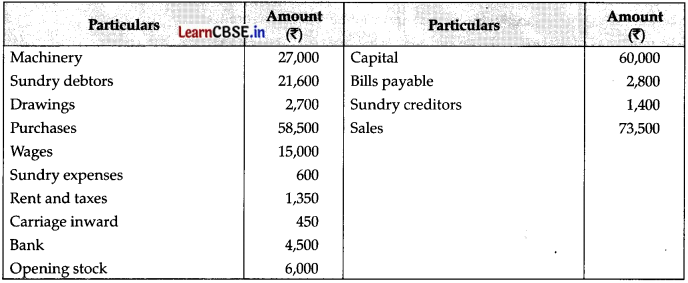

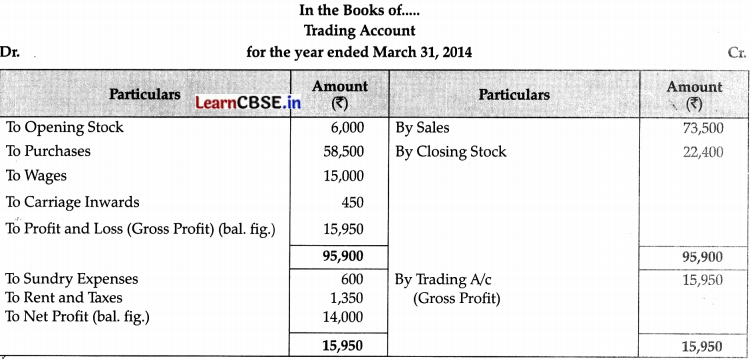

Prepare Trading and Profit & Loss Account as on March 31,2014:

Closing stock as on March 31,2014 ₹ 22,400. [4]

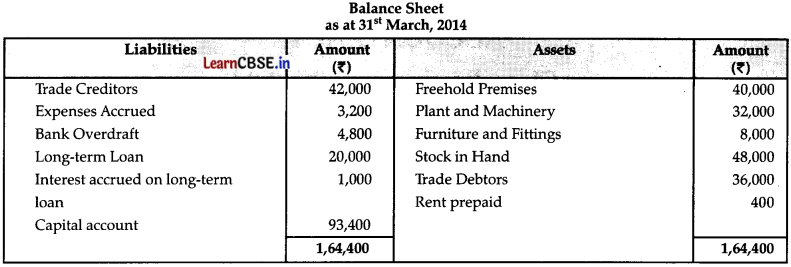

OR

From the Balance Sheet given below, calculate the following :

(i) Fixed Assets

(ii) Current Assets

(iii) Current Liabilities

(iv) Working Capital

Answer:

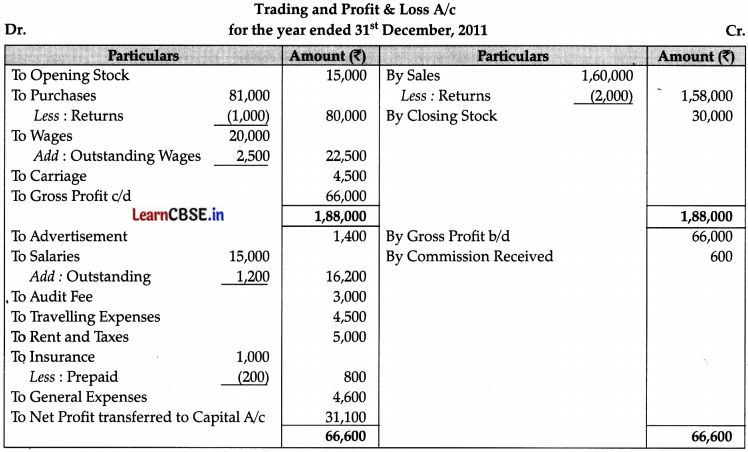

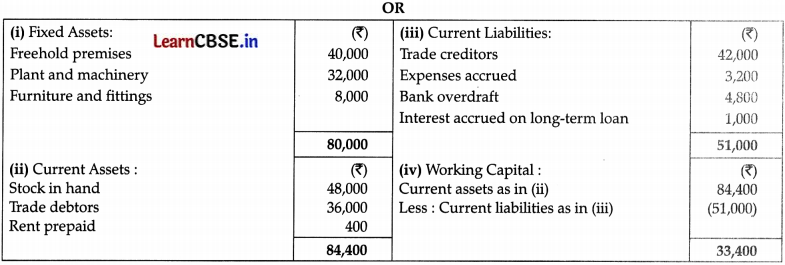

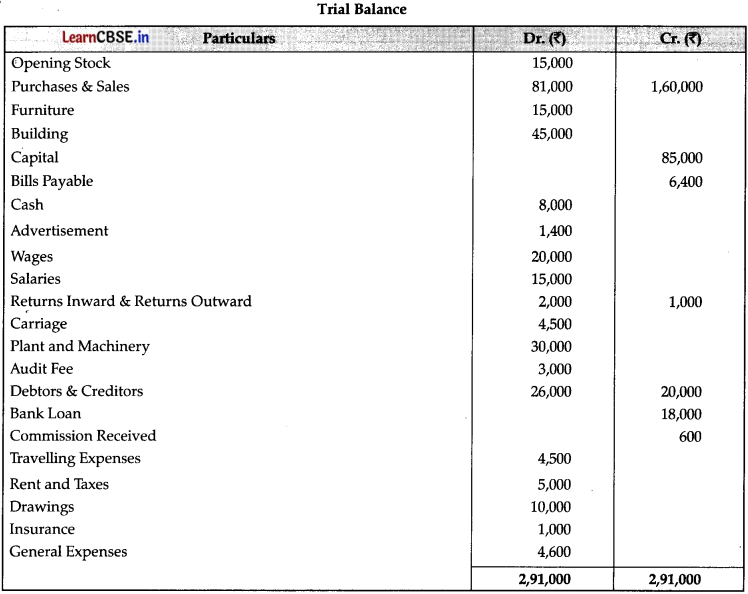

Question 34.

From the following Trial Balance and Adjustments, prepare Trading Account, Profit & Loss Account and Balance Sheet as on 31-12-2011:

Adjustments:

(i) Closing Stock ₹ 30,000 (Cost); ₹ 32,000 (Market Price).

(ii) Wages Outstanding ₹ 2,500.

(iii) Salaries Outstanding ₹ 1,200.

(iv) Prepaid Insurance ₹ 200.

Answer: