CBSE Previous Year Question Papers Class 12 Economics 2015 Outside Delhi

Time allowed : 3 hours

Maximum marks: 70

** Answer is not given due to change in the present syllabus

CBSE Previous Year Question Papers Class 12 Economics 2015 Outside Delhi Set – I

Section – A

Question 1.

Define indifference curve. [1]

Answer:

Indifference curve is a curve that depicts various combinations of two goods that provides a consumer with the same level of satisfaction. In other words, it shows those combinations of two goods between which the consumer is indifferent.

Question 2.

If due to fall in the price of good X, demand for good Y rises, the two goods are : (choose the correct alternative) [1]

(a) Substitutes

(b) Complements

(c) Not related

(d) Competitive

Answer:

(b) Complements.

Question 3.

If Marginal Rate of Substitution is increasing throughout, the Indifference Curve will be : (choose the correct alternative) [1]

(a) Downward sloping convex

(b) Downward sloping concave

(c) Downward sloping straight line

(d) Upward sloping convex

Answer:

(b) Downward sloping concave.

Question 4.

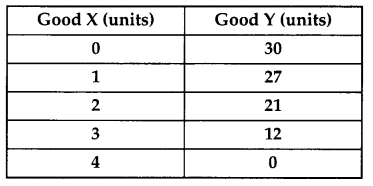

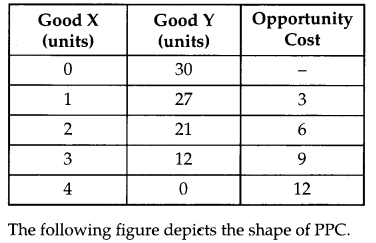

Giving reason comment on the shape of Production Possibilities curve based on the following schedule: [3]

Answer:

Based on the below schedule, we can say that PPC is concave to origin. This is because as the production increases, to produce each additional unit of Good X, more and more units of Good Y need to be sacrificed. In other words, the opportunity cost of producing one good in terms of another increases.

Thus, the shape of PPC is concave which can be attributed to the law of increasing opportunity cost.

Question 5.

What is likely to be the impact of “Make in India” appeal to the foreign investors by the Prime Minister of India, on the production possibilities frontier of India? Explain.

OR

What is likely to be the impact of efforts towards reducing unemployment on the production potential of the economy? Explain. [3]

Answer:

“Make in India” appeal to the foreign investors by the Prime Minister of India will lead

to the large scale inflow of foreign capital which will result in the increase in the availability of resources in the economy, thereby shifting the Production Possibility Curve (PPC) parallelly to the right from AB to CD as shown in the following diagram.

Impact of “Make in India” appeal on PPC

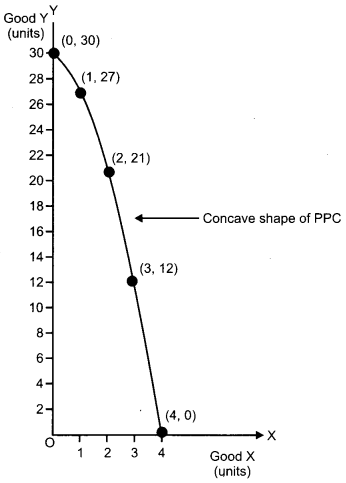

OR

Due to the efforts towards reducing unemployment. The point which was earlier below the Production possibility curve (indicating under utilisation of resources) will shift close to or on the PPC (indicating better utilisation of resources). This movement is being depicted in the below graph with the help of the arrow from point P.

Question 6.

Explain the significance of ‘minus sign’ attached to the measure of price elasticity of demand in case of a normal good, as compared to the ‘plus sign’ attached to the measure of price elasticity of supply. [3]

Answer:

The measure of price elasticity of demand of normal good carries minus sign as there exists an inverse relationship between demand and price of the good. That is, other things remaining constant, as the price of a good rises (or falls), the quantity demanded of the good falls (or rises). On the other hand, price elasticity of supply carries plus sign as there exists a positive relationship between the supply of a commodity and its price. To put in other words, when the price of a good rises (or falls), then the quantity supplied will increase (or decrease), other things remaining unchanged.

Question 7.

In a perfectly competitive market the buyers treat products of all the firms as homogeneous. Explain the significance of this feature. [3]

Answer:

In a perfectly competitive market, the buyers treat products of all the firms as homogeneous. This implies that all the firms in perfect competitive market produces homogeneous product. This further implies that the product of each and every firm in the market is perfect substitute to other product in terms of quantity, quality, colour, size, features, etc. This indicates that the buyers are indifferent between the products of different firms. Due to homogeneity of the products, existence of uniform price is guaranteed.

Implication: The products of different firms are qualitatively and quantitatively homogeneous.

Question 8.

What are the effects of ‘price-floor’ (minimum price ceiling) on the market of a good? Use diagram. [3]

Answer:

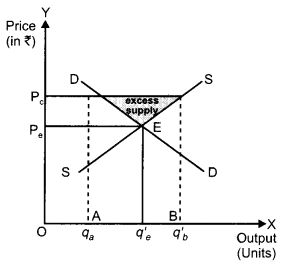

Price floor implies legislated or government fixed minimum price that should be charged by the seller. Since price floor is above the equilibrium price (OPe), thus the imposition of the price floor leads to excess supply as shown in the diagram below.

The following are the consequences and effects of price floor:

Assurance to the farmers: The imposition of the price floor assures the farmers that, whatever they produce will get sold in the market. This implies that the farmers can produce to their maximum.

Assurance of returns: Due to the price floor, the farmers need not to bother about the sale of their output. This ensures a minimum guaranteed return to their investment in the production process.

Higher income: The minimum guaranteed returns in form of minimum price and minimum wage to labourers, result in increase in the income of the poor people.

Burden on consumers: Price floor exerts additional pressure on the consumers and the traders, as they need to buy the products at comparatively higher price (OPc in the figure) instead of the equilibrium price (OPe).

Burden on government: It also puts extra burden on the government revenues. It becomes mandatory for the government to purchase the excess produce, even if it runs a sufficient volume of buffer stocks.

Higher taxes: The government tries to shift the burden (associated with purchasing the excess produce at higher price) to the consumers and traders in form of higher taxes.

Question 9.

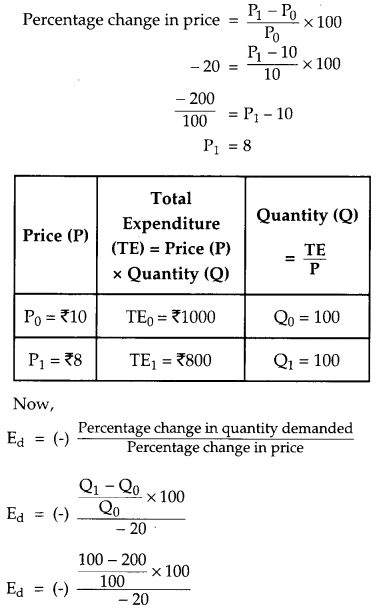

A consumer spends ₹ 1,000 on a good priced at 10 per unit. When its price falls by 20 percent, the consumer spends ₹ 800 on the good. Calculate the price elasticity of demand by the Percentage method. [4]

Answer:

Given:

Initial Total Expenditure (TE0) = ₹ 1000

Final Total Expenditure (TE1) = ₹ 800

Initial Price (P0) = ₹ 10

Percentage change in price = -20

Ed = 0

Ed = 0

Thus, the price elasticity of demand is 0.

Question 10.

What is the behaviour of (a) Average Fixed Cost and (b) Average Variable Cost as more and more units of a good are produced?

OR

Define Average Revenue. Show that Average Revenue and Price are same. [4]

Answer:

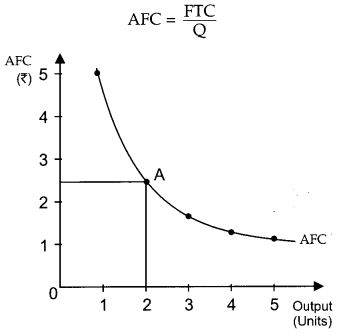

(a) Average Fixed cost is defined as the fixed cost per unit of output produced. It is derived by dividing the total fixed cost produced. That is,

As more and more units of output are produced, the shape of AFC becomes that of rectangular hyperbola. That is, AFC is downward sloping rectangular hyperbola. This is because at any point on AFC curve, if AFC is multiplied by corresponding unit of output, then we get TFC. For example, at point A in the above figure, AFC is ₹ 2.5 and corresponding output produced is 2 units, hence, TFC is ₹ 5 {i.e. ₹ 2.5 × 2)

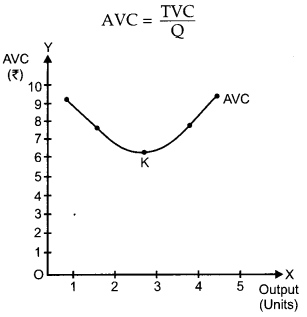

(b) Average Variable Cost is defined as the variable cost per unit of output produced. It is derived by dividing the Total Variable Cost by quantity of output produced. That is,

AVC is a U-shaped curve, That is, as output increases, the AVC curve falls and reaches its minimum point ‘K’ and then rises up. The reason behind the U-shape of AVC curve is the Law of Variable Proportion.

OR

Average Revenue(AR) is defined as revenue earned per unit of output sold. AR is same as that of price (P) of the output (Q).

Algebraically,

AR = \(\frac{\mathrm{TR}}{\mathrm{Q}}\)

where, TR is total revenue

Q = Output

We know that TR = P × Q

∴ AR = \(\frac{P \times Q}{Q} \Rightarrow A R=\frac{P \times Q}{Q}\)

AR = P

Thus, AR is always equal to the price of the output.

Question 11.

A consumer consumes only two goods X and Y, both priced at ₹ 2 per unit. If the consumer chooses a combination of the two goods with Marginal Rate of Substitution equal to 2, is the consumer in equilibrium? Why or why not?

What will a rational consumer do in this situation? Explain. [6]

OR

A consumer consumes only two goods X and Y whose prices are ₹ 5 and ₹ 4 respectively. If the consumer chooses a combination of the two goods with marginal utility of X equal to 4 and that of Y equal to 5, is the consumer in equilibrium? Why or why not? What will a rational consumer do in this situation? Use utility analysis.

Answer:

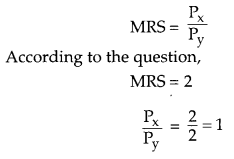

At the point of consumer equilibrium the following equality should be met:

So, MRS is greater than the price ratio. Thus, to reach the equilibrium point a rational consumer would decrease the consumption of good y.

OR

According to the utility approach, a consumer reaches equilibrium where the following equality is met.

\(\frac{\mathrm{MU}_{\mathrm{y}}}{\mathrm{P}_{\mathrm{y}}}=\frac{5}{4}\)

So, \(\frac{\mathrm{MU}_{\mathrm{y}}}{\mathrm{P}_{\mathrm{y}}}\) is greater than \(\frac{\mathrm{MU}_{\mathrm{x}}}{\mathrm{P}_{\mathrm{x}}}\) .Thus, to reach the equilibrium, a rational consumer would increase the consumption of good y and decrease that of good x.

Question 12.

What are the different phases in the Law of Variable Proportions in terms of marginal product? Give reason behind each phase. Use diagram. [6]

Answer:

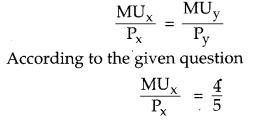

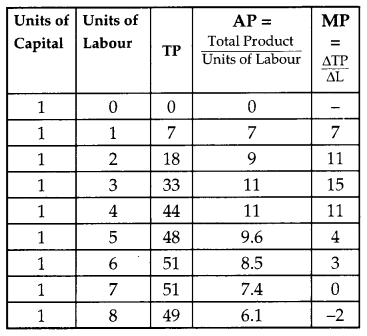

The Law of Variable Proportions states that if more and more of variable factor (labour) is combined with the same quantity of fixed factor (capital), then initially the total product will increase but gradually after a point, the total product will become smaller and smaller. Also, a point will be reached thereafter, the marginal product of the variable factor will start falling and after this point the marginal product of any additional variable factor can be zero and even be negative.

The following are the three phases (stages) of the Law of Variable Proportions.

Ist Stage : Increasing returns to a factor This stage starts from the origin point O and continues till the point M on the TP curve. During this phase, TP increases at an increasing rate and is also accompanied by rising MP curve (in figure ii). The MP curve attains its maximum point (U) corresponding to the point of inflexion (K). Throughout this stage, AP continues to rise.

Reasons for Increasing returns to a factor

(1) Underutilization of the fixed factor: In the first stage of production, there are not enough labour units to fully utilise the fixed factor. Therefore, the firm can increase its output just by combining more and more of labour inputs with the fixed factor, thereby; the output of the additional unit of labour (i.e. MP) tend to rise.

(2) Division of labour: The increase in the labour input enables the division of labour, which further increases the efficiency and productivity of the labour.

(3) Specialisation of labour: Due to the division of labour, specialisation of individual labour unit increases, which in turm raises the overall efficiency and productivity. Consequently, the MP curve rises and TP curve continues to rise.

IInd Stage : Diminishing returns to a factor This stage starts from point K and continues till point B on the TP curve. During this stage, the TP increases but at a decreasing rate and attains its

maximum point at B, where it remains constant. On the other hand (in the figure ii), the MP curve continues to fall. When TP attains its maximum point, corresponding to it, MP becomes zero. AP, in this stage initially rises, attains its maximum point at Z and thereafter starts falling.

Reasons for decreasing returns to a factor

(1) Fuller utilisation of fixed factor—In this stage, the fixed factor is utilised to its maximum level as more and more of labour inputs are employed. Imperfect substitutability between labour and capital, the variable factors are imperfect substitute for the fixed factor. Therefore, the firm cannot substitute labour for capital and as a result diminishing retuns takes place.

(2) Optimum proportion/ideal factor ratio :

The optimum proportion (or ideal factor ratio) is a fixed ratio in which the labour and capital inputs are employed. These factors will be most efficient if they are employed as per the optimum proportion. If this proportion is disturbed (by combining more of labour inputs to the fixed units of capital), then the efficiency of the factors will fall, thereby leading to the diminishing retuns to the factor.

IIIrd Stage : Negative returns to a factor

This stage begins from the point B on the TP curve. Throughout this point, TP curve is falling and MP curve is negative. Simultaneously, the AP curve continues to fall and approaches the X-axis (but does not touch it). Like the first stage, this stage is also known as non- economic zone as any rational producer would not operate in this zone. This is because the addition to the total output by the additional labour unit (i.e. marginal product) is negative. This implies that employing more labour would not contribute anything to the total product but will add to cost of the production in form of additional wage. Hence, the cost of the additional labour input is greater than the benefit of employing it.

Reasons for negative returns to a factor

(1) Over utilisation of the fixed factors : In the third stage of production, the variable factor is in excessive relative to the fixed factors. This leads to the over utilisation of the fixed factor, thereby negative returns to a factor sets in.

(2) Negative marginal product : Throughout this stage the TP curve is continuously falling, consequently, the additional product by the additional unit of labour becomes negative. This implies that in this stage of production, the cost of employing labour is substantially higher than its contribution to the total product.

(3) Problem of management: With the increased number of labour units employed, it becomes hard for the management of the firm to efficiently manage them. Thus, due to the mismanagement and lack of responsibility, inefficiency is infused in the system. Let us understand the various stages with the help of following schedule and graph.

Question 13.

Explain why will a producer not be in equilibrium if the conditions of equilibrium are not met. [6]

Answer:

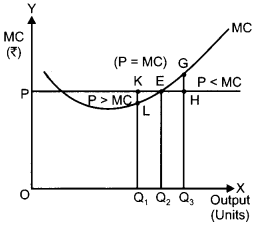

According to MR-MC approach, the firm (or producer) will attain its equilibrium, when the following two necessary and sufficient conditions are fulfilled.

1. MR = MC

2. MC is rising at the point of intersection with MR

Now, let us evaluate what would happen if the two conditions are not met.

Case A : If Price (MR) > MC

‘At output OQ1,. price is KQ1, and the marginal cost is LQ1 such that KQ1, > LQ1. Therefore, OQ1, is not the profit maxmising output. This is due to the fact that the firm can increase profit by increasing the production of output to OQ2.

At output OQ3, price is HQ3 and the marginal cost is GQ3, such that HQ3 < GQ3. Therefore, OQ3 is not the profit maximizing output. This is due to the fact that the firm can increase its profit by reducing its output level to OQ2.

Thus, we can conclude that at profit maximization output, the equilibrium price (or MR) must be equal to the MC curve and it cannot be greater or lesser than the MC curve.

The equality of MR and MC is only the necessary condition. The sufficient condition is that the MC should be rising at the point of intersection with MR.

Case B : If Price (MR) < MC

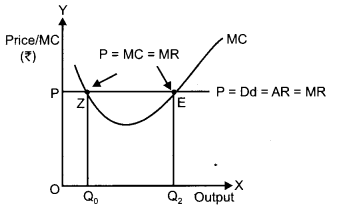

In the figure, the MC curve cuts the price line (or MR) at two different points i.e., at Z’ and ‘E’. The first order condition of profit maximization, i.e., Price (or MR) = MC is fulfilled at both of these points. Now let us evaluate which of the following two cases fulfills the second order condition of profit maximization.

Case A: At point ‘Z’

At point ‘Z’, price is equal to MC but MC is falling and is negatively sloped. At this point, any output level slightly more than the OQ0, the firm is facing price that exceeds the MC. This implies that the profit can be maximized by increasing output level beyond OQ0. Therefore, OQ0 is not a profit maximisation output.

Case B: At point ‘E’

To the left of the point ‘E’, if the firm produces slightly lesser level of output than OQ2, then the firm is facing price that exceeds the MC. This implies that higher profits can be achieved by ‘ increasing the level of output to OQ2. On the other hand, to the right of the point ‘E’. If the firm produces slightly higher level of output than OQ2, then the firm is facing price that falls short of the MC. This implies that higher profits can be achieved by reducing the output level to OQ2. Thus, the point E is the producer’s equilibrium and OQ2 is the profit maximizing output level, where Price = MC and also MC curve is rising.

Question 14.

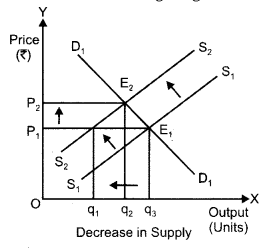

Market for a good is in equilibrium. The supply of good “decreases”. Explain the chain of effects of this change. [6]

Answer:

When the market is in equilibrium, this implies that the market demand is equal to the market supply at the equilibrium point. Now, in case the market supply decreases, this leads to a leftwards shift in the market supply curve. This is because a decrease in supply refers to a fall in the supply of the given commodity due to change in factors other than price. Thus, in the given case the supply curve will shift towards left. As a result, there will exist a situation of excess demand at the equilibrium point. This can be shown in the following diagram.

As the market supply decreases, the initial supply shifts leftwards to the new supply curve S2S2 from S1S1. Now at the initial market price of OP1. There exists excess demand. This excess demand will increase competition among the buyers and they will now be ready to pay a higher price to acquire more units of a good. This will further raise the market price. The rise in the price will continue till the market price becomes OP2. The new market supply curve intersects the initial demand curve. The total quantity supplied will fall to Oq2 and the new equilibrium price will rise to OP2.

Section – B

Question 15.

What is ‘aggregate demand’ in macroeconomics? [1]

Answer:

Aggregate demand refers to the total value of final goods and services which all the sectors of an economy are planning to buy at a given level of income during a period of an accounting year.

Question 16.

If MPC = 1, the value of multiplier is : (choose the correct alternative) [1]

(a) 0

(b) 1

(c) Between 0 and 1

(d) Infinity

Answer:

The value of multiplier is \(\frac{1}{1-\mathrm{MPC}}\)

Here, MPC

refers to the Marginal propensity to consume.

As we are given the value of MPC as 1.

Thus, the value of multiplier becomes infinity.

Hence, the correct answer is option (d).

Question 17.

Primary deficit in a government budget is : (Choose the correct alternative). [1]

(a) Revenvue expenditure – Revenvue receipts

(b) Total expenditure – Total receipts

(c) Revenvue deficit – Revenue payments

(d) Fiscal deficit – Interest payments

Answer:

(d). Fiscal deficit

Question 18.

Direct tax is called direct because it is collected directly from: (Choose the correct alternative) [1]

(a) The producers on goods produced

(b) The sellers on goods sold

(c) The buyers of goods

(d) The income earners

Answer:

(d) The income earners

Question 19.

Other things remaining the same, when in a country the market price of foreign currency falls, national income is likely: (Choose the correct alternative) [1]

(a) to rise

(b) to fall

(c) to rise or to fall

(d) to remain unaffected

Answer:

(b) to fall

Question 20.

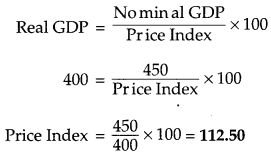

If the Real GDP is ₹ 400 and Nominal GDP is ₹ 450, calculate the Price Index (base = 100). [3]

Answer:

We know,

Question 21.

What are fixed and flexible exchange rates? [3]

OR

Explain the meaning of Managed Floating Exchange Rate.

Answer:

Fixed exchange rate refers to a system where the exchange rate is held constant or fixed by the monetary authority of the country. Under this regime, the monetary authority of the country pegs (or, fixes) the value of its currency against various other currencies. This system of exchange rate avoids frequent fluctuations in the exchange rate and makes international trade more predictable.

On the other hand, a flexible exchange rate refers to a system where the exchange rate is determined by the market forces (demand for foreign exchange and supply of foreign exchange) with minimum or no government intervention. The equilibrium exchange rate is determined where the demand for foreign currency is equal to the supply of foreign currency.

OR

Managed floating system of exchange rate combines the features of both the fixed exchange rate as well as the flexible exchange rate. On one hand, the foreign exchange market is allowed to operate freely and on the other hand, there is an official declaration of rules or guidelines for the intervention by the monetary authority. In other words, the managed floating exchange rate regime determines the exchange rate through the market forces with intervention of the monetary authority as and when required.

Question 22.

Where is ‘borrowings from abroad’ recorded in the Balance of Payments Accounts? Give reasons. [3]

Answer:

Borrowings by a country from the foreign countries or from the international money market are recorded in the Capital Account of the BOP. As these borrowings results in inflow of foreign exchange into the country. Hence, they are recorded as positive items in the Capital Account of BOP.

Question 23.

Explain the “Banker’s Bank as a function” of the central bank. [4]

OR

Explain the “Bank of Issue function” of the central bank.

Answer:

Banker’s Bank: Central bank is the apex bank of all the commercial banks and financial institutions in the country. It holds the same relationship with the commercial banks as the commercial bank holds with its customer. The central bank accepts deposits from the commercial banks and holds it as reserves for them. The commercial banks are compulsorily required to hold a part of their deposits as reserves with the central bank in accordance with the cash reserve ratio (CRR). In addition to the CRR requirements, the commercial banks hold reserves with the central bank for clearing their settlements with other banks and to fulfill their requirements of inter-bank transfers.

OR

Bank of issue function of central bank implies that Central Bank has the exclusive authority to issue the currency (notes + coins). The currency issued by the central bank is known as ‘legal tender money’ i.e., the value of such currency is backed by the central bank. However, the currency issued by the central bank is its monetary liability. In other words, the central bank is obliged to back the currency issued with, assets of equal value such as gold coins and bullions, foreign exchange, etc. In addition to issuing currency to the general public, the central bank also issues currency to the central government of the country. That is, the central government if required, can sell its securities to the central bank and in return gets the required cash currency.

Question 24.

Currency is issued by the central bank, yet we say that commercial banks create money. Explain. How is this money creation by commercial banks likely to affect the national income? Explain. [4]

Answer:

We know that RBI prints new money, while on the other hand, commercial banks multiplies money supplied by the RBI through the process of credit creation. People deposit money in their respective bank accounts. As per the central bank guidelines, the commercial banks are required to maintain a portion of total deposits in form of cash reserves. With the help of the past experiences, the commercial banks know that not all the depositors will turn-up for withdrawal at the same day. Consequently, the commercial banks lends the remaining portion (left after maintaining cash reserves) of the total deposits to the general public in form of credit, loans and advances. It is the second portion of the total deposits that is responsible for the credit creation (credit money).

The process of creation of credit money begins as soon as the commercial banks start the lending process. The amount of the credit money increases as the banks lend loans to more and more number of people in the economy. The deposit of money by the people in the banks and the subsequent lending of loans by the commercial banks is a recurring process. This lending process of the commercial banks increases the rate of investment and production in the economy, which in turn helps in improving the national income in the economy.

Question 25.

An economy is in equilibrium. Calculate the Investment Expenditure from the following : [4]

National Income = 800

Marginal Propensity to Save = 0.3

Autonomous Consumption = 100

Answer:

Given

Y = 800 MPS(s) = 0.3

i.e. MPC(c) = 1 – MPS = 1 – 0.3 = 0.7

C = 100

We know that at equilibrium,

Y = C + I

C = ab + by

= 100 + 0.7y

By putting the value of Y & C

800 = 100 + 0.7 (800) + I

800 = 100 + 560 + 1

I = 800 – 660

I = ₹ 140

Thus, the Investment expenditure is ₹ 140.

Question 26.

Giving reason explain how the following should be treated in estimation of national income: [6]

(i) Payment of interest by a firm to a bank

(ii) Payment of interest by a bank to an individual

(iii) Payment of interest by an individual to a bank

Answer:

(i) Payment of interest by a firm to bank will be included in the national income. This is because the firm would have taken loan for productive purposes.

(ii) Payment of interest by a bank to an individual will be included in the national income. This is because the bank would have used the savings of the individuals (on which the loan is paid) for productive purposes.

(iii) Payment of interest by an individual to a bank will not be included in the national income. This is because the individual is expected to have taken a loan for consumption purposes rather than for productive purposes.

Question 27.

What is ‘deficient demand’? Explain the role of ‘Bank Rate’ in removing it. [6]

OR

What is ‘excess demand’? Explain the role of ‘Reverse Repo Rate’ in removing it.

Answer:

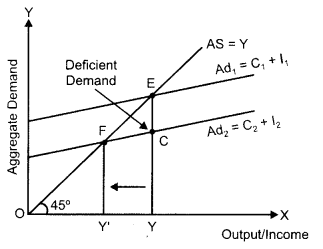

Deficit demand refers to a situation where the actual or equilibrium level of demand for output (AD2) is less than the full employment level of output (AD1). That is, if AD2 < AD1 (situation of Deficit Demand)

In the figure, AD1 and AS represents the aggregate demand curve and aggregate supply curve. The economy is at full employment equilibrium at point ‘E’, where AD1 intersects AS curve. At this equilibrium point, or represents the full employment level of output and EY is the aggregate demand at the full employment level of output.

Let us suppose that, the actual aggregate demand for output is only CY, which is lower than EY. This implies that actual aggregate output demanded by the economy CY falls short of the potential (full employment) aggregate output EY. Thus, the economy is facing a deficiency in demand. This situation is termed as deficit demand.

Bank rate refers to the rate at which the central bank provides loans to the commercial banks. In case of deficit demand, central bank reduces the bank rate, which reduces the cost of borrowings for the commercial banks. This implies that people can get loans at cheap rates from the commercial banks. This increases the demand for loans and credits in the market, Therefore, the consumption expenditure increases and finally the aggregate demand increases.

OR

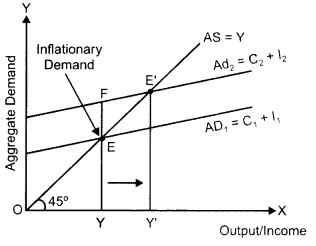

Excess demand refers to a situation where the actual aggregate demand for output (AD2) is above the full employment level of output (AD1), then there exists excess demand. That is, if AD2 > AD1 (situation of Excess Demand)

In the figure, AD1 and AS represents the aggregate demand curve and aggregate supply curve respectively. The economy is at full employment equilibrium at point ‘E’, where AD1 intersects AS curve. At this equilibrium point, OY represents full employment level and EY is aggregate demand at the full employment level of output.

Let us suppose that, the actual aggregate demand for output is FY, which is higher than EY. This implies that actual aggregate output demanded by the economy FY is more than the potential (full employment) aggregate output EY. Thus, the economy is facing surplus demand. This situation is termed as excess demand.

Reverse repo rate refers to the rate at which the Central Bank borrows from the commercial banks. In situation of excess demand, the Central Bank would increase the reverse repo rate. An increase in the reverse repo rate reduces the money supply in the economy, thereby aggregate demand falls.

Question 28.

Explain how the government can use the budgetary policy in reducing inequalities in incomes. [6]

Answer:

The govenment through its budgetary policy attempts to promote fair and right distribution of income in an economy. This is done through taxation and expenditure policy. On one hand, through its taxation policy, the government taxes the higher income group and on the other hand, through the expenditure policy (subsidies, transfer payments, etc.), it transfers the purchasing power in the hands of the poor sections of society. With the help of these policies, the government aims at fair distribution of income in the society.

Question 29.

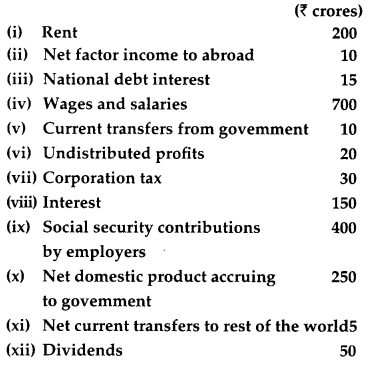

Calculate the ‘National Income’ and ‘Private Income’ : [6]

Answer:

National Income = Wages and salaries + Social security contributions by employers + Rent + Interest + Dividends + Corporation tax + Undistributed profits – Net factor income to abroad

NNPFC = 700 + 100 + 200 + 150 + 50 + 30 + 20 – 10

= ₹ 1240 crore

CBSE Previous Year Question Papers Class 12 Economics 2015 Outside Delhi Set – II

Note : Except for the following questions, all the remaining questions have been asked in previous set.

Section – A

Question 2.

Define budget line. [1]

Answer:

A budget line represents the different combinations of two goods that are affordable and are available to a consumer; while being aware of his/her income level and market prices of both the goods. The budget line is represented by the following equation.

M = Px.Qx + Py.Qy

Question 5.

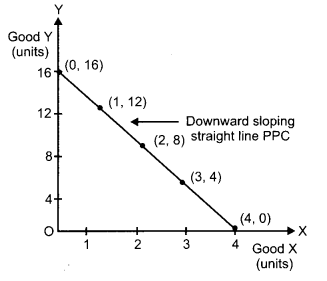

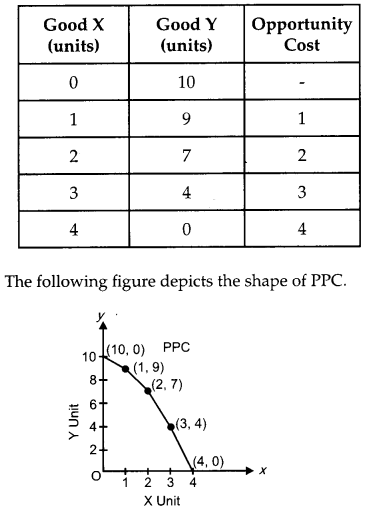

Giving reasons comment on the shape of Production Possibilities curve based on the following schedule: [3]

| Good X (units) | Good Y (units) |

| 0 | 16 |

| 1 | 12 |

| 2 | 8 |

| 3 | 4 |

| 4 | 0 |

Answer:

Based on the schedule given below, we can say that PPC is a downward sloping straight line. This is because the opportunity cost of producing one good (i.e. Good X) in terms of another (i.e. Good Y) remains the same, that is, 4 (ignoring the minus sign).

| Good X (units) | Good Y (units) |

Opportunity Cost |

| 0 | 16 | – |

| 1 | 12 | 4 |

| 2 | 8 | 4 |

| 3 | 4 | 4 |

| 4 | 0 | 4 |

The following figure depicts the shape of PPC.

Thus, the shape of PPC is downward sloping straight line which can be attributed to the constant opportunity cost.

Question 8.

Explain the implication of non-price competition in an oligopoly market. [3]

Answer:

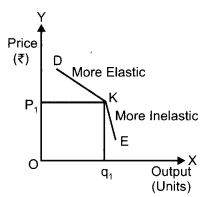

Non-price competition in an oligopoly implies that the demand curve faced by an oligopolistic firm cannot be determined as it is uncertain to forecast its sales. This is because any change in the price or output decisions by a firm sets in a series of the reaction of the rival firms. That is why the demand curve is indeterminate and indefinite. The oligopolistic firm faces a kinked demand curve at any given price. The following figure shows the demand curve faced by an oligopolistic firm.

The upper portion of this demand curve is more elastic than the lower portion of the demand curve.

Question 10.

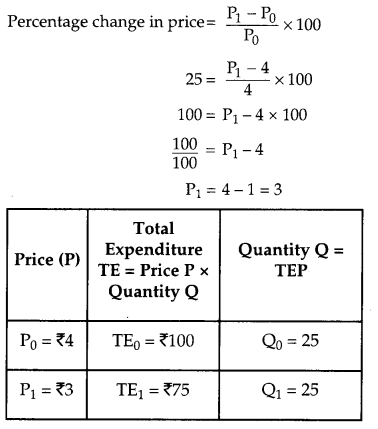

A consumer spends ₹ 100 on a good priced at ₹ 4 per unit. When its price falls by 25 percent, the consumer spends ₹ 75 on the good. Calculate the price elasticity of demand by the percentage method. [4]

Answer:

Given:

Initial Total Expenditure TE0 = ₹ 100

Final Total Expenditure TE1 = ₹ 75

Initial Price P0 = ₹ 4

Percentage change in price = -25

Now,

Ed = Percentage change in quantity demanded = Percentage change in price

Thus, the price elasticity of demand is 0.

Question 11.

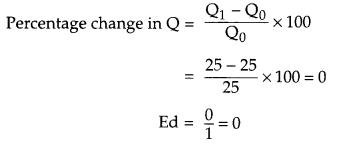

Market for a good is in equilibrium. The supply of the good ‘Increases’. Explain the chain of effects of this change. [6]

Answer:

When the market is in equilibrium, this implies that the market demand is equal to the market supply at the equilibrium point. Now, in case the market supply increases, this leads to a rightward shift in the market supply curve. This is because, an increase in supply refers to a rise in the supply of the given commodity due to change in factors other than price. Thus, in the given case the supply curve will shift towards right. As a result, there will exist a situation of excess supply at the equilibrium point. This can be shown in the following diagram.

As the market supply increases, the initial supply shifts rightwards to the new supply curve S2S2 from S1S1. Not at the initial market price of OP1, there exists excess supply. Due to the excess supply, some of the existing firms are ready to sell the output at comparatively lower prices to increase their sale, therefore, the market price will tend to fall. The fall in the market price will continue until it reaches OP2. The new market equilibrium will occur at point E2, where the new market supply curve intersects the initial demand curve. The total quantity supplied will be equal to the quantity demanded at Oq2 and the new equilibrium price will fall to OP2.

Section – B

Question 21.

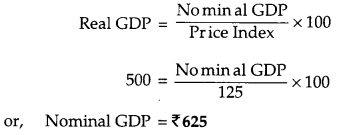

If the Real GDP is ₹ 500 and Price Index (base = 100) is 125, calculate the Nominal GDP. [5]

Answer:

Question 23.

An economy is in equilibrium. Calculate the Marginal Propensity to Save from the following:

National income = 1,000

Autonomous consumption = 100

Investment = 120

Answer:

Given :

National Income (Y) = 1000

Autonomous Consumption (a) = 100

Investment (I) = 120

Y = C + I

C = a + by

Y = 100 + b × 1000 + 120

1000 – 120 = 100 + b

880 = 100 + 1000

880 – 100 = 1000 b

780 = 1000 b

b = \(\frac{780}{1000}\) = 0.78

MPC = 0.78

MPS = 1 – MPC

= 1 – 0.78

= 0.22

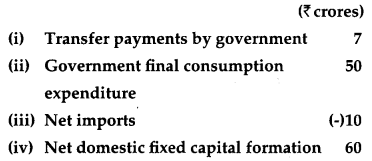

Question 29.

Calculate ‘Net National Product at Market Price’ and ‘Personal Income’** : [6]

Answer:

NNPMP = Private final consumption expenditure + Government final consumption expenditure + (Net domestic fixed capital formation + depreciation) + Change in stock – Net imports – depreciation – Net factor income to abroad

NNPMP = 300 + 50 + 60 + 12 + (8 – 8) – (-10) – 12 – (-5)

NNPMP = ₹ 425 Crore

CBSE Previous Year Question Papers Class 12 Economics 2015 Outside Delhi Set – III

Note : Except for the following questions, all the remaining questions have been asked in previous set.

Section – A

Question 3.

Define Indifference Map. [1]

Answer:

Indifference map is a family or collection of indifference curves that depicts the different levels of satisfaction and preferences of a consumer. Each indifference curve in an indifference map depicts a particular level of satisfaction’.

Question 5.

Distinguish between co-operative and non-cooperative oligopoly. [3]

Answer:

Co-operative oligopoly is the oligopoly in which firms might decide to collude together and not to compete with each other. Thus, in such a case the firms would behave as a single monopoly and aim at maximising their collective profits rather than their individual profits.

On the other hand, non-cooperative oligopoly is the oligopoly where each firm aims at maximising its own profits and decides how much quantity to produce assuming that the other firms would not change their quantity supplied.

Question 8.

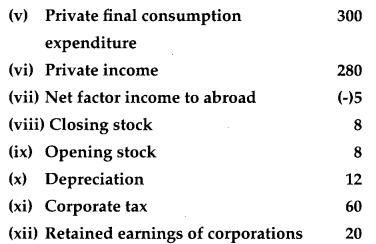

Giving reason comment on the shape of Production Possibilities Curve based on the following table: [3]

| Good X (units) | Good Y (units) |

| 0 | 10 |

| 1 | 9 |

| 2 | 7 |

| 3 | 4 |

| 4 | 0 |

Answer:

Based on the below schedule, we can say that PPC is concave to origin. This is because as the production increases, to produce each additional unit of Good X, more and more units of Good Y need to be sacrificed. In other words, the opportunity cost of producing one good in terms of another increases.

Thus, the shape of PPC is concave which can be attributed to the law of increasing opportunity cost.

Question 9.

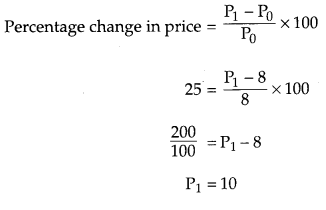

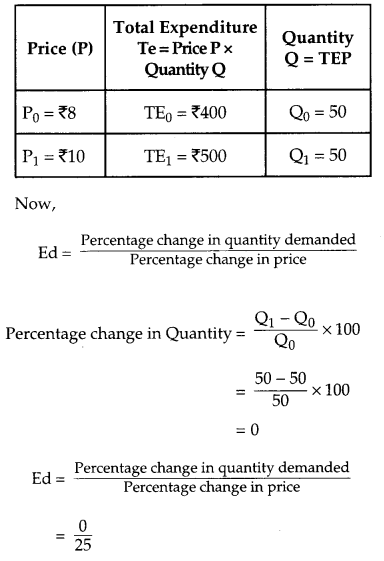

A consumer spends ₹ 400 on a good priced at ₹ 8 per unit. When its price rises by 25 percent, the consumer spends ₹ 500 on the good. Calculate the price elasticity of demand by the Percentage method. [4]

Answer:

Given

Initial Total Expenditure TE0 = ₹ 400

Final Total Expenditure TE1 = ₹ 500

Initial Price P0 = ₹ 8

Percentage change in price = +25

Ed = 0

Thus, the price elasticity of demand is 0.

Section – B

Question 22.

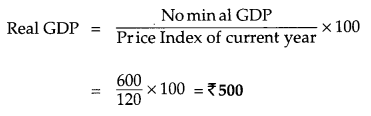

If the Nominal GDP is ₹ 600 and Price Index (base = 100) is 120, calculate the Real GDP. [3]

Answer:

We know,

Question 24.

An economy is in equlibrium. Calculate the national Income from the following : [4]

Autonomous Consumption = 120

Marginal Propensity to Save = 0.2

Investment Expenditure = 150

Answer:

a = 120

MPS = 0.20

(b) MPC = 1 – MPS = 1 – 0.20 = 0.86

I = 150

Y =?

Y = C + I

C = a + by

= 120 + 0.8Y

Y = 120 + 0.8Y + 150

1Y – 0.8Y = 270

0.2Y = 270

Y = \(\frac{270}{0.20}\) = 1350

Question 29.

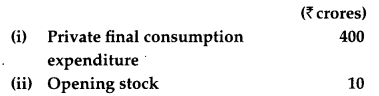

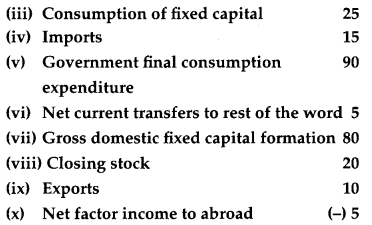

Calculate ‘Net Domestic Product at Market Price’ and ‘Gross National Disposable Income’**:

Answer:

Net Domestic Product at Market Price = Private final consumption expenditure + Government final consumption expenditure + Gross domestic fixed capital formation + change in stock + Net exports – depreciation

Net Domestic Product at Market Price = 400 + 90 + 80 + (20 – 10) + (10 – 15) – 25

Net Domestic Product at Market Price = ₹ 550 crore