Students must start practicing the questions from CBSE Sample Papers for Class 11 Accountancy with Solutions Set 1 are designed as per the revised syllabus.

CBSE Sample Papers for Class 11 Accountancy Set 1 with Solutions

Time Allowed : 3 hours

Maximum Marks: 70

General Instructions:

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts, Part A and B.

- Question Nos.1 to 15 and 25 to 29 carries 1 mark each.

- Questions Nos. 16 to 18, 30 to32 carries 3 marks each.

- Questions Nos. 19, 20 and 33 carries 4 marks each.

- Questions Nos. 21 to 24 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, 2 questions of three marks, I question of four marks and 2 questions of six marks.

Part – A ((Financial Accounting – I)

Question 1.

Consider the following points with respect to the steps of Accounting:

(i) Identification of business transaction.

(ii) Recording of transaction into Journal.

(iii) Posting the transaction into Ledger.

(iv) Paying salary to the accountant.

Identify the correct statement/statements:

(A) (i) only

(B) (i) and (ii) only

(C) (i), (ii) and (iii)

(D) (i), (ii), (iii) and (iv) [1]

Answer:

(C) (i), (ii) and (iii)

Explanation:

Paying salary to the accountant falls under the category of recording the transactions itself so is already included In that step as it forms the part of the day to day working of a business.

![]()

Question 2.

Assertion: Only financial transactions are recorded in Accounting.

Reasoning: Events or transactions, which can be expressed in terms of money, are recorded in the books of accounts.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Explanation:

One of the important attributes of accounting is that only those transactions and events are recorded in accounting, which are of financial character. It means that events or transactions, which can be expressed in terms of money, are recorded in the books of accounts. Consequently, those events or transactions that cannot be expressed in terms of money, do not find a place in the books of accounts though they may be very useful for the business.

![]()

Question 3.

are the properties and resources owned by an enterprise:

(A) Assets

(B) Liabilities

(C) Capital

(D) Creditors [1]

OR

From which type of transactions do capital receipts arise?

(A) Recurring Transactions

(B) Non-recurring Transactions

(C) Both (A) and (B)

(D) Neither (A) nor (B) [1]

Answer:

(A) Assets

OR

(B) Non-recurring Transactions

Question 4.

Which of the following limitations is covered with the manipulation of accounts:

(A) Problem of window dressing

(B) Not fully exact

(C) Ignores qualitative factors

(D) Ignores the effect of price level changes [1]

OR

Who among the following is not an internal user of financial accounting:

(A) Chief Executive Officer

(B) Financial Manager

(C) Employees

(D) Potential Inventors [1]

Answer:

(A) Problem of window dressing

Explanation:

Window dressing is an accounting practice of manipulating the business results, usually to show a respectable figure of profits more than the real profits. The practice may be followed by loss-making companies to show profit. For this purpose. companies may not show some expenses or the expenses may be shown less. On the other hand, income may be more than the actual, the Firm may show inventories at a higher value (overvaluation of stock) and may hide bad debts written off during the year.

![]()

OR

(D) Potential Inventors

Explanation:

As potential investors have not yet joined the firm, they are not internal user of financial accounting. Rest all CEO, Financial Manager and Employees are the internal users of the firm, as they work in the firm.

Question 5.

Mr. Ram creates provisions for certain types of contingencies that may happen in near future but does not anticipate any future profits.

Identify the accounting concept being followed by Mr. Ram.

(A) Conservatism concept

(B) Full disclosure concept

(C) Dual aspect concept

(D) Money measurement concept [1]

Answer:

(A) Conservatism concept

Explanation:

The pnndple of conservatism requires a business to be extremely cautious about possible losses. It should guard against any possible losses. If there is an anticipated loss, there should be adequate there is an anticipated 1os, there shu1d be adequate provision In the account. There need not to be any provision for anticipated revenue or gain.

Question 6.

“Personal transactions of the owner are not recorded in the books of the business unless it involves inflow or outflow of business funds.” To which accounting principle the above phrase is related?

(A) Dual Aspect Concept

(B) Principle of Conservatism

(C) Business Entity Concept

(D) Accounting Period Concept [1]

OR

What are the written statements of uniform accounting rules and guidelines adopted while preparing financial statements called?

(A) Accounting Standards

(B) IFRS

(C) AS and IFRS

Answer:

(C) Business Entity Concept

Explanation:

According to the business entity concept, a business unit should be understood as a separate entity apart from the businessman. Transactions of business should not be merged with the personal transactions of businessman. When the owner invests money into the business it should be assumed that the business owes money to the owner. This is known as capitaL Capital is the amount which a business owes to its owner.

OR

(A) Accounting Standards

![]()

Question 7.

Assertion: Accounting standards help auditors in the audit of accounts.

Reasoning: Accounting standards raise standard of audit of accounts.

(A) Both A and R are correct, and R is the correct explanation of A.

(B) Both A and R are correct, but R is not the correct explanation of A.

(C) A is correct, but R is incorrect.

(D) A is incorrect, but R is correct. [1]

Answer:

(B) Both A and R are correct, but R is not the correct explanation of A.

Question 8.

Ajay wants to start a business systematically. Which accounting system he should follow?

(A) Single Entry System

(B) Double Entry System

(C) Cash basis

(D) Accrual basis [1]

OR

Pick the odd one out:

(A) Double Entry System

(B) Single Entry System

(C) Dual Aspect Principle

(D) Indian Accounting System [1]

Read the following hypothetical situation, answer question no. 9 and 10.

Mr. Manoj Manohar Lai started a new business with cash of ₹ 60,000 by the name Manohar Lai and Sons on 1st of March, 2020. For the business, he had to purchase furniture on the 2nd of March worth ₹ 10,000. He decided to buy the goods for cash as well on that day for ₹ 25,000 and on credit from Janki Das and Sons for ₹ 50,000. On 4th of March he was able to sell the goods at ₹ 60,000 out of which 75% was on credit to different people.

Answer:

(B) Double Entry System

Explanation:

Every transaction has two aspects, one aspect is debit and the other aspect is credit. When both the aspects of a transaction are recorded in the books of accounts, it is said that the accounts are systematically maintained under Double Entry System.

OR

(C) Dual Aspect Principle

Explanation:

Dual aspect principle is an accounting principle while the rest are systems of accounting.

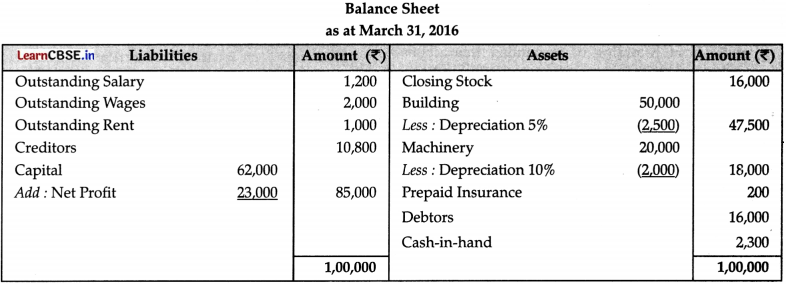

Question 9.

What will be the journal entry for the cash introduced by Mr. Manoj Manohar Lai to commence his business?

Answer:

Option (B) is correct.

![]()

Question 10.

For the sale of goods on 4th of March, how much will be recorded in the Cash Account?

(A) ₹ 60,000

(B) ₹ 45,000

(C) ₹ 15,000

(D) ₹ 75,000 [1]

Answer:

Option (C) is correct.

Explanation:

As 75% of sales is on credit, 25% of ₹ 60,000 will he recorded in cash account, i.e., ₹ 15,000

Question 11.

During the lifetime of an entity, accounting produces financial statements in accordance with which basic accounting concept?

(A) Conservation

(B) Matching

(C) Accounting period

(D) None of the above [1]

Answer:

(C) Accounting period

Question 12.

In which subsidiary book all transactions relating to cash receipts and cash payments are recorded?

(A) Cash Account

(B) Journal Proper

(C) Cash Book

(D) Ledger [1]

Answer:

(C) Cash Book

Question 13.

Consider the following statements with regard to the maintenance of subsidiary books:

(i) All credit purchases are maintained in the Purchases Book.

(ii) All credit sales are recorded in the Sales Return Book

(iii) All the cash transactions are recorded in the Cash Book.

Identify the correct statement/statements:

(A) (i) and (iii)

(B) (i), (ii) and (iii)

(C) (i) only

(D) (iii) only [1]

Answer:

(A) (i) and (iii)

Explanation:

Statement (ii) is incorrect as all credit sales are recorded in the sales book and the sales returns book records all the sales returns of the goods sold on credit.

![]()

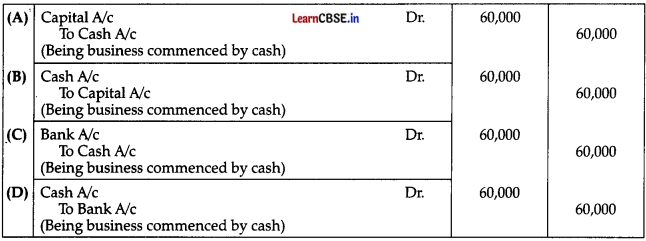

Question 14.

ABC enterprises depreciate their furniture every year at the rate of 10%. The value of furniture was ₹ 20,000. What will be the journal entry?

Answer:

Option (A) is corred

Explanation:

Depredation is a non-cash expense, hence it will be debited and the value of furniture is declining, hence to be credited. Amount of depreciation = 10% of 20,000 = ₹ 2,000

Question 15.

Which of the following transactions will become a part of Bank Reconciliation Statement:

(A) Amount wrongly debited by Bank ₹ 5,000

(B) Amount wrongly credited by bank ₹ 500

(C) Both (A) and (B)

(D) None of the above [1]

OR

Which of the following is a limitation of Trial Balance:

(A) Helps in preparation of final accounts.

(B) Transactions that are not recorded at all cannot be found out.

(C) Helps in locating errors.

(D) Ascertains the arithmetical accuracy of books.

Answer:

(C) Both (A) and (B)

Explanation:

Bank reconciliation statement reconciles the bank balance as per pass book and balance as per the cash book. So, the errors committed by bank while recording transactions in bank pass book or by the businessman in bank column of cash book are taken into account while preparing Bank Reconciliation Statement.

![]()

OR

(B) Transactions that are not recorded at all cannot be found out.

Question 16.

Accounting provides information about the profitability and financial soundness of a concern. In addition, it also provides various other valuable information. However, accounting has certain limitations. Explain any three of such limitations. [3]

Answer:

Following are the Limitations of accounting:

(i) Only monetary transactions : Accounting records only those transactions which can be measured in terms of money. But transactions and events, that are not measurable how-so-ever are important for business are not recorded.

(ii) are recorded at their costs and not at their market prices. Hence, financial statements fail to show real worth of the business,

(iii) Personal judgement : Based on the personal judgement of the accountant, certain accounting policies are adopted. As a result. financial statements. may not be objective and comparable.

(iv) Not exact : Accounting information is sometimes based on estimates. Hence, the financial statements do not reflect the true position of the business.

(v) Not a good tool for management : Accounting records the past facts which do not help the management in decision-making. It not provide for evaluation of business policies and plans.

Question 17.

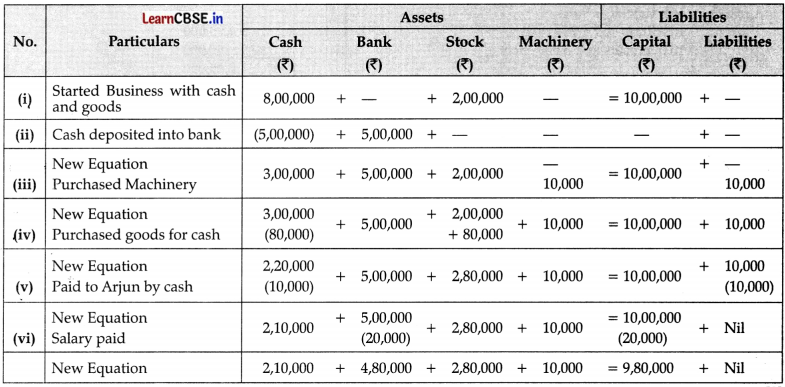

Create accounting equations on the basis of the following transactions: [3]

(i) Started business with cash ₹ 8,00,000 and goods ₹ 2,00,000.

(ii) Cash deposited into Bank ₹ 15,00,000.

(iii) Purchased machinery from Arjun ₹ 10,000.

(iv) Bought goods for cash ₹ 80,000.

(v) Paid to Arjun by cash ₹ 10,000.

(vi) Salary paid by cheque ₹ 20,000.

OR

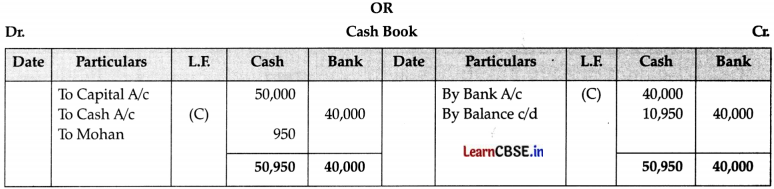

Enter the following transactions in a two column cash book: [3]

(i) Commenced business with cash ₹ 50,000.

(ii) Deposited in bank ₹ 40,000.

(iii) Received cash from Mohan ₹ 950 in full settlement of a debt of ₹ 1,000.

Answer:

Question 18.

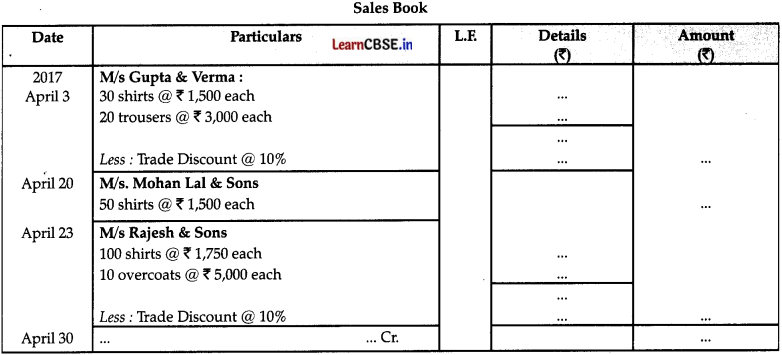

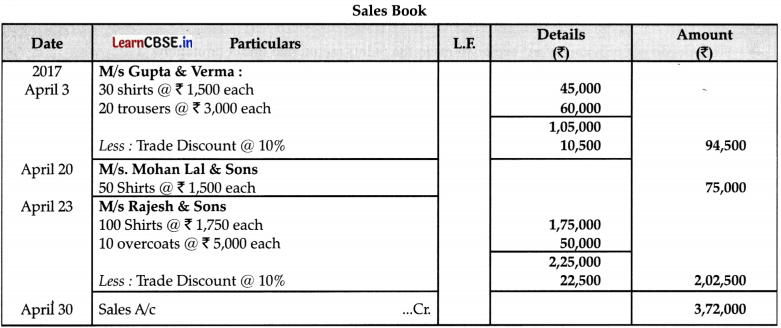

In the following Sales Book, determine the missing information: [3]

Answer:

Question 19.

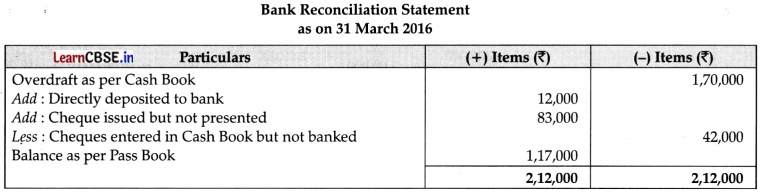

From the following information, prepare Bank Reconciliation Statement as on 31st March, 2016 : [4]

| ₹ | |

| (i) Bank overdraft as per Cash Book | 1,70,000 |

| (ii) Directly deposited to the bank by Sudhir (customer) | 12,000 |

| (iii) Cheques issued but not presented for payment | 83,000 |

| (iv) Cheques entered in Cash book but not banked | 42,000 |

Answer:

Question 20.

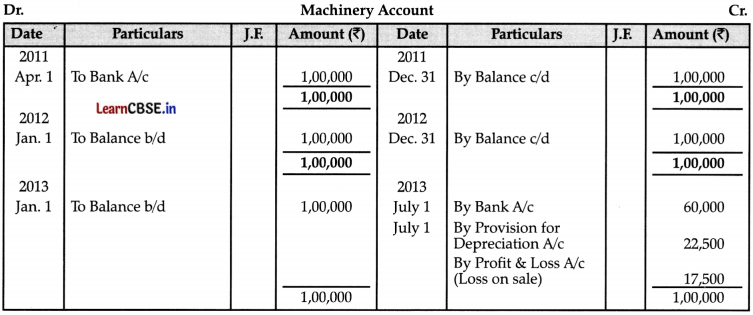

On April 1, 2011 X purchased a Machinery for ₹ 1,00,000 with CGST and SGST @ 6% each for his firm. The accounting year of the company ends on 31st Dec. every year. Depreciation @ 10% p.a. on the initial cost is charged to P & L Account and credited to a separate account known as ‘provision for depreciation’ account. On 1st July, 2013, the machine purchased on 1st April, 2011 was sold for ₹ 60,000. You are required to prepare Machinery Account and Provision for Depreciation Account upto 2013. [4]

Answer:

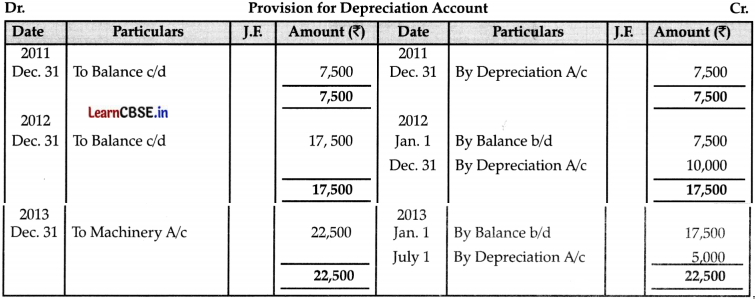

Question 21.

Rectify the following errors:

(i) Sale of old furniture to A for ₹ 11,500 was passed through the Sales Book.

(ii) Credit purchases of ₹ 12,000 from Ojas omitted to be recorded in the books.

(iii) Repair made was debited to Building Account ₹ 7,000.

(iv) Credit Sale of ₹ 1, 800 to Avikan was recorded as 18,100.

(v) ₹ 6,000 paid for office furniture was debited to office expense account.

(vi) A credit sale of goods of ₹ 15,000 to Ramesh has been wrongly passed through the Purchases Book.

OR

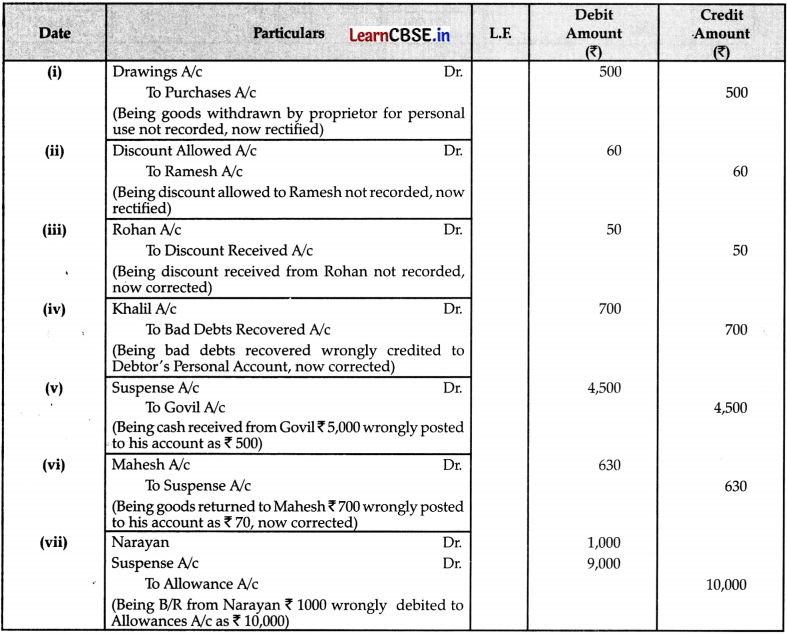

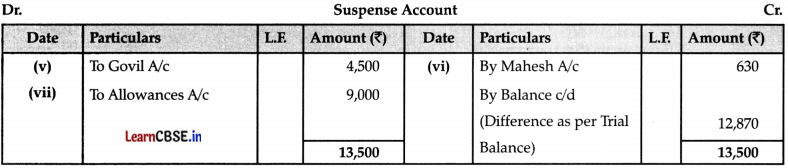

Trial Balance of Kailash did not agree. He put the difference to Suspense A/c. The following errors were discovered:

(i) Goods withdrawn by Kailash for personal use ₹ 500 were not recorded in the books.

(ii) Discount allowed to Ramesh ₹ 60 on receiving ₹ 2,040 from him was not recorded in the books.

(iii) Discount received from Rohan ₹ 50 on paying ₹ 3,250 to him was not recorded.

(iv) ₹ 700 received from Khalil, a debtor, whose account had earlier been written off as bad, were credited to his Personal A/c.

(v) Cash received from Govil, a debtor, ₹ 5,000 was posted to his account as ₹ 500.

(vi) Goods returned to Mahesh ₹ 700 were posted to his account as ₹ 70.

(vii) Bill Receivable from Narayan ₹ 1,000 was dishonoured and wrongly debited to Allowances A/c as ₹ 10,000.

Give Journal entries to rectify the above errors and prepare Suspense Account to ascertain the amount of difference in Trial Balance. [6]

Answer:

OR

Question 22.

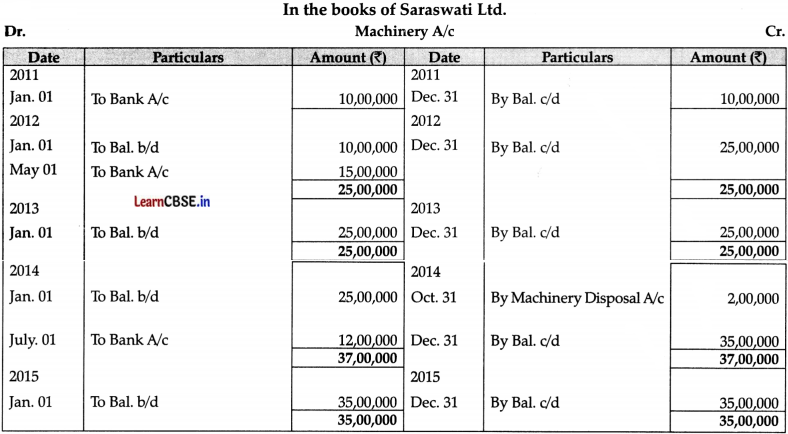

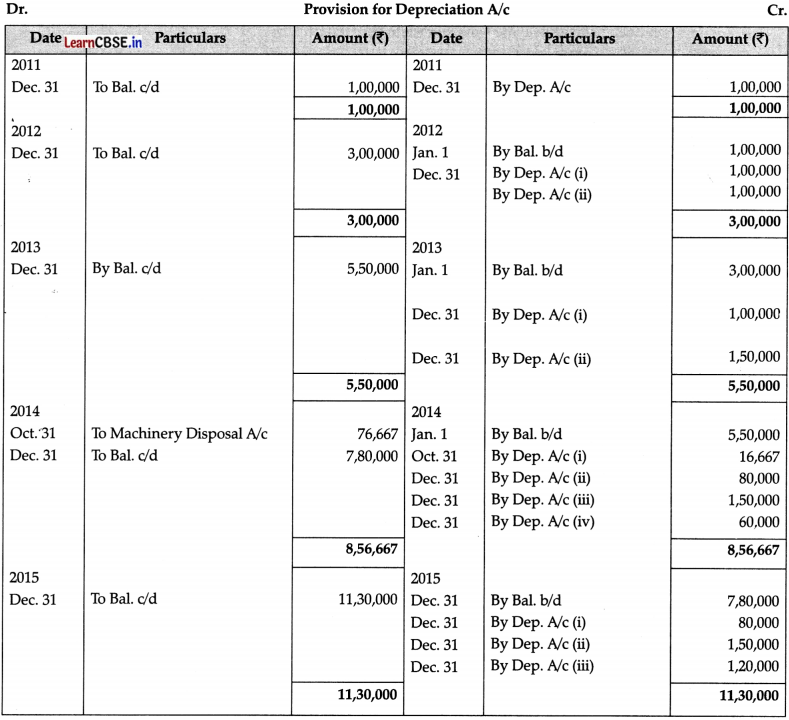

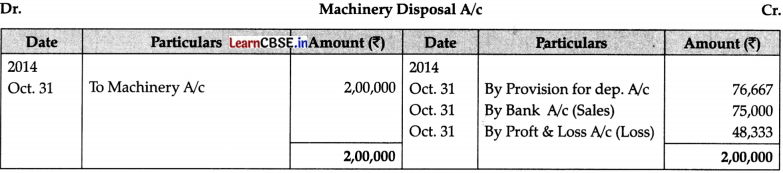

Saraswati Ltd. purchased a Machinery costing ₹ 10,00,000 on January 01, 2011. A new machinery was purchased

on 1 May, 2012 for ₹ 15,00,000 and another on July 01,2014 for ₹ 12,00,000. A part of the machinery which originally cost ₹ 2,00,000 in 2011 was sold for ₹ 75,000 on October 31,2014. Show the Machinery account, Provision for depreciation account and Machinery disposal account for 2011 to 2015 if depreciation is provided at 10% p.a. on original cost and accounts are closed on December 31 every year. [6]

OR

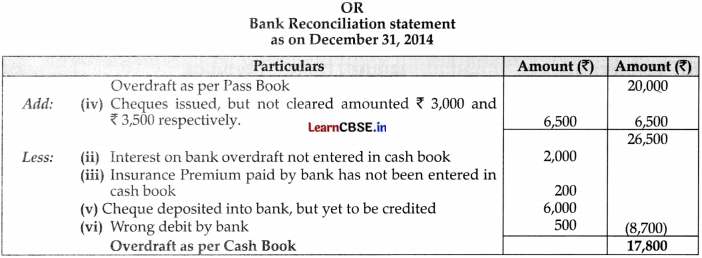

Prepare a Bank Reconciliation Statement from the following particulars and show the balance as per cash book.

(i) Balance as per pass book on December, 31 2014 overdrawn ₹ 20,000.

(ii) Interest on Bank overdraft not entered in the cash book ₹ 2,000

(iii) 200 Insurance prcmium paid by bank has not been entered in the cash book.

(iv) Cheques drawn in the last week of December 2014, but not cleared till date for ₹ 3,000 and ₹ 3,500.

(y) Cheques deposited into bank on November 2014, but yet to be credited on dated December, 31 2014 ₹ 6,000.

(vi) Wrongly debited by bank ₹ 500. [6]

Answer:

Question 23.

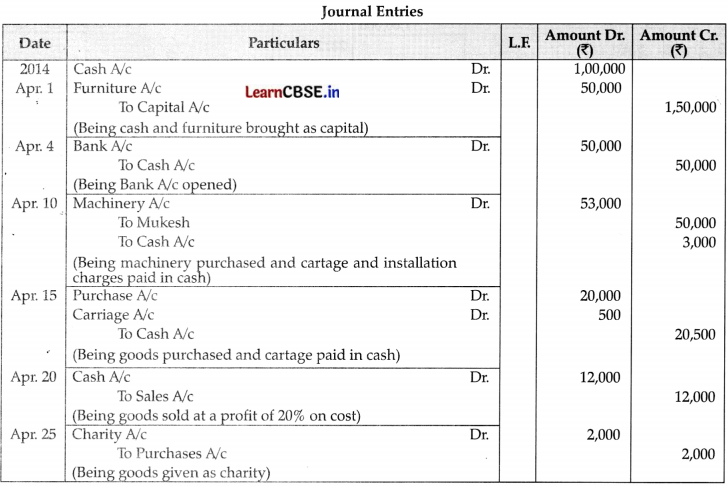

Journalise the following transactions:

| 2014 | Rohit the proprietor of the business invested ₹ 1,00,000 cash and furniture of ₹ 50,000. |

| April 1 | Opened a bank account by depositing ₹ 50,000. |

| April 4 | Bought machinery from Mukesh ₹ 50,000. Paid carriage ₹ 1,000 and installation charges ₹ 2,000 in cash. |

| April 10 | Purchased goods for ₹ 20,000 and paid carriage ₹ 500. |

| April 15 | Sold goods costing ₹ 10,000 at a profit of 20% on cost. |

| April 20 | Goods given away for charity ₹ 2,000. |

| April 2.5 | Rohit the proprietor of the business invested ₹ 1,00,000 cash and furniture of ₹ 50,000. |

| 2014 | Opened a bank account by depositing ₹ 50,000. |

[6]

Answer:

Question 24.

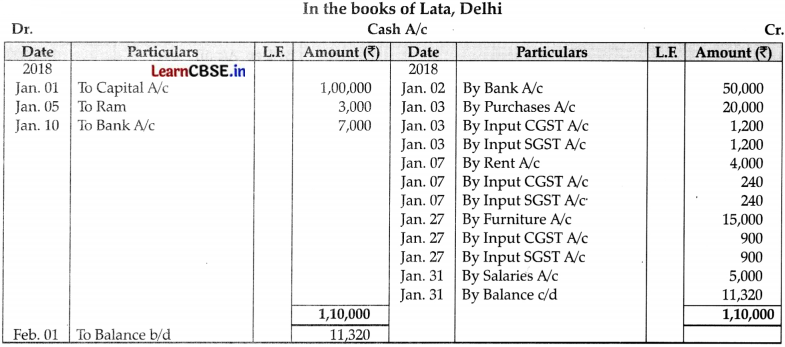

Enter the following transactions in a simple Cash Book of Lata, Delhi:

| 2018 | Particulars | ₹ |

| Jan. 01 | Started Business with Cash | 1,00,000 |

| Jan. 02 | Opened a bank account and deposited | 50,000 |

| Jan. 03 | Purchased goods for cash for ₹ 20,000 plus CGST and SGST @6% each from Kala Electricals, Delhi | |

| Jan. 03 | Sold goods of ₹ 5,000 plus IGST @ 12% to Ram of Chandigarh on credit. | |

| Jan. 05 | Received from Ram | 3,000 |

| Jan. 07 | Paid Rent of ₹ 4,000 plus CGST and SGST @6% each | |

| Jan. 10 | Withdrew cash from bank | 7,000 |

| Jan. 27 | Purchased furniture in Cash ₹ 15,000 plus CGST and SGST @ 6% each from a trader of Delhi | |

| Jan. 31 | Paid Salaries | 5,000 |

Answer:

Part – B ((Financial Accounting – II)

Question 25.

Formula to calculate cost of goods sold : [1]

(A) Cost of goods sold = Net sales – Gross Profit

(B) Cost of goods sold = Opening stock + Net Purchases + Direct expenses – Closing stock

(C) Both (A) and (B)

(D) None of the above

OR

Consider the following statements with respect to the limitations of Trial Balance:

(i) Transactions that are not recorded at all cannot be found out.

(ii) The wrong amount written on both sides of a Trial Balance cannot be detected.

(iii) The wrong amount recorded of an account is compensated by the wrong amount of the other account. Identify the correct statement/statements:

(A) (i) only

(B) (i) and (ii)

(C) (iii) only

(D) (i), (ii), and (iii) [1]

Answer:

(C) Both (A) and (B)

Explanation:

Cost of Goods Sold (COGS) measures the” direct cost” incurred in the production of any goods or services.

OR

(D) (i), (ii), and (iii)

![]()

Question 26.

Commission of ₹ 1,000 is received in advance. The accountant is not able to pass an adjustment entry for this

advance commission received. Help him in identifying which of the following entries will be the adjusting entry for this advance commission: [1]

(A) Debit Commission Account and credit Commission Received in Advance Account

(B) Debit Cash Account and credit Commission Received in Advance Account

(C) Debit Commission Account and credit Cash Account

(D) Debit Commission Received in Advance Account and credit Commission Account [1]

Answer:

(A) Debit Commission Account and credit Commission Received in Advance Account

Question 27.

Statement I: The expenses that are unpaid during the year are shown in the liability side of the Balance Sheet. Statement II: The income that are not yet received during the year are shown in the asset side of the Balance Sheet.

(A) Both Statements are correct.

(B) Both Statements are incorrect.

(C) Statement I is correct and Statement II is incorrect.

(D) Statement I is incorrect and Statement II is correct.

OR

Entries which are made at the end of each accounting period for the purpose of preparing Profit & Loss Account:

(A) Adjusting entries

(B) Opening entries

(C) Closing entries

(D) Transfer entries [1]

Answer:

(C) Statement I is correct and Statement II is incorrect.

Explanation:

Income that does not pertain to current year and are not received are not recorded.

OR

(C) Closing entries

Explanation:

Closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account.

Question 28.

Consider the following statements with respect to the limitations of single entry system:

(i) Arithmetical accuracy cannot be determined as Trial Balance cannot be prepared.

(ii) Figures or profits cannot be relied upon as the system is incomplete and unscientific.

(iii) True and fair financial health of the business concern cannot be shown.

Choose the correct option:

(A) (i) and (ii)

(B) (ii) and (iii)

(C) (i) and (iii)

(D) (i), (ii) and (iii) [1]

Answer:

(D) (i), (ii) and (iii)

Question 29.

Which of the following means a statement of assets and liabilities prepared to find out the amount of capital?

(A) Incomplete Records

(B) Statement of Affairs

(C) Statement of Profit & Loss

(D) None of the above [1]

Answer:

(B) Statement of Affairs

![]()

Question 30.

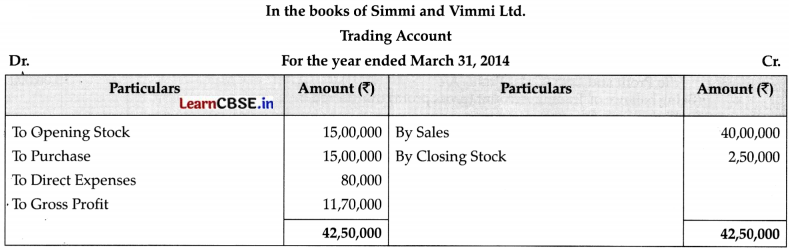

From the following balances taken from the books of Simmi and Vimmi Ltd. for the year ending March 31,2014, calculate the gross profit.

| (₹) | |

| Closing stock | 2,50,000 |

| Net sales during the year | 40,00,000 |

| Net purchases during the year | 15,00,000 |

| Opening stock | 15,00,000 |

| Direct expenses | 80,000 |

OR

Operating profit earned by M/s Arora and Sachdeva in 2013-14 was ₹ 17,00,000. Its non-operating incomes were ₹ 1,50,000 and non-operating expenses were ₹ 3,75,000. Calculate the amount of net profit earned by the firm. [3]

Answer:

OR

Net Profit = Operating Profit + Non – operating Income – Non-operating Expenses

= 17,00,000 + 1,50,000 – 3,75,000 = ₹ 14,75,000

Net profit earned by M/S Arora and Sachcleva th 2013 – 14 was ₹ 14,75,000

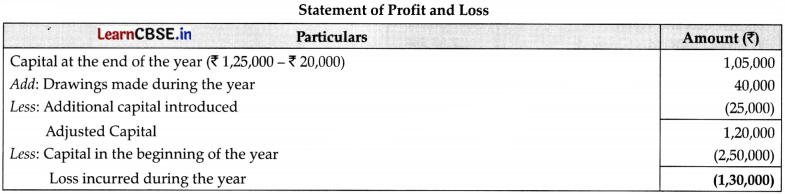

Question 31.

Mr. A started a business with a capital of ₹ 2,50,000 on 1st April, 2013. He withdrew ₹ 40,000 for his personal use

on 31st March, 2014. He sold his personal investment for ₹ 25,000 and brought the amount into the business. On 31st March, 2014, his assets stood at ₹ 1,25,000 and creditors at ₹ 20,000. You are required to prepare statement of profit or loss for the year ended 31st March, 2014. [3]

Answer:

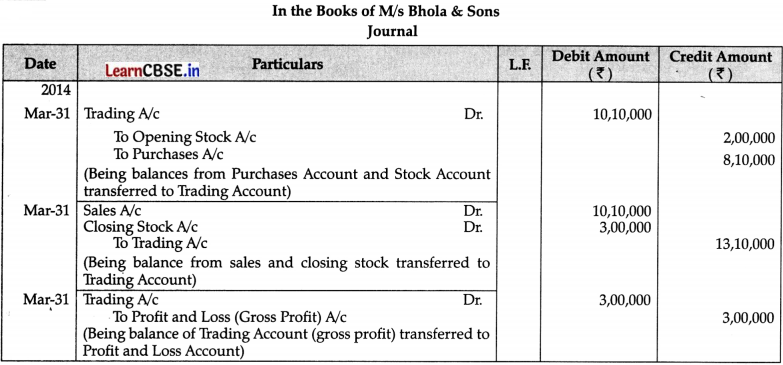

Question 32.

The following are the extracts from the trial balance of M/s Bhola & Sons as on March 31,2014:

| Particulars | Debit (₹) | Credit (₹) |

| Opening stock | 2,00,000

8,10,000 |

10,10,000 |

| Purchases | ||

| Sales | 10,10,000 | 10,10,000 |

You are required to record the necessary journal entries The value of closing stock on March 31,2014 was ₹ 3,00,000. [3]

Answer:

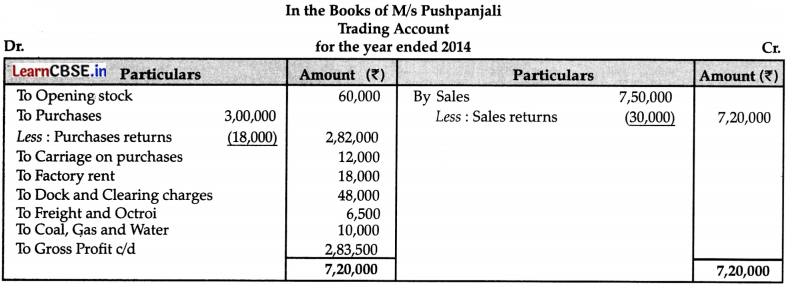

Question 33.

Prepare a Trading Account of M/s Pushpanjali from the following information related to 2013-14 :

| ₹ | |

| Opening stock | 60,000 |

| Purchases | 3,00,000 |

| Sales | 7,50,000 |

| Purchases returns | 18,000 |

| Sales returns | 30,000 |

| Carriage on purchases | 12,000 |

| Carriage on sales | 15,000 |

| Factory rent | 18,000 |

| Office rent | 18,000 |

| Dock and Clearing charges | 48,000 |

| Freight and Octroi | 6,500 |

| Coal, Gas and Water | 10,000 |

OR

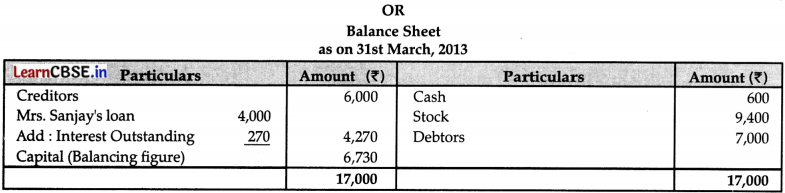

Sanjay started a firm on 1st April, 2012 with a capital of ₹ 10,000. On 1st July, 2013 he borrowed from his wife a sum of ₹ 4,000 @ 9% p.a. (interest not yet paid for business and introduced a further capital of his own amounted to ₹ 1,500. On 31st March, 2013 his position was:

Cash ₹ 600, Stock ₹ 9,400, Debtors ₹ 7,000 and Creditors ₹ 6,000.

Ascertain his profit or loss taking into account ₹ 2,000 for his drawing during the year. [4]

Answer:

Question 34.

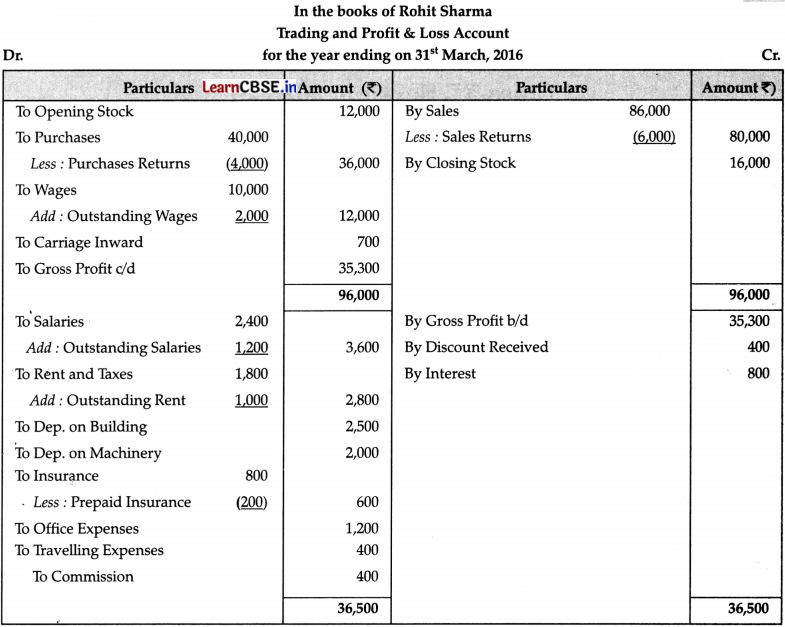

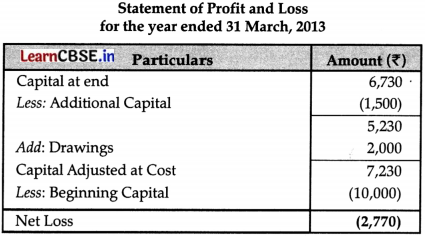

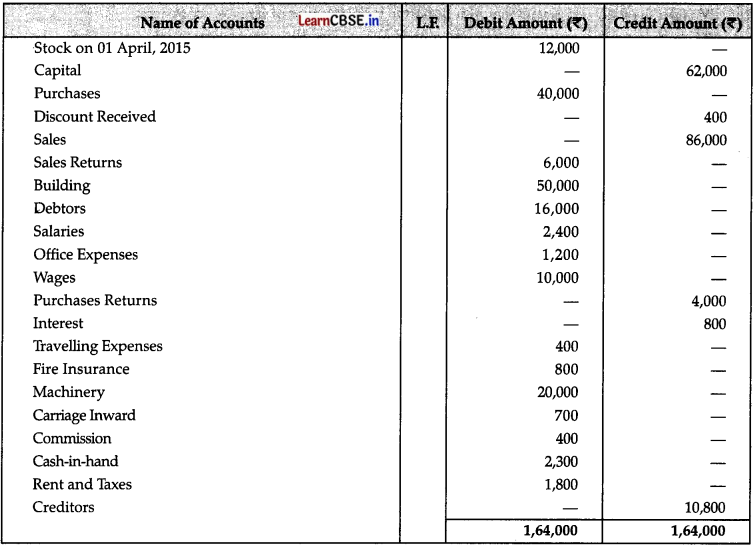

From the following Trial Balance of Rohit Sharma, prepare Trading and Profit & Loss Account for the year ending 31st March, 2016 and a Balance Sheet on the same date after making necessary adjustments:

Adjustments:

(i) Closing stock was ₹ 16,000.

(ii) Wages ₹ 2,000 and salaries ₹ 1,200 are outstanding.

(iii) Rent for two months at the rate of ₹ 500 per month is outstanding.

(iv) Depreciation Building by 5% and Machinery by 10%.

(v) Prepaid insurance ₹ 200. [6]

Answer: